[ad_1]

Shoppers have lengthy trusted their banks to take care of their cash as a result of they know that they’re insured towards theft and loss. Merely put, if the financial institution goes out of enterprise and loses the cash of its account holders, these folks can nonetheless get their a reimbursement. It’s due to this belief that banks have come to dominate the monetary system and are, actually, a necessity of contemporary life.

Nonetheless, this degree of belief in banks seems to have created a mirage within the various monetary system often called crypto. For too lengthy, hundreds of thousands of crypto customers have positioned their religion within the “banks,” in any other case often called exchanges, that are the go-to platform for most individuals trying to purchase and promote cryptocurrency.

Whenever you open an account with a crypto alternate, they give you your very personal pockets that specifies precisely what number of funds you have got. Identical to a financial institution, you may withdraw these funds anytime by exchanging them for crypto. Some exchanges even provide debit playing cards that can be utilized to purchase issues in bodily shops utilizing crypto, identical to a financial institution. Individuals might be forgiven for considering that their crypto alternate is, certainly, identical to a financial institution.

Alas, the one factor that crypto exchanges don’t have, or moderately, mustn’t have, is person belief. That’s as a result of exchanges aren’t insured towards theft or loss. If the alternate goes bust, your funds can in a short time disappear, as a whole lot of 1000’s of FTX’s prospects not too long ago came upon.

Beforehand thought of to be the world’s second-largest crypto alternate, FTX spectacularly went bust in early November, halting all buyer withdrawals from its platform due to what was described as a “liquidity disaster.” With greater than $8 billion reportedly owed to depositors, a lot of its prospects have been left short-changed with little hope of ever recovering their funds.

The Guardian reported on the story of “William,” a building web site supervisor primarily based in California who awoke to a textual content message warning him of potential bother at FTX on November 8. The 40-year-old instructed The Guardian that he had round $85,000 value of fiat saved within the alternate’s wallets, along with 3 Bitcoins – value round $55,000 – and $10,000 in numerous different tokens. Sadly, he was warned too late to have the ability to withdraw his cash. With fiat withdrawals restricted to simply $25,000, he may withdraw that a lot earlier than being instructed to attend 24 hours.

“After I tried to withdraw the bitcoins, I obtained an error message,” he stated.

All instructed, William continues to be owed greater than $60,000 from FTX however has had no luck in having the ability to get well it. It’s a nightmare state of affairs that might have been prevented so simply had he simply executed his homework and saved his funds correctly in a non-custodial pockets.

A non-custodial pockets is one which the person controls. Each crypto pockets is related to one thing referred to as a “personal key,” which is a string of letters and numbers that present entry to the funds held inside it. With a non-custodial pockets, the person is tasked with storing this personal key by themselves. Nonetheless, exchanges like FTX preserve customers’ funds in what’s often called a “custodial pockets,” the place they keep management of the personal key. In actuality, the person is entrusting FTX with management of their funds. However bear in mind, FTX is just not a financial institution, and it isn’t insured.

The explanations so many individuals proceed to make use of alternate wallets are manifold. Some are most likely unaware of the distinction between custodial and non-custodial wallets, whereas others doubtless don’t need the effort of managing their very own personal keys. The exchanges, with their slick interfaces and advertising campaigns, and sponsorship offers, do an ideal job of lulling customers right into a false sense of safety. They earn their person’s belief, regardless of not really meriting it.

Customers don’t need the effort of managing their personal keys due to the horror tales they’ve learn. Just like the man who unintentionally threw away a hard drive containing over $2 million value of Bitcoin into the trash or the Bitcoin millionaires who lost their passwords. Shedding your password isn’t an issue with a crypto alternate, in spite of everything, as a result of you may merely get well it by way of your electronic mail. However that solely issues if the alternate is definitely going to present you entry to your funds when wanted.

The silly factor is that this needn’t be an issue, for there are already current options to the personal key administration complications. ZenGo is the world’s first consumer-focused multiparty computation pockets, which is basically a seedless pockets that doesn’t require customers to retailer their personal keys safely. As a substitute, it makes use of some intelligent technical trickery to retailer that personal key for you and as a substitute allows entry to your pockets by way of a 3-factor authentication course of that entails electronic mail, cloud storage, and 3D facial recognition. The important thing factor is that the person is the one one who can entry that pockets, and the funds stay completely secure.

In a nutshell, with ZenGo you don’t want to put in writing down your personal key and fear about storing it safely someplace. There’s no likelihood you’ll find yourself just like the man who’s now taking his native council to courtroom for the correct to excavate a landfill web site to get well his misplaced onerous drive. ZenGo has been round for a number of years already and never as soon as has one in all its prospects been unable to entry their funds.

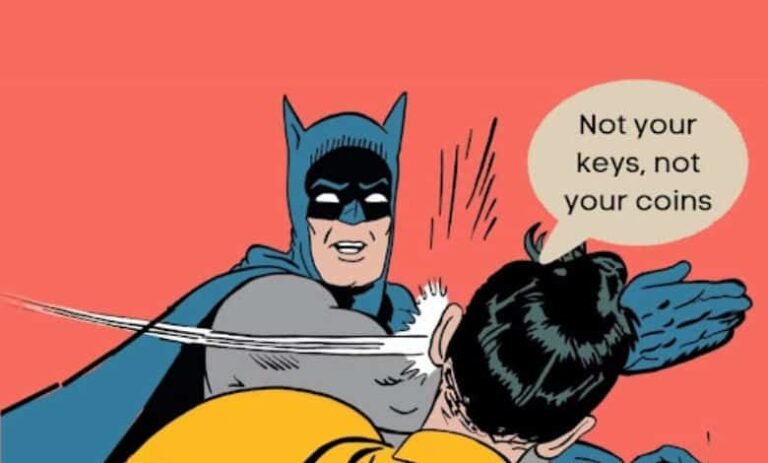

It’s a foolproof system that’s solely now getting the popularity it deserves. Within the wake of FTX’s collapse, ZenGo has seen a 375% increase in asset deposits, together with a 230% improve in new pockets customers. Persons are lastly waking as much as one thing that the crypto trade has been preaching for years already. If it’s not your keys, it’s not your coins.

It’s only a disgrace that it has been such a needlessly painful studying curve for thus many. Don’t change into the subsequent sufferer of an alternate collapse. Take again management, and do it the straightforward approach.