[ad_1]

Ethereum worth is down by round 10% after the profitable Merge improve on the principle internet. Many consultants suppose Merge was a ‘Sale the Information’ occasion the place buyers entered the market to promote after this ‘Crypto Climax.’ Within the final 24 hours, Bitcoin (runs on PoW consensus) has dropped solely 2%, whereas Proof of Stake consensus-based Ethereum is down by round 10%, and DeFi Pulse Index (DPI) is down 6%.

Certainly, it’s excellent news that Ethereum Merge has been accomplished efficiently with none glitches, nevertheless it results in promoting stress on ETH due to the speculators who entered the market solely to get the next return within the final two months. The market consultants are hopeful that this alteration in consensus will make the community technically stronger with larger vitality effectivity.

The Ethereum-based PoW chain is the results of this Merge, and the miners will get the identical quantity of ETHPoW as their holding on ETH. Nevertheless, the value of ETHPoW has dropped considerably within the final 24 hours, which might additionally affect the value of ETH.

Nevertheless, this speculation-based volatility won’t final lengthy, and the value will stabilize inside a couple of weeks. The worth of Ethereum has not damaged its help degree, so long-term buyers mustn’t fear about this sudden sell-off.

In addition to that, within the USA, the most recent CPI information additionally affect the inventory market worth and cryptocurrencies, so buyers are promoting due to the danger of inflation and shifting their cash to a safer asset.

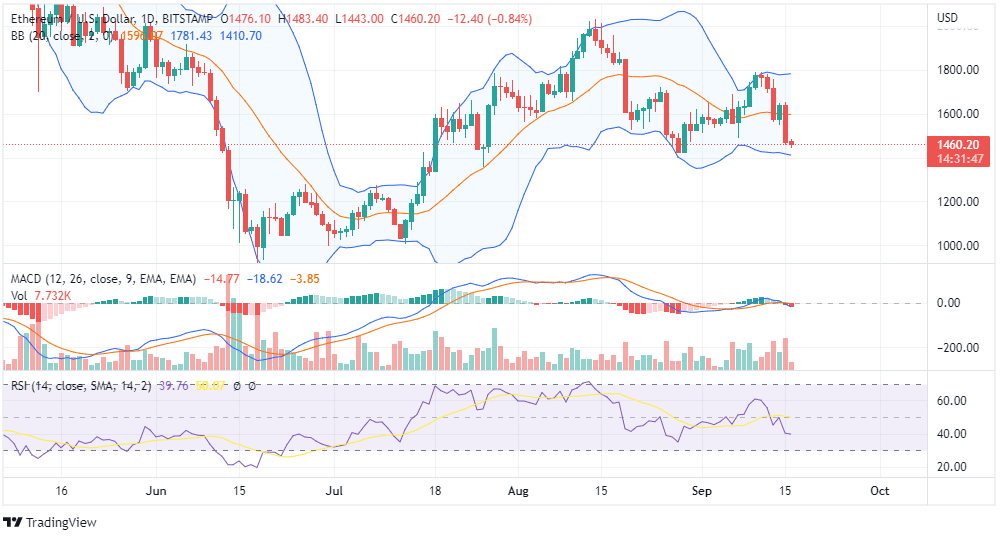

Earlier than investing in ETH long-term, click on right here and browse our ETH predictions that can assist you make the correct resolution. On the time of penning this publish, Ethereum was buying and selling round $1460, which is a help degree of this coin. On the higher facet, $1770 is resistance, and beneath $1400, there’s robust help of round $1200.

On the time of penning this publish, Ethereum was buying and selling round $1460, which is a help degree of this coin. On the higher facet, $1770 is resistance, and beneath $1400, there’s robust help of round $1200.

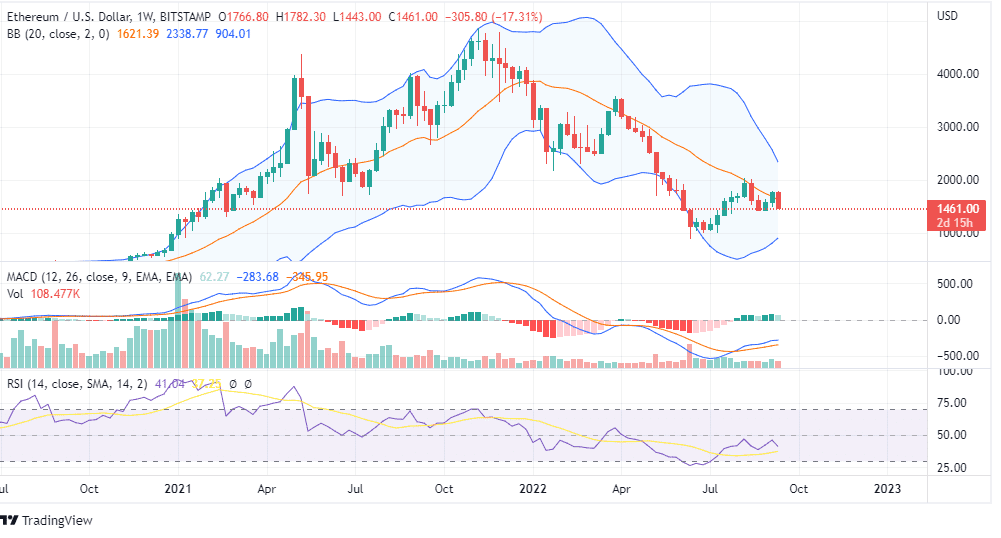

So, the ETH token will consolidate inside these ranges. Within the quick time period, there’s a robust chance that the value will reclaim the extent of $1600, so you shouldn’t miss this purchase place for a couple of days with a goal set as per your funding objectives. On the weekly chart, ETH has fashioned greater lows and decrease highs that signify a triangle-like sample. Certainly, Ethereum will break the resistance in the long run, so we predict it is a perfect time to build up ETH for the long run.

On the weekly chart, ETH has fashioned greater lows and decrease highs that signify a triangle-like sample. Certainly, Ethereum will break the resistance in the long run, so we predict it is a perfect time to build up ETH for the long run.

Within the subsequent two months, the speculator will promote their stakes, and the actual buyers will accumulate ETH, which can increase the value in the long run. As a retail investor, you shouldn’t promote out of panic however maintain your positions as a result of it has modified its fundamental core, making it an asset within the subsequent few years.