[ad_1]

IoTeX will not be your common blockchain providing a bunch of digital companies. Moderately, it realizes the notion that blockchain can remodel how machines work together with one another. In easy phrases, IoTeX permits blockchain know-how to work in your machines and is not only restricted to software program. It’s amongst the only a few blockchain applied sciences that one can simply combine into their private life.

Within the present timeline the place putting in door cams, good cameras, laptops, interconnected fridges, and air conditioners are a simple device; hackers can simply hack your WiFi community and achieve entry to those digital machines. It marks a serious query on what one can do to stop hacking of IoT units and has develop into the core topic of the IoTeX blockchain.

IoTeX makes use of a delegated Proof of Stake validation mechanism and has even invented Proof of Presence for its Pebble product. Initially developed as an ERC-20 token in 2017, it developed its blockchain in 2018 and included options reminiscent of staking.

IOTX token at the moment has a market capitalization of $317,788,723 with a provide of 9.54 Billion tokens. IOTX attained its all-time excessive worth of $0.2611 in November 2021 and at the moment trades at an 87% low cost to this worth. The expansion of the IoT ecosystem will immensely profit this blockchain and its development prospects.

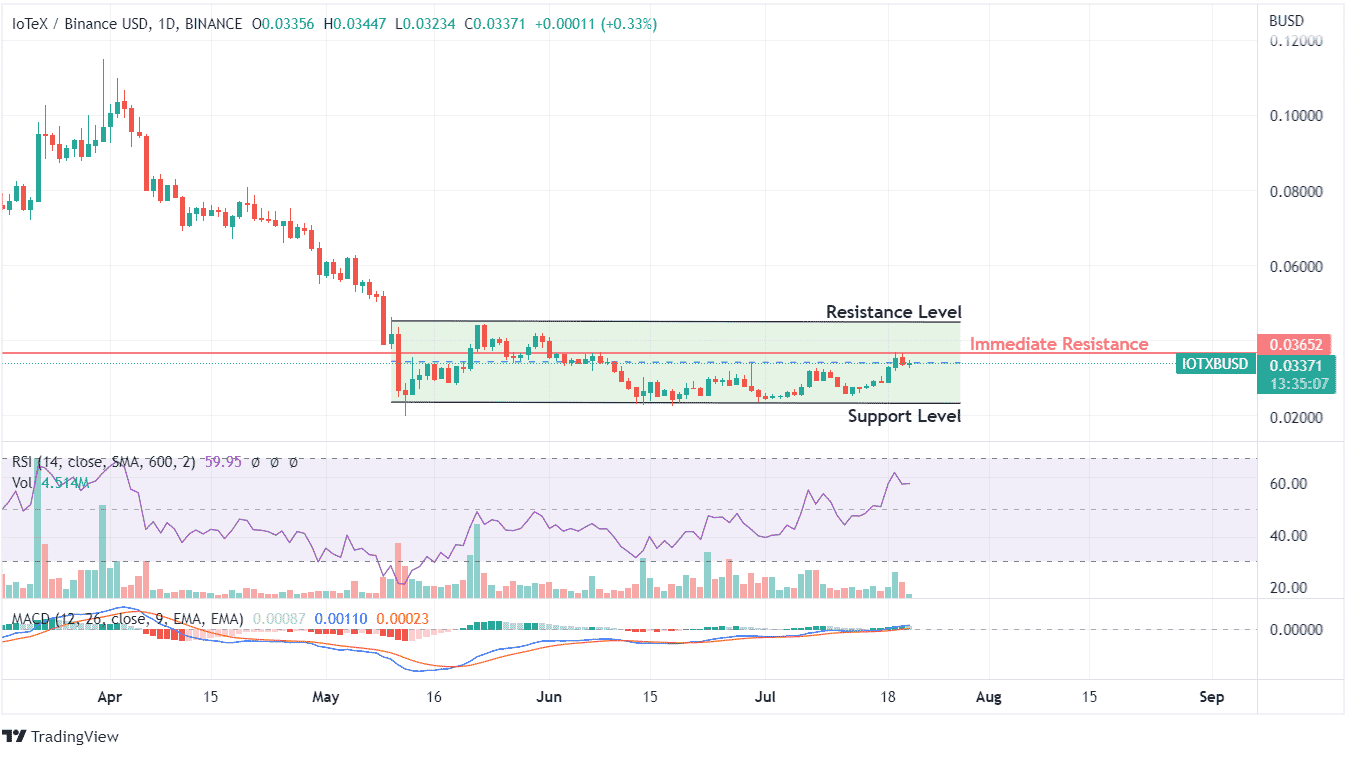

After leaping considerably from its June 2022 lows, IoTeX hasn’t been capable of escape the realm of revenue reserving. The sudden bounce for this week has already been misplaced to revenue reserving by the patrons who entered at decrease valuations.

The worth motion of IOTX signifies a consolidative value motion that hasn’t been capable of attain the primary rejection degree of Could 2022. As such, patrons should not permitting the costs to seashore resistance zones due to a revenue reserving mindset.

The RSI ranges have elevated from oversold zones of 20 throughout Could 2022, it has now entered a degree of 59, however the influence of this shopping for sentiment isn’t mirrored within the value motion. The MACD line and Sign line has been buying and selling shut to one another since mid-Could. All these points spotlight the vital ingredient of upper shopping for regardless of a lower cost hike.

With the current rally having created higher wicks on July 19, it grew to become evident {that a} promoting zone become resistance. The identical evident reality was confirmed on July 20, however the formation of three inside-down candles has signified a detrimental stance. If the value motion of July 21 may shut the candle above the opening worth of the day prior to this, the candlesticks would point out a shopping for facet state of affairs.

RSI indicator has turned sideways for the day, and the course of its continuous mixed with breaching the $0.3652 degree will guarantee a optimistic rally. Failure to mark such a bullish stance may drive IOTX to enter a revenue reserving state of affairs with the next likelihood of testing the quick help degree at $0.2300.