[ad_1]

Bitcoin is among the first decentralized cryptocurrencies, which helps in cross-border transactions. In contrast to paper currencies, it’s a digital forex saved in smartphones, computer systems, or different media storage units. Many analysts assume it’s the way forward for forex, and that’s the reason they deal with it as an asset for the long run, like gold or oil.

Nevertheless, many different analysts imagine Bitcoin is extra risky than gold, so it’s not an asset for the long run. It could come to zero sooner or later, which suggests it doesn’t have actual worth.

Because of the uncertainty of the market, giant cryptocurrencies reminiscent of Bitcoin and Ethereum see an outflow in quantity. Apart from that, the incident of Terra (LUNA) additionally discourages individuals from investing in a decentralized asset for the long run.

Bitcoin runs on a Proof of Work consensus, which isn’t eco-friendly as a result of it makes use of extra energy for mining. Apart from that, it additionally faces points with scalability and better transaction charges.

Alternatively, Ethereum will change from Proof of Work to Proof of Stake consensus, which is able to profit the system in the long term. There isn’t a such information for Bitcoin Protocol. BTC led the rally within the final two years, but it surely doesn’t imply it can lead the rally after the consolidation section. Go to right here for extra particulars concerning the future Bitcoin prediction.

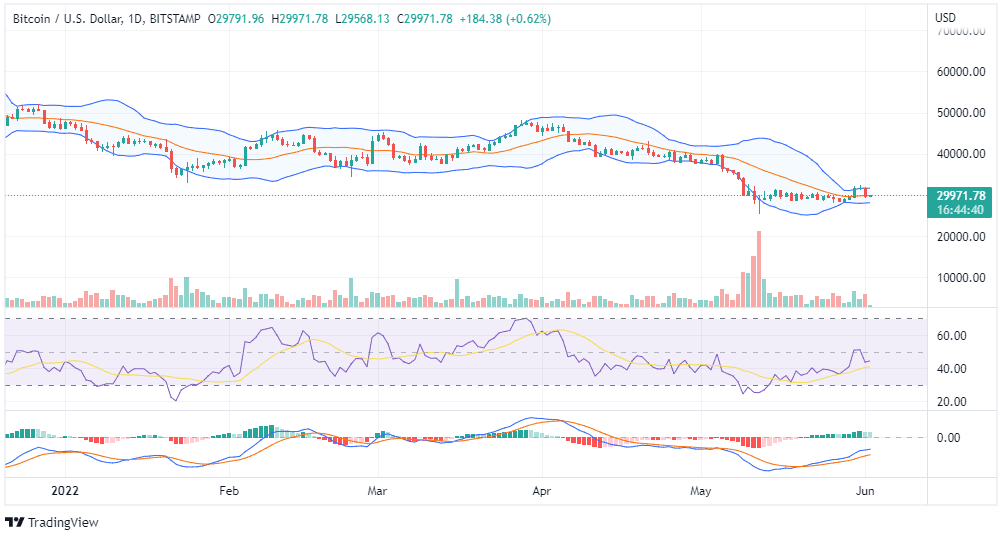

On the time of writing, BTC was buying and selling round $29,971. In the previous few months, it has been consolidating between $45K and $32K.However after the market crash of Might, it’s buying and selling under the help degree.

The MACD indicator and RSI replicate bullishness within the brief time period, however Bollinger Bands lacks volatility. After analyzing the technicalities within the brief time period, we predict BTC will consolidate and may not see any upside or draw back rally, at the very least within the subsequent few weeks.

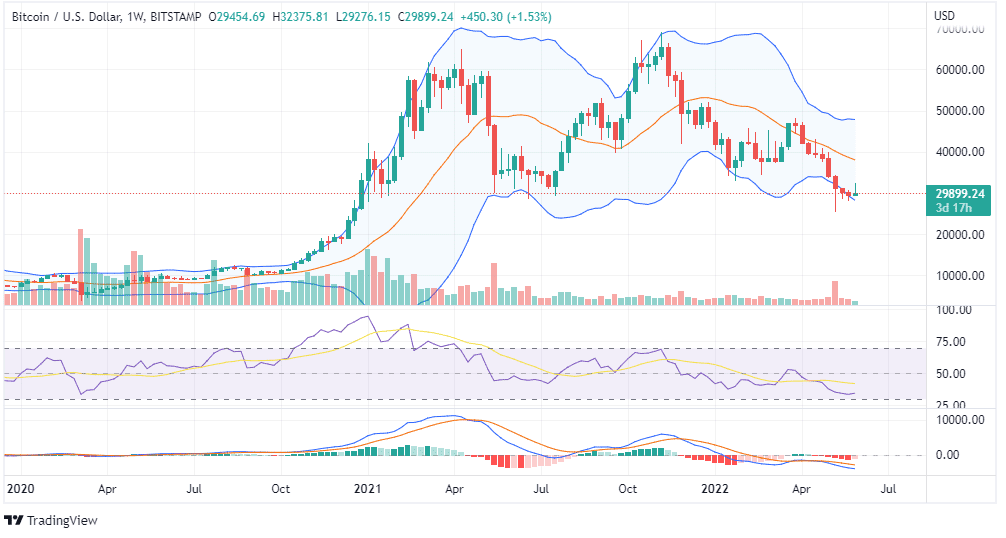

Though the long-term weekly chart appears good, the BTC’s value has damaged the robust Help Degree of $32K. It means BTC will regain its degree; in any other case, it can fall additional. If it falls, the following help degree will probably be onerous to foretell.

We’ve got to attend for a couple of extra months earlier than it takes one other help. Nevertheless, if it doesn’t fall, then merchants might accumulate some cash for the long run.

Bitcoin is a well-liked asset, and many individuals maintain it for the long run. On the weekly chart, the MACD indicator is forming pink histograms, and RSI exhibits bearishness available in the market. The latest weekly candle is forming an inverted hammer within the decrease vary of the Bollinger Bands.

For those who belief Bitcoin, you possibly can accumulate some cash, however technically it’s not the best time for long-term funding. The value might go down additional, creating a greater alternative to purchase extra BTC.