[ad_1]

Litecoin has not solely didn’t create a breakout but in addition moved additional towards the abyss. Litecoin is widespread not only for its funds ecosystem however because the second pure cryptocurrency to exist in its unique state after BTC. This can be a big revelation {that a} cryptocurrency can survive the onslaught of improvement and enchancment if there may be sufficient stamina in its supplied service.

LTC has the biggest service provider community that counts above 2000. The newest interactions of fixes and code upgrades have improved the privateness and value of LTC tokens. Litecoin ranks twenty first when it comes to market capitalization and at present holds a internet price of $3,854,861,406. LTC hit an all-time excessive of $412.96 in Could 2021 and once more a excessive worth above $300 in November 2021.

The worth motion of Litecoin showcases a optimistic development on the weekly outlook, however on month-to-month charts, the outlook once more shifts to destructive motion. Patrons must turn into extra conscious of the event of the most recent resistance degree and try and keep away from such ranges to cut back the likelihood of volatility of their holding portfolio.

LTC value motion has as soon as once more been trapped in a consolidation zone, the place patrons and sellers are each hyperactive of their zones. Technical indicators have been sound and proactive, and the present outlook has modified drastically owing to the double-digit decline of September 6, 2022. What does the long run appear to be for Litecoin? Learn our LTC prediction to know!

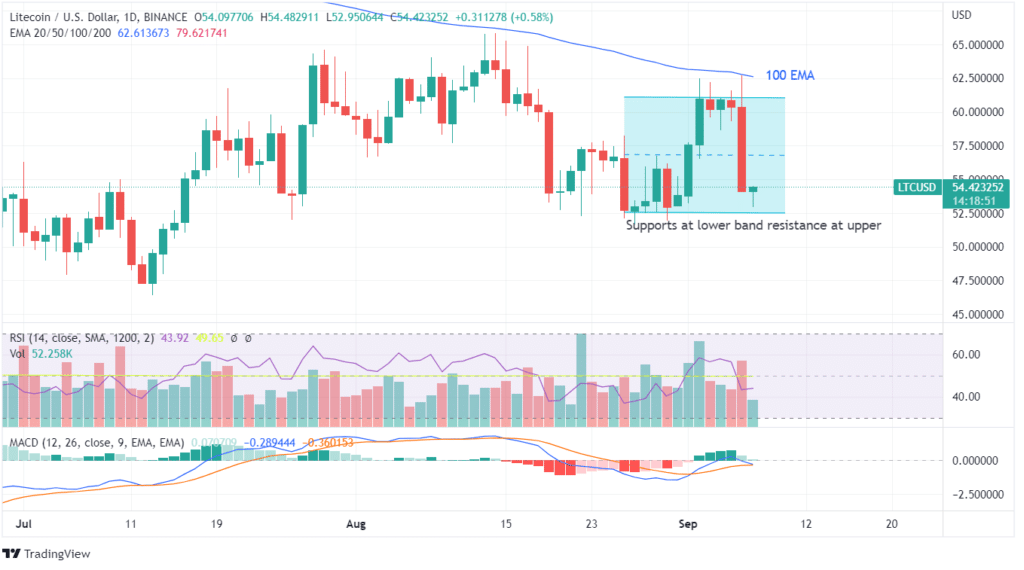

Monitoring the worth motion, we’re witnessing rising anxiousness over the customer’s functionality to regulate the momentum close to the 100 EMA curve of LTC. $52 has turn into a shopping for zone, whereas $61 has become a promoting degree. Between these two ranges, there’s a first rate distinction.

The large revenue reserving witnessed over the last hours turned the tables for LTC fanatics within the quick time period. Brief-term holders already made an honest profit simply by scalping their positions and making a re-entry at $52.

Technical indications displayed by RSI present a below-neutral degree that emphasizes on creation of a revenue reserving, whereas the MACD indicator has shaken arms with RSI to mark a bearish crossover. However given the truth that a simultaneous shopping for exercise is seen as we speak, the possibilities of creation of a bullish crossover have simply elevated.

For an extended length, Litecoin candlestick patterns present shopping for momentum of the earlier week has already been tied by the promoting sentiment of simply three days. This superimposes a better revenue reserving likelihood within the coming days.

As soon as once more, the costs of LTC must have help from the $50 vary, or a optimistic candle can emerge solely after a better breakout sample within the subsequent 4 days of this week. The final destructive candle showcases optimistic motion, rejection, adopted by withdrawal of patrons, which created a panic promoting sentiment for LTC.