[ad_1]

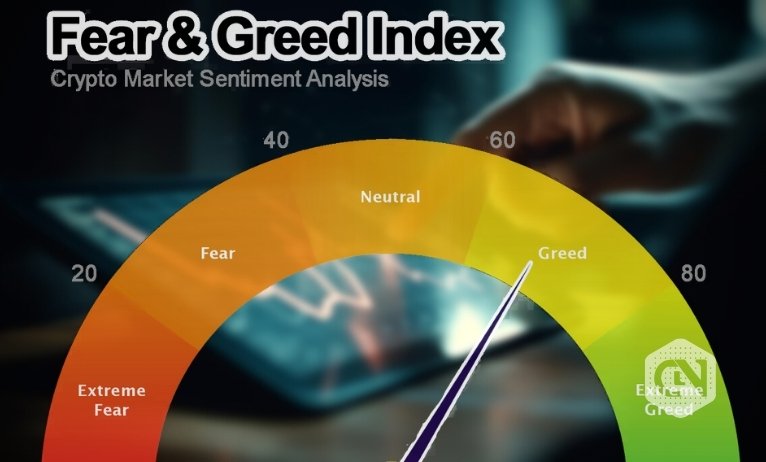

The Worry and Greed Index is a metric that signifies the continued market sentiment on a scale of 0 to 100. Because the identify suggests, it measures the concern or greed of the traders.

For crypto traders, the metric considers social media sentiment and market volatility. Whereas the metric is used prominently, it’s thought-about a contrarian indicator. Thus, merchants ought to use it at the side of further evaluation instruments.

The Worry and Greed Index for the crypto market has just lately been over 70. It’s the first time the quantity has crossed 70 since November 2021. Though the quantity nonetheless signifies “greed,” it’s getting nearer to “excessive greed.”

However what pushed the index in the direction of such a excessive extent? Let’s determine it out.

Understanding the Worry and Greed Index

Earlier than delving deep into the subject, it’s essential to know the Worry and Greed Index.

The metric calculates buying and selling quantity, trade momentum, market surveys, technical indicators, and on-line sentiment. A low rating (0 to 25) signifies excessive concern, whereas a reasonable rating (26 to 50) signifies concern.

Going up a rating between 51 to 75 means greed, whereas 76 to 100 signifies excessive greed. A low rating on the index means merchants should not prepared to purchase crypto. Alternatively, a rating above 65 exhibits first rate confidence.

Underneath the present market sentiment, the crypto market crossing 70 on the Worry and Greed Index is intriguing information. The rating exhibits how assured merchants are presently in investing in cryptos.

Latest Market Situations

Bitcoin, the king of cryptocurrencies, gained 28% up to now two weeks, making it a extremely sought-after asset for a lot of merchants, which led to a worth rally in the complete market. The BTC crypto has lastly crossed the $37k mark and is buying and selling at $37,946 whereas writing.

BTC managed to the touch its 17-month excessive just lately to interrupt the F&G curse after November 2021. The most important issue that pushed BTC’s worth is the spot ETF speculations.

The present crypto rally began with the whispers of BlackRock getting its BTC ETF accredited by the SEC. The rumors helped BTC achieve 7% in minutes, pushing its worth to $30,000, which led to the complete crypto market going up. Whereas the rumors have been promptly discovered to be false, the movement showcased the potential Bitcoin boasts even in hostile market situations.

Bullish Sentiment Components

In addition to the opportunity of a Bitcoin ETF getting accredited, the crypto market has witnessed large developments.

For example, Ripple managed to land a partial win in opposition to the SEC in its long-fought authorized battle. The DOGE group lastly selected a date to ship a bodily DOGE token to the moon. Disney determined to make use of NFTs to increase its market attain.

Shiba Inu’s Shibarium set new heights for blockchain networks. With Bitcoin able to conduct its halving within the upcoming months, the bullish sentiments for the crypto trade hold growing.

Skilled Opinions and Evaluation

Bitcoin has solely been on the rise for the previous couple of months. August was the month that solidified BTC’s place out there. Crypto outperformed gold and tech shares when it comes to market volatility.

The asset hit $26,962 in September and a 28% rise in October to $34,650. In November, the crypto reached $37,354 and is rising. Primarily based on our Bitcoin prediction, the token could cross the $100,000 mark within the subsequent 2 years, and by 2030, the crypto is predicted to cross $313,600.

Pockets Investor expects BTC to keep up a mean of $39,194 earlier than 2023 ends. Whereas Worth Prediction additionally has the same evaluation, placing BTC at $35,461 for 2023. As for Gov Capital, their evaluation places BTC at $60,722 in a yr.

Conclusion

For the previous few months, Bitcoin has proven find out how to steer the market single-handedly. Ever for the reason that rumors surrounding BTC ETF began surfacing, Bitcoin has been on the rise.

With that, the remainder of the market has adopted Bitcoin’s lead. In addition to this, the F&G Index for Bitcoin has crossed 70 after 2 years. Given the present F&G index, extra merchants should purchase into BTC because the metric signifies how assured merchants are in regards to the crypto’s efficiency.

The speculations relating to Bitcoin ETFs hold growing whereas the crypto is nearing its fourth halving. Underneath the circumstances, the market expects BTC to shut in on its all-time excessive shortly.