[ad_1]

XRP slips to the seventh spot as three stablecoins dominate the highest 6 spots. Having declined 55% within the final yr, even months’ motion has moved negatively. XRP has been a dominant power in making use of its decentralized ledger know-how, XRP ledger, for microtransactions, DeFi, and even NFT trades. The first benefit of finishing giant transactions within the shortest intervals has change into a profitable guess for XRP because the cryptocurrency is now used to pay for such funds as transaction charges.

Deployed available in the market in 2012, XRP helps main improvement languages resembling JAVA, Python, and Javascript, permitting extra flexibility to builders. With greater than 150 validators on its ledger know-how being operated by establishments, companies, and exchanges, XRP has change into a disruptive know-how that rivals the pace and safety supplied by SWIFT cost programs.

Nonetheless, in December 2022, the bottleneck was created by the SEC lawsuit demanding XRP be handled as a safety after gross sales of $1.2 billion value of tokens since late 2020. It will be the second yr with out a clear outlook on the XRP lawsuit. Nonetheless, the underlying operations for XRP are operating easily regardless of the help stage trending worth of the cryptocurrency.

XRP Value Evaluation

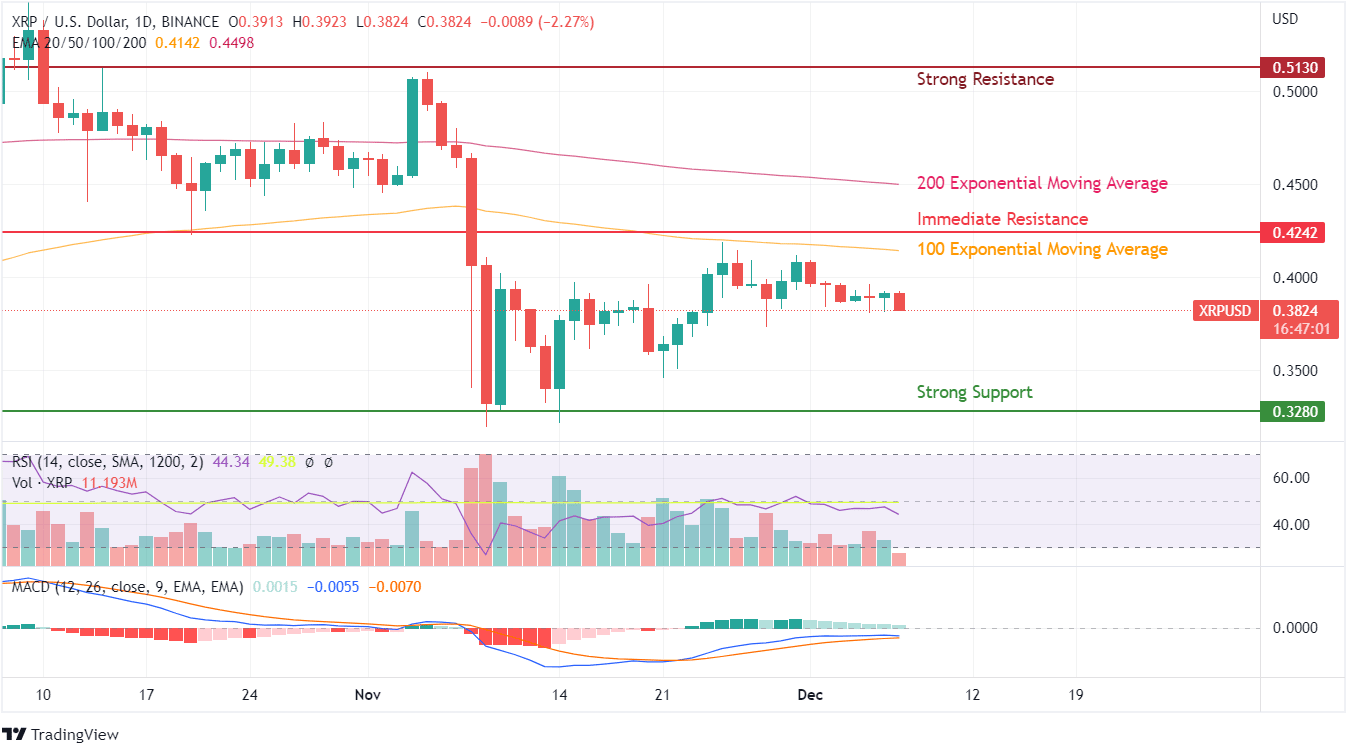

XRP has confronted latest rejections from a lot increased ranges that led to a breach of 200 EMA, adopted by 100 EMA. Returning to the height worth would require the next shopping for quantity and a requirement spike.

The decline from the resistance stage of $0.51 grew to become a turning level for XRP as the worth tanked by near 40% in lower than 5 days. The sudden FTX fiasco turned the tables for trending tokens by making a downtrend. Whereas patrons have enthusiastically bought XRP from the lows of $0.32, the rally ended on the 100 EMA curve. Individuals are deploying buy-on-dip methods however ready for an general enchancment in crypto situations earlier than going all in.

Regardless of the mildly constructive vary of 20%, XRP is witnessing constant purchaser participation. Present resistance ranges primarily based on value motion are energetic at $0.42, adopted by $0.51. On the identical time, RSI is displaying a sudden decline as XRP has didn’t development in the previous couple of days. It will create additional promoting stress on patrons who bought the token earlier than the precise reversal at $0.32. If you’re seeking to put money into XRP for the long run, try our projections to get extra particulars on the outlook of XRP.

From the MACD indicator, it may be confirmed {that a} bearish crossover is underway. Therefore the outlook for XRP is detrimental, and a bullish response might be anticipated solely from a value action-based decline as a substitute of a news-based disruption of the final detrimental run. On weekly charts, XRP has kept away from retesting the low of $0.2875 reached in the course of the detrimental development in Might 2022. Furthermore, XRP has marked the second constant decline.