[ad_1]

Ethereum is the second largest cryptocurrency, and it has turn out to be much more standard after the merge improve as a result of it runs on Proof of Stake consensus, which is energy-efficient and sustainable for the long run.

Ethereum has vast use instances, so ETH as an asset will present long-term capital appreciation. Buyers are carefully watching Ethereum’s worth even after the autumn of the FTX liquidity disaster.

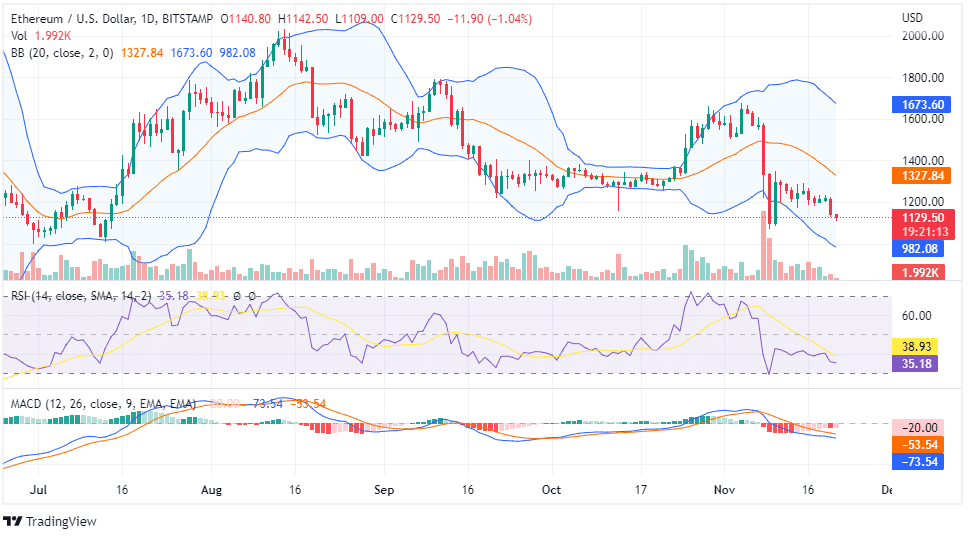

Most technical indicators are bearish, particularly MACD, which displays robust bearishness with pink histograms. Ethereum candlesticks are forming within the decrease BB, which suggests adverse sentiment in the previous few days. Ethereum obtained a robust quantity in the previous few days, particularly when it broke the help, which exhibits that buyers nonetheless consider in ETH. One other constructive signal is that the ETH worth continues to be buying and selling above its yearly low.

Within the quick time period, it has fashioned three decrease highs at $2000, $1800, and $1600. We expect investing is protected till it breaks the yearly low of $1000 for the quick time period. Ethereum could consolidate between $1400 and $1100. Nevertheless, is it the best time to speculate for the long run? Know the ETH predictions by clicking right here!

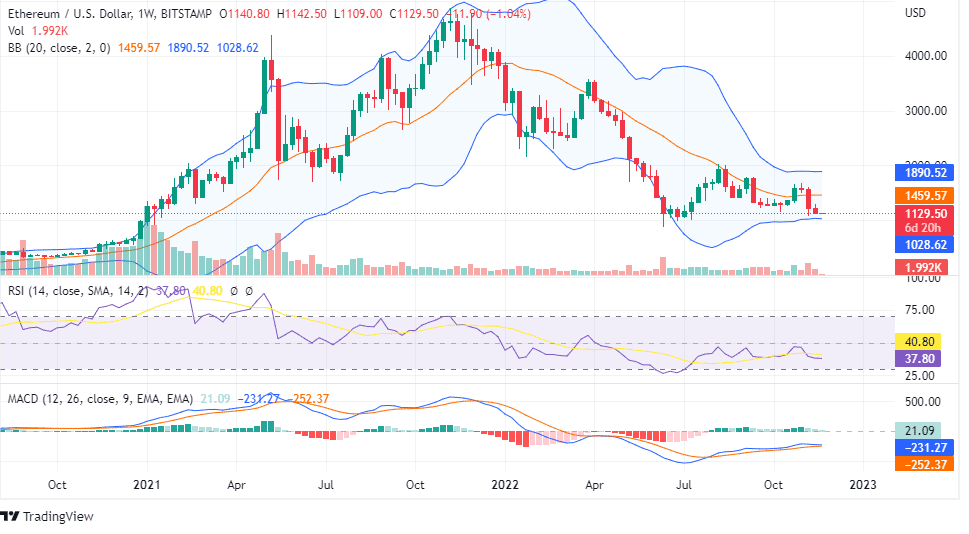

On the weekly chart, Ethereum has fashioned 4 weekly pink candles, buying and selling within the decrease Bollinger Bands. Most technical indicators are impartial that suggesting a consolidation for the quick time period.

Primarily based on the long-term ETH worth evaluation, we predict it’s the proper time to build up ETH crypto. If Ethereum breaks the help degree, it is going to be long-term bearish, offering higher alternatives to build up extra ETH.

Certainly, the market is bearish, but when ETH modifications the momentum, you possibly can make investments for the quick time period, however it is going to be bullish long-term when it breaks the resistance of $2100.

Many consultants consider in investing in ETH as a result of it has real-world use. Most areas are extremely aggressive, and lots of blockchain protocols present comparable options.

Ethereum would be the lone survivor in aggressive areas as a result of it’s a time-tested resolution than its rivals. Many altcoins have been launched out there that gives higher services to the customers, however a lot of them could not survive within the subsequent 20 years.

It’s a time to rethink your portfolio and focus extra on blue-chip cryptos quite than risking hard-earned cash in small and mid-cap altcoins.