[ad_1]

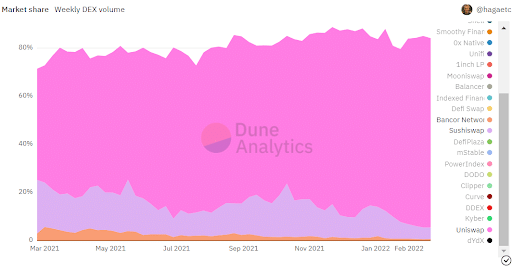

Bancor, the first-ever automated market maker (AMM) liquidity pool, is planning the launch of its third improve, bringing a full suite of options and improvements to the decentralized finance (DeFi) area. Regardless of elevating a $153 million preliminary token sale in 2017 (the most important ICO on the time), Bancor has witnessed a fall off in its market share in recent times as competitor AMMs corresponding to Uniswap, Pancakeswap, Sushiswap, and so on. develop in worth and adoption charges.

Nonetheless, improvement on the protocol has been enhancing previously few months, with the workforce saying the launch of an upgraded model, Bancor V3, within the coming weeks. In keeping with the workforce, the newly upgraded AMM will introduce new mechanisms to chop the price of transactions whereas stopping consumer publicity to impermanent loss (IL) on their pooled property.

Nonetheless, improvement on the protocol has been enhancing previously few months, with the workforce saying the launch of an upgraded model, Bancor V3, within the coming weeks. In keeping with the workforce, the newly upgraded AMM will introduce new mechanisms to chop the price of transactions whereas stopping consumer publicity to impermanent loss (IL) on their pooled property.

The Bancor V3 Improve Launch

Introduced in November 2021, Bancor V3 plans to boost the DeFi ecosystem and staking protocols. As DeFi grows its tentacles throughout the normal finance area, many buyers are deciding on to carry their funds in cryptocurrency to earn extra return or defend themselves from inflation. Staking has remodeled into “community-sourced liquidity”, powered by AMMs, providing customers permissionless blockchain ecosystems to swap, earn, and provide liquidity to the market.

Nevertheless, DeFi is regularly changing into tougher for atypical buyers, particularly in AMMs, as most buyers face the difficulty of impermanent loss, which is changing into extra prevalent within the ecosystem. Impermanent loss refers back to the distinction in buyers shedding a part of their tokens staked in a liquidity pool versus holding the tokens of their wallets. To additional clarify, impermanent loss happens once you give liquidity to a liquidity pool, & the deposited tokens worth modifications in comparison with once you deposit them. As the value modifications, the investor suffers from impermanent loss.

Nevertheless, DeFi is regularly changing into tougher for atypical buyers, particularly in AMMs, as most buyers face the difficulty of impermanent loss, which is changing into extra prevalent within the ecosystem. Impermanent loss refers back to the distinction in buyers shedding a part of their tokens staked in a liquidity pool versus holding the tokens of their wallets. To additional clarify, impermanent loss happens once you give liquidity to a liquidity pool, & the deposited tokens worth modifications in comparison with once you deposit them. As the value modifications, the investor suffers from impermanent loss.

You will need to word that loss occurs whichever the route of the value is, and Impermanent loss cares concerning the worth ratio relative to the deposit time.

To stop this, Bancor launched an upgrade in 2020 that allowed customers to supply liquidity within the type of single tokens, versus the pairs required by AMMs like Uniswap. This was to stop impermanent loss from occurring, and it was profitable. Whereas profitable, the one token swimming pools required each token to be paired in Bancor’s native BNT token, which doubled the transaction prices on the platform.

The Bancor V3 Impermanent Loss (IL) Answer

As defined above, Bancor V2.1 (launched in 2020) gives a separate BNT pool for every pair, which introduces extra transaction prices for customers. Bancor V3 will introduce the “Omnipool“, a single pool to stake your BNT and earn yield from the complete community. The one asset pool simplifies the method of incomes yield by way of BNT, as you don’t want to maneuver your BNT throughout completely different swimming pools to earn probably the most rewards and charges.

Most significantly, Omnipool reduces the transaction prices on the community for buyers. In earlier variations, merchants and staking buyers wanted to route transactions by means of two pairs. As an example, to swap from ETH to USDT, you’ll must swap from ETH to BNT then from BNT to USDT, which doubles the transaction prices. On Bancor V3, all trades can be accomplished in a single transaction. With single-hop trades, Bancor can appeal to buying and selling charges with the identical stage of liquidity, making the protocol extra capital environment friendly. Moreover, staking can even turn out to be cheaper because the protocol will make withdrawals with far fewer transactions.

Moreover, Bancor V3 will supply full Impermanent Loss Safety from day one. In Bancor v2.1, 100% IL safety was accrued by staking your tokens in a pool for 100 days or extra; now, it’s achieved immediately.

Different Enhancements on the Bancor V3 Improve

Aside from the impermanent loss options, Bancor V3 can even introduce different options to boost the efficiency of its AMM swimming pools. First, there are not any deposit limits on the platforms anymore. The improve introduces ‘Infinity Swimming pools’, permitting anybody to contribute as a lot as they like with out ready for area to open up the liquidity-capped area. These infinity swimming pools additionally introduce the idea of “Superfluid Liquidity”. This can be utilized concurrently for market-making and different fee-earning methods native and exterior to the protocol.

Moreover, Bancor V3 will present auto-compounding charges & rewards, that means earnings are immediately re-added to the pool, enhancing the community’s liquidity and growing your potential to earn extra charges & rewards, with no consumer motion required.

Lastly, Bancor V3 can even introduce twin rewards token system, whereby liquidity suppliers can earn different tokens reasonably than BNT. Each BNT and non-BNT rewards are free from the danger of impermanent loss, decreasing the price of operating rewards applications for third-party protocols.