[ad_1]

Fb has wrapped up nearly 16 years of historical past. Based in 2004 mainly as a social community firm, Fb initially launched to attach Harvard College college students collectively. The corporate’s first steps occurred at a infamous historic second, with the primary iteration beginning off in a Harvard dorm room.

Mission: Connecting the World

The corporate’s preliminary mission sounded harmless sufficient, primarily based on the thought of connecting folks by a single platform. Mark Zuckerberg, the corporate’s founder, has talked about in a number of variances.

Fb was not initially created to be an organization. It was constructed to perform a social mission – to make the world extra open and linked

In late 2019, Fb counted nearly 2.5 billion customers worldwide, as soon as once more making it the most important social community. The connectivity and invitation algorithms expanded the variety of customers, resulting in international community of individuals.

Within the early 2000s, Fb arrived simply as MySpace and different methods to attach on-line had been unraveling. With the opportunity of sharing a number of media, constructing a Fb profile was instantly interesting.

The chief promise of Fb is that its service is free, and all the time will probably be. Through the years, the corporate boosted its promoting revenues, whereas fixed progress mirrored available on the market capitalization. In fact, the service didn’t go with out revenues, as Fb grew its advert outreach, harnessing algorithms to tailor content material.

And it was exactly that tailor-made content material, personalised instruments and timelines which elevated engagement. Fb allowed every person to tweak the relevance of their info, honing in on an important information from their very own perspective. Zuckerberg has remarked on this phenomenon with a direct rationalization on how he sees information relevance.

“A squirrel dying in entrance of your own home could also be extra related to your pursuits proper now than folks dying in Africa,” Zuckerberg has talked about.

Fb’s mannequin is to use this considering to nearly all information, ultimately resulting in fixed engagement and person curiosity.

Fb Inventory Success

Fb went public in 2012, when it had accrued over one billion customers, a milestone for any firm. The corporate debuted with 421 million shares, and was thought of one of many greatest tech IPOs in historical past. After negotiating on a per-share vary of between $28 and $38, Faccebook went public with a worth of $26.81, sparking hopes for an ultra-growth valuation.

However the months after the IPO had been underwhelming, as costs on the open market slid to round $19. However within the years after that, FB inventory turned one of many stars within the new tech increase. A part of the FAANG group of firms (Fb, Apple, Amazon, Netflix and Google), the shares had been on the forefront of a brand new inventory increase.

Fb (NASDAQ:FB) now trades at $221.32, reaching new worth information after a profitable 2019. After the hunch within the fall of 2018, which created fears the US bull market might break, the inventory went on to have one other profitable yr, climbing out of the lows close to $124. Mixed with person progress, and an enlargement of 20% on earnings per share year-on-year, Fb retains itself within the highlight.

Cambridge Analytica Scandal

The Fb inventory worth took off in earnest after 2016. However that was additionally the time when the affect of Fb was being questioned. It was exactly the news-tailoring algorithms which had been taken to talks.

It turned out the enterprise mannequin of Fb was not simply centered round tailor-made promoting. It was additionally a monster information collector.

The Cambridge Analytica scandal identified that sample. Fb had accrued large quantities of information, in addition to expertise in sifting by it. Customers, at that time, had been additionally comfy with the platform and would offer a continuing stream of all manners of information – together with geolocation, information desire, and different varieties of info.

At that time, Fb contained a number of instruments to tailor one’s account, and this additionally produced extra information.

In the long run, it turned out Cambridge Analytica used the info to tweak information and tales, with accusations arising that this tailor-made marketing campaign ended up swaying the US election ends in 2016, which allowed Donald Trump to change into President.

The info assortment occurred at a time when laws had been lax on what might be accomplished with person information. There was no specific consent, and no regulation in place to make customers notice that every considered one of their actions on Fb generated information.

The harvesting additionally occurred primarily based on a personal effort, as Cambridge Analytica was employed to assemble information for US Senator Ted Cruz. However the impact of information assortment and tailor-made content material unfold a lot additional, presumably contributing to a story that led to voting in favor of Brexit.

Your complete scope of the scandal was uncovered within the spring of 2018, simply in time to quickly tank the FB inventory worth.

The info assortment was accomplished by an innocent-looking app, which curated customers’ digital footprint. However the app additionally collected and saved information, which had been later used throughout the scope of political campaigns.

The ultimate depend held that greater than 78 million person profiles had been affected, with the bulk belonging to US-based accounts. Seemingly harmless information like birthdays, places and some different information factors had been used to create profiles, and tailor promoting and tales to these customers. These tales matched and, in response to accusers, amplified sure political moods, which had nothing to do with information about squirrels or cute cat photos.

Zuckerberg’s public involvement elevated within the spring of 2018. The corporate’s founder needed to clarify to a worldwide viewers, and even apologize about its information dealing with practices. The corporate ended up paying a small high-quality of $653,000 for the trespass, which was particularly about not safeguarding person information.

However the true scandal that affected Fb was that the social community had the potential to spice up sure phenomena. Faux information, believably-built tales produced in content material farms in third-world nations, unfold all through the social community, main nations like Germany to brazenly assault the platform’s potential for disseminating dangerous content material.

The social media big was additionally accused of enabling overseas meddling in election outcomes, and having a basic potential in its very mechanisms to sway public opinion.

And that potential has been realized with solely a handful of the customers. Regardless of calls to boycott Fb, the social community nonetheless hosts billions of latest accounts, from vastly totally different cultures, making it a worldwide drive.

Based mostly on the latest information, the info harvesting has not stopped. Information Propria, an organization based in 2018, has reportedly been tasked with engaged on the US election cycle in 2020, with the intention to spice up the probabilities of President Trump’s re-election.

Fb and Cryptocurrency

It was through the greatest crypto increase that Fb set fully totally different priorities. Initially, Fb had little to do with Bitcoin or crypto property, solely exercising warning and banning crypto-related adverts in early 2018.

At that time, Bitcoin and cryptocurrencies had been going by their frenzy part, and adverts helped thinly hid scams collect extra customers. Fb moved in with an outright ban, which lasted for a couple of yr.

For some time, the blowout of the Cambridge Analytica scandal took the forefront for all Fb efforts. Cryptocurrencies had been, at that time, a comparatively minor difficulty.

The world of crypto was additionally going by a crunch, coming into a two-year bear market that affected most property. Your complete 2018 was counted as a foul yr in crypto, when the preliminary hype unraveled, and the guarantees of digital initiatives did not materialize.

Total curiosity in crypto property diminished, together with a dissipation of social media teams and general searches. Therefore 2018 was not the best yr for crypto curiosity, and Fb stood on the sidelines. Within the meantime, a number of crypto startups got here up with the thought of mixing a social media platform with a crypto-based coin or token.

Nevertheless, none of these initiatives had the sources to construct a extremely usable, in style platform. The largest platform, Steemit, ended up firing most of its employees. The Steemit ecosystem additionally held an unfair benefit for early adopters, basically turning into a pyramid scheme.

Different related initiatives did not take off, missing the sources and runaway funding, because the bear market diminished the potential of startups.

Moreover, token-based initiatives misplaced their credibility, and Bitcoin turned the main subject of hypothesis. All of these components meant no large firm wished to the touch crypto property with any seriousness.

Enter Stablecoins

The largest defect of crypto property was their risky worth. Retailers quickly discovered Bitcoin was not the best instrument for funds, as its worth might be extraordinarily risky.

Quickly, the thought of stablecoins appeared – an asset that stored its valuation intuitive at $1. On the similar time, these property allowed for quick, borderless transfers of worth. Reportedly, their chief concept was to gather precise funds in {dollars}, retailer them in financial institution accounts, then difficulty the respective token that matches the worth.

This preliminary concept was realized by Tether, Inc., some of the infamous firms within the crypto house. Over the course of two years, Tether issued USDT tokens, claiming to mirror actual curiosity in crypto funding. The expansion of USDT provide additionally coincided with worth booms for Bitcoin, main skeptics to consider it was a direct effort to control costs.

However the concept of stablecoins picked up, and was expanded upon by new startups. It was exactly the failings of Tether which constructed the brand new technology of stablecoins. These initiatives required buyer screening and de-anonymization earlier than taking in {dollars} and issuing new tokens. Tasks like TrueUSD, Paxos, and USDC by Circle additionally tried to be compliant with the newest laws.

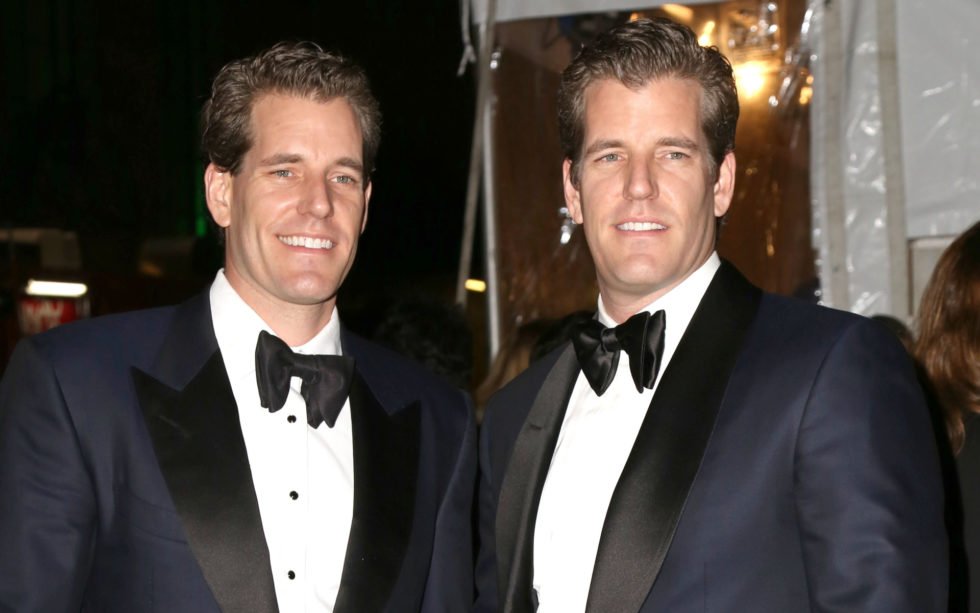

Even the Winklevoss twins joined the stablecoin bandwagon. They’re nonetheless supporting a comparatively small stablecoin, Gemini USD (GUSD), principally energetic on the Gemini alternate. The asset has proven that stablecoins can work even below the strict laws of New York.

This mannequin turned fairly profitable for the crypto house, ushering in new types of buying and selling and entry for each retail traders and large-scale consumers. Stablecoins had a world outreach, and relied on public blockchains to ship the tokens wherever across the globe.

In a world much more used to connectivity, stablecoins, particularly USDT, had been a lifeline. These property made it attainable to accumulate crypto cash and maintain onto them with out the worth threat. Moreover, stablecoins provided a less expensive technique to switch funds worldwide, whereas avoiding a number of the capital controls.

A stablecoin may be despatched in minutes, additionally serving as a type of fintech resolution, whereas avoiding the ready time for financial institution transfers.

The utility of stablecoins was established on the time of comparatively stagnant buying and selling. Nonetheless, stablecoin initiatives appeared and began to unfold by exchanges. When the bullish attitudes returned in 2019, the usability of stablecoins was even larger, as they’d already unfold by exchanges.

Enter Fb’s Libra

Fb’s Libra challenge was introduced in June 2019, simply after a number of months of considerably bettering efficiency on the cryptocurrency markets. Round that point, the Cambridge Analytica scandal had blown over in its worst.

So Fb abruptly introduced it might copy the stablecoin mannequin, and introduce Libra, a digital coin full with an ecosystem and a wallet. David Marcus was put on the helm of the challenge.

Fb, it seems, had copied a number of concepts from the crypto house. Past the thought of an asset-backed stablecoin, Fb additionally waited for extra innovation in constructing networks.

Fb’s Libra, it turned identified, wouldn’t copy Bitcoin. As an alternative, it might resemble cash like TRON and EOS, which used a collection of delegates to provide blocks. This method is called delegated proof-of-stake, and goes past mining and democratic staking. As an alternative, it permits large gamers to help a community and allocate sources.

Fb, with its large affect, went additional. It enlisted 27 large firms to take part within the Libra Affiliation. Among the many listed had been massive telecoms, in addition to VISA, MasterCard, and a handful of different cost processing firms.

The announcement of Libra was initially greeted by the crypto market, unleashing a rally in most property which lasted for a number of months. It appeared Fb, of all firms, can be the entity to unfold the utilization of digital property into the mainstream.

However as an alternative, Fb’s Libra opened a can of worms. Worldwide, regulators shortly recalled the large affect of Fb, and its impact through the years of information gathering and focused content material. Nearly instantly, Mark Zuckerberg needed to go to Congress as soon as once more, and clarify the case for Libra.

Zuckerberg conceded that Libra wouldn’t launch with out regulatory inexperienced mild.

…Some have steered that we intend to avoid regulators and laws. We need to be clear: Fb won’t be launching the Libra funds system in any a part of the world except all U.S. regulators approve it. And we help Libra delaying its launch till it has totally addressed all U.S. regulatory considerations

The preliminary plan was for Libra to launch in early 2020. However to this point, there may be little readability on what regulators intend to do. Libra has been prepared with a plan to base its worth on a basket of worldwide currencies, with a prevalence of the US greenback (50%), but additionally together with the euro (18%), yen (14%), British pound (11%), and Singapore greenback (7%).

The place is Libra Now?

Libra has been working as a testnet token, inviting builders so as to add use instances. The Calibra pockets has been created, although it’s ineffective with out the mainnet token launch.

Based on David Marcus, the Libra challenge will intention to construct a brand new protocol for cash, and nonetheless sticks to its authentic goal to present entry to the unbanked.

The Libra Affiliation continues to be gathering new members, with no strict timeline on once they would change into block producers. The entity has gained regulatory approval within the canton of Zug, Switzerland, thus making use of the regulatory local weather in what has change into often known as “Crypto Valley.”

On the subject of adoption, skepticism about Fb’s information gathering has created a backlash. Fb has spoken a number of instances in regards to the firm having no direct steerage on the utilization of Libra, and has promised it might not collect transaction information.

Central banks in Europe and Asia have additionally spoken towards Libra, suggesting it could result in the formation of a gray economic system and scale back monetary transparency. Thus far, there was no readability on how funds can be transferred or exchanged for Libra tokens.

It’s attainable Libra could also be used throughout the Fb ecosystem, together with throughout the WhatsApp chat. Libra has the potential to achieve hundreds of thousands of unbanked in nearly all world areas, however the acceptance could also be a prolonged course of with many extra regulatory hurdles.

Technically, the Libra community will use fuel to pay for transactions, constructing on the thought of the Ethereum community and even utilizing the very identify for the useful resource. Not like TRON and EOS, the community won’t be free.

Moreover, the newly appointed Technical Steering Committee will oversee how Libra develops sooner or later.

The council of the Libra Affiliation appoints an impartial Technical Steering Committee to manipulate technical improvement for the Libra challenge. Meet the members: @diogomonica @JoeLallouz @ricoflan @nickgrossman @gc3tweets https://t.co/ytQj1NJKAf

— Libra Dev (@LibraDev) January 17, 2020

Probably the most optimistic information about Libra is that its improvement continues. And with crypto markets beginning the yr on a excessive notice, there could also be extra demand for this digital asset. Nevertheless, there may be nonetheless no strict deadline for the launch.

Do you suppose Fb can have success with its Libra cryptocurrency? Add your ideas under!

Pictures by way of Shutterstock, Twitter @LibraDev