[ad_1]

As soon as once more, the macro elements have began dominating the crypto markets. Most cryptos are in purple this week. Most buyers count on a possible hundred foundation level hike, however some additionally count on FED to proceed mountain climbing at 0.75 foundation factors.

This inflation and different elements in macroeconomics stop the investor from shopping for the shares/cryptos in massive volumes. They’re discovering safer choices reminiscent of fastened deposits and bonds. The Crypto market is observing an outflow, which is able to proceed as the worldwide macro financial system deteriorates.

The excessive bond yield is an element that influences the value of crypto belongings, and market consultants are additionally forecasting that buyers have to attend a bit of longer for the following bull market.

Now crypto buyers should pay attention to the macroeconomy and central financial institution insurance policies to manage inflation. Fiat currencies and sector-specific regulatory headwinds additionally play an vital function within the inventory market.

In consequence, it’s going to affect the value of most cryptocurrencies within the subsequent few months. Try our XRP predictions and technical evaluation by clicking right here earlier than you spend money on Ripple.

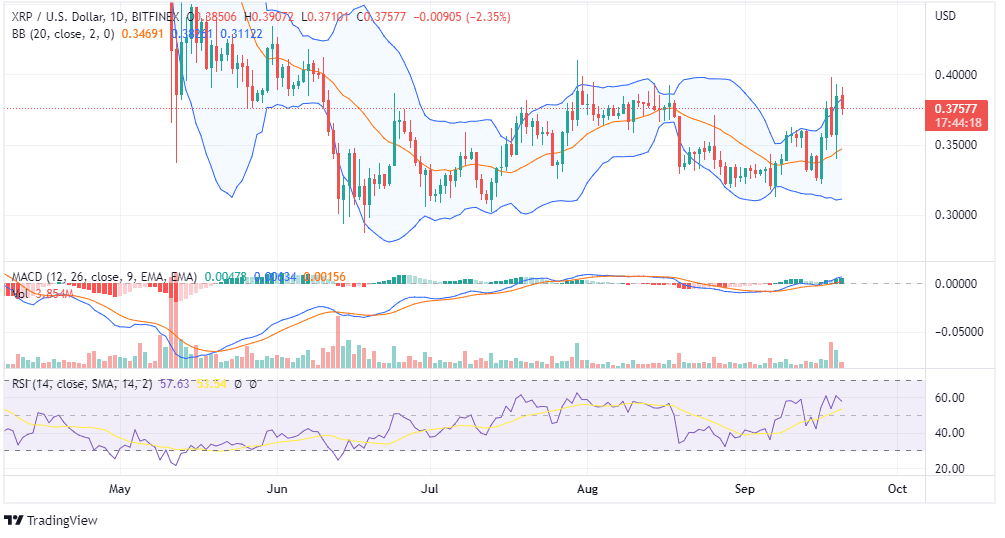

On the time of scripting this submit, XRP was buying and selling round $0.37. The each day candlesticks are forming within the higher half of the Bollinger Bands. The XRP worth has been consolidating inside a variety of $0.38 and $0.30.

On the time of scripting this submit, XRP was buying and selling round $0.37. The each day candlesticks are forming within the higher half of the Bollinger Bands. The XRP worth has been consolidating inside a variety of $0.38 and $0.30.

The current candles are forming across the resistance, so it’s not a superb time to speculate for the quick time period as a result of it would come all the way down to the extent of $0.35. Most technical indicators are bullish, so XRP might break the resistance quickly.

After hitting a excessive of $1.96, XRP has been in a downtrend. The optimistic signal is that XRP has taken assist at round $0.3. We don’t assume it’s going to break this degree quickly. BB lacks volatility; RSI is round 40, and MACD is bullish. Most technical indicators mirror impartial motion in the long run.

After hitting a excessive of $1.96, XRP has been in a downtrend. The optimistic signal is that XRP has taken assist at round $0.3. We don’t assume it’s going to break this degree quickly. BB lacks volatility; RSI is round 40, and MACD is bullish. Most technical indicators mirror impartial motion in the long run.