[ad_1]

A latest survey by Pew Research confirmed greater than 86% of People that are actually conscious of cryptocurrency, and the variety of cryptocurrency customers is now estimated at greater than 300 million. Progress of consciousness has additionally attracted fraudsters’ consideration, with crypto fraud peaked up to now yr. With a bountiful set of fraud strategies and inventive scams, fraudsters have been profitable in not solely accessing and withdrawing funds from victims’ crypto accounts but additionally opening new accounts for use for cash laundering.

Fraud in Crypto Apps Has By no means Been Increased

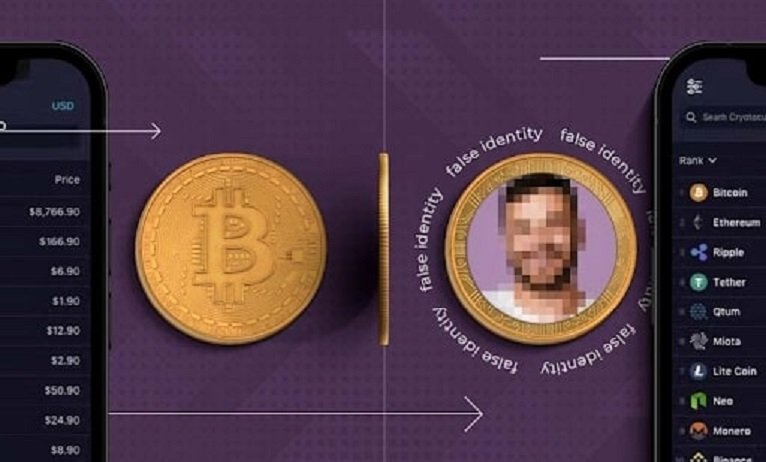

Cryptocurrency-related crime grew 79% in 2021, with greater than $14 Billion of the funds deposited in crypto wallets being tied to legal actions. In a latest interview by way of Telegram, fraudsters admitted to the opening between 1,500 to 2,000 accounts per month in crypto exchanges utilizing artificial identities.

These are pretend identities constructed from stolen private info, and such accounts are used for cash laundering or different forms of worthwhile crime. At the moment in skilled hacker boards, it’s attainable to purchase an artificial verified crypto change account for $150 and skim suggestions and recommendation on opening a brand new account utilizing a pretend, artificial id.

Know Your Buyer and Your Fraudster

Know your buyer (KYC), and Anti-Cash Laundering (AML) laws require monetary providers organizations to confirm the id of consumers. As a part of the brand new account opening; nevertheless, as we speak’s fraud detection is leaving the door open for fraudsters on crypto apps. Balancing the necessity for safety and catching fraudsters on the entrance door is a problem when making an attempt to onboard new customers as quick as attainable.

Presently, one of many KYC obligations for crypto exchanges is handle verification, in accordance with the Bank Secrecy Act (BSA). As well as, the Crypto Exchanges will need to have a Buyer Identification Program (CIP), and one of many items of data required within the CIP is the handle and a proof of handle.

Andre Ferraz, co-founder, and CEO at Incognia supplies frictionless cellular authentication to banks, crypto exchanges, fintech, and wallets for extra cellular income and fewer fraud losses. Says, “At Incognia, we took a detailed take a look at 19 cellular crypto apps to see how they had been balancing safety and friction by reviewing their onboarding course of to see how the consumer handle is verified as a part of id verification.”

The fraudulent strategies used to move handle validation at new account opening embrace:-

Faux and Artificial IDs – An artificial ID is made up of a mix of stolen items of personally identifiable info together with pretend info – as an illustration, a stolen SSN, handle, identify, pretend driver’s license. Particular person ID gadgets could also be actual, both stolen or bought on the Darkish Internet, they could even originate from totally different individuals, and they’re mixed to create an artificial id. Utilizing this artificial ID, it’s attainable to move the doc examine with put-together paperwork and to idiot much less subtle face recognition methods.

Actual IDs and Faces – Fraudsters pay as little as $7 for individuals keen to move the verification on a crypto change utilizing their very own actual id, precise identification paperwork, and face and ship the account on the market.

Location Spoofing – When recruiting apprentices to pretend an ID verification, skilled fraudsters clarify one other go-to and often efficient option to pretend compliance: faking the cell phone location. A part of the directions in dark-web boards states that the perpetrators ought to use a digital non-public community (VPN) to disguise an IP handle to permit them to be pretend their location when opening the account. So any fraudster on the opposite facet of the globe might open an account with a pretend ID and faux they’re, for instance, in New York Metropolis.

The placement spoofing a part of the account opening factories is essential since efficiently detecting location spoofing is a fast option to detect a fraudster. If a consumer is faking their handle, that may be a massive crimson flag through the id verification.

Handle Verification Is Not Only for KYC Compliance However Is Additionally a Highly effective Device to Stop Fraud

In the course of the onboarding, the examined crypto apps employed a number of strategies to confirm a brand new consumer handle and examine compliance with the nation of residence. The most typical strategies used embrace:-

Handle Verification Utilizing Uploaded Paperwork – Requiring the consumer to add an ID or doc to confirm, by way of optical character recognition (OCR), to match the uploaded information with the data offered throughout onboarding. The data within the ID might be cross-referenced with static databases, such because the DMV or bureaus.

One drawback with counting on pinging static databases is that there is probably not handle databases out there on-line in lots of worldwide jurisdictions. Even the place handle databases exist, they could be incomplete and generally present dated info.

The larger drawback is that almost all of those static databases have leaked up to now, and the info is accessible for buy in on-line boards, making it straightforward for fraudsters to make use of this info to create accounts utilizing pretend or artificial identities.

IP Handle – It is without doubt one of the commonest methods nonetheless in place for cellular apps to find out if an individual is opening a brand new account from the place they’re claiming, be it nation of residence or zip code. The data crammed in by the consumer is matched with the IP handle location.

At the moment, location is routinely spoofed utilizing a wide range of strategies. There are 5 widespread strategies fraudsters use to spoof their location, together with VPNs, Proxies, GPS spoofing apps, emulators, instrumentations, and app tampering. VPNs and Proxies are the fraudster’s go-to answer towards IP handle location verification.

Within the latest Incognia examine, we discovered that the present handle verification strategies utilized by nineteen main crypto cellular apps are probably the most fragile types of KYC throughout onboarding. Ten of fourteen exchanges required the brand new consumer to enter declared handle info, and 4 apps required the enter of nation of residence or ZIP Code.

Nonetheless, not one of the nineteen apps required proof of handle utilizing geolocation or by way of uploaded paperwork similar to a utility invoice or bank card assertion. In different international locations, such because the UK, importing a doc to show handle is required, however within the US, it isn’t usually requested, presumably as a result of it provides friction to the onboarding.

Out of the ten apps requiring handle information, solely 5 required a driver’s license image, which might alternatively be used to confirm the handle by way of OCR and match the info with a static database such because the DMV database. Often, static info in databases is incomplete or dated.

The necessities of KYC and AML laws are the principle supply of friction for onboarding on crypto exchanges. And that is the principle purpose why most apps use a gentle onboarding course of. That is additionally known as progressive onboarding, an method through which the heaviest a part of the id verification is left for when the consumer makes their first try to deposit funds or commerce crypto. Notably, the 2 exchanges not supporting progressive onboarding and requiring an ID scan had been additionally those with the best friction through the onboarding.

To be taught extra concerning the strategies utilized by main crypto apps for id verification at onboarding and likewise, which had been the cellular apps presenting extra friction to customers, obtain the Incognia Crypto Mobile App Friction Report – Onboarding.

This weblog incorporates excerpts from the Incognia Crypto Cellular App Friction Report – Onboarding. To obtain the complete report, click here.