[ad_1]

CAKE token is extra of an alternate token additionally used for governance functions. The rating of #76 place is merely primarily based on its in-circulation provide of CAKE tokens, which is nineteen% of its whole provide. PancakeSwap has a complete worth locked (TVL) of $3,088,813,752, however the market cap is proscribed to only $532,308,510. PancakeSwap is much like Uniswap, which is a part of the decentralized alternate platforms that allow swift change in token property immediately. CAKE helps its ecosystem extract the very best worth from completely different exchanges primarily based on its liquidity pool.

PancakeSwap helps the alternate of BEP-20 tokens, earns charges for offering liquidity to their swimming pools, and even staking can be utilized to earn extra CAKE tokens and alternate them with different BEP-20 tokens. The first idea is liquidity which permits them to deal with the adjustments in demand of patrons and sellers. Main elements affecting the expansion of the DEX financial system are higher execution and a community of centralized exchanges, which supply a number of options, help, and advantages to the precise person.

CAKE token hasn’t even reached the midway mark of the June 2022 resistances and has been shifting in consolidation, adopted by additional draw back motion. Technicals signify a decline in shopping for motion that will be trapping the costs underneath a decent consolidation for an extended timeframe. Get detailed details about the identical by clicking right here!

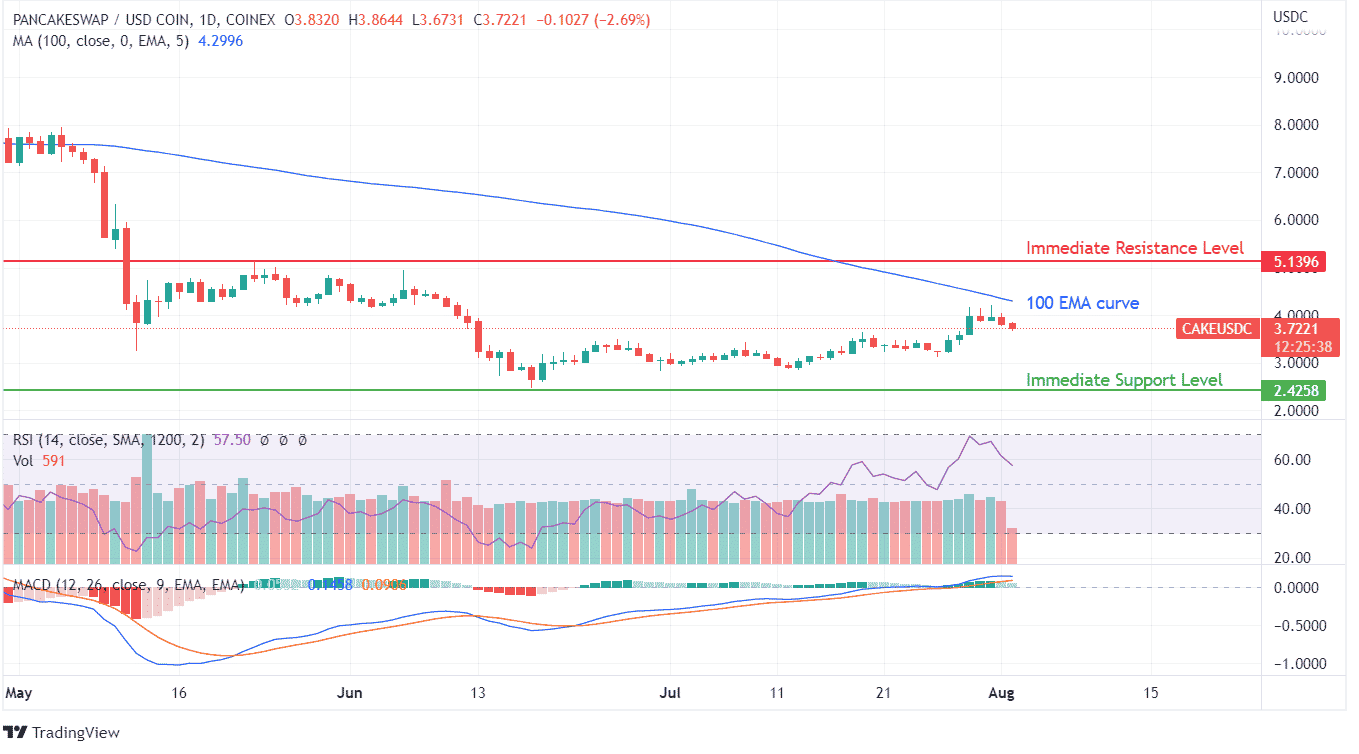

CAKE token is dealing with stiff consolidation with no sudden upside motion witnessed within the final three months. With value motion slowly shifting nearer to the 100 EMA curve, there’s a minor risk of a breakout. This value motion shall be additional examined on the resistance of $5.1 on the short-term time scale.

RSI through the present section touched the overbought zones with out important shopping for in July 2022. The revenue reserving stance was initiated after a big achieve, which is able to preserve the CAKE token underneath stress. The higher wicks shaped on the current candles point out revenue reserving sentiment getting stronger, with the bearish engulfing candle of August 2 confirming sellers in management.

MACD indicator showcases the continuation of the bull run, and the rising wick on the lower-end present candle exhibits the client’s try and contribute towards a optimistic sentiment. Transactional volumes of PancakeSwap shouldn’t be thought-about a technical indicator as this token is multifaceted with restricted liquidity, permitting for an increase in quantity.

Weekly charts present a loss in volatility every week for the reason that crash in Might 2022, and such momentum would require an incredible push to achieve its all-time excessive of $44.18. The value of PancakeSwap continues to be buying and selling at a unfavourable of 91.54% in comparison with its peak valuation.