[ad_1]

Ethereum’s rise to the second-largest cryptocurrency community has been a tremendous journey. From splitting to creating its market presence inside a only a few years to now shifting on to a brand new validation protocol to save lots of on electrical energy and different issues put forth by analysts, ETH has the very best potential to dethrone BTC. Whereas the details and figures appear wonderful, it even helps a number of blockchain networks by its layers-2 companies and validations.

Nonetheless, one have to be questioning why it has been falling since hitting a contemporary excessive in November 2021? The reply lies in escalating valuation primarily based on the information of a futuristic protocol it goals to launch; ETH has been falling since, as the actual date for proof of stake validation is being pushed in the direction of the tip of 2022.

From technical notion, there are sturdy provide and demand zones since individuals are most desirous about shopping for for much less for the reason that days of FOMO have lengthy been pushed behind. With its present market capitalization, ETH is ten occasions bigger than Solana and near 45% of BTC’s market worth.

Ethereum Value Evaluation

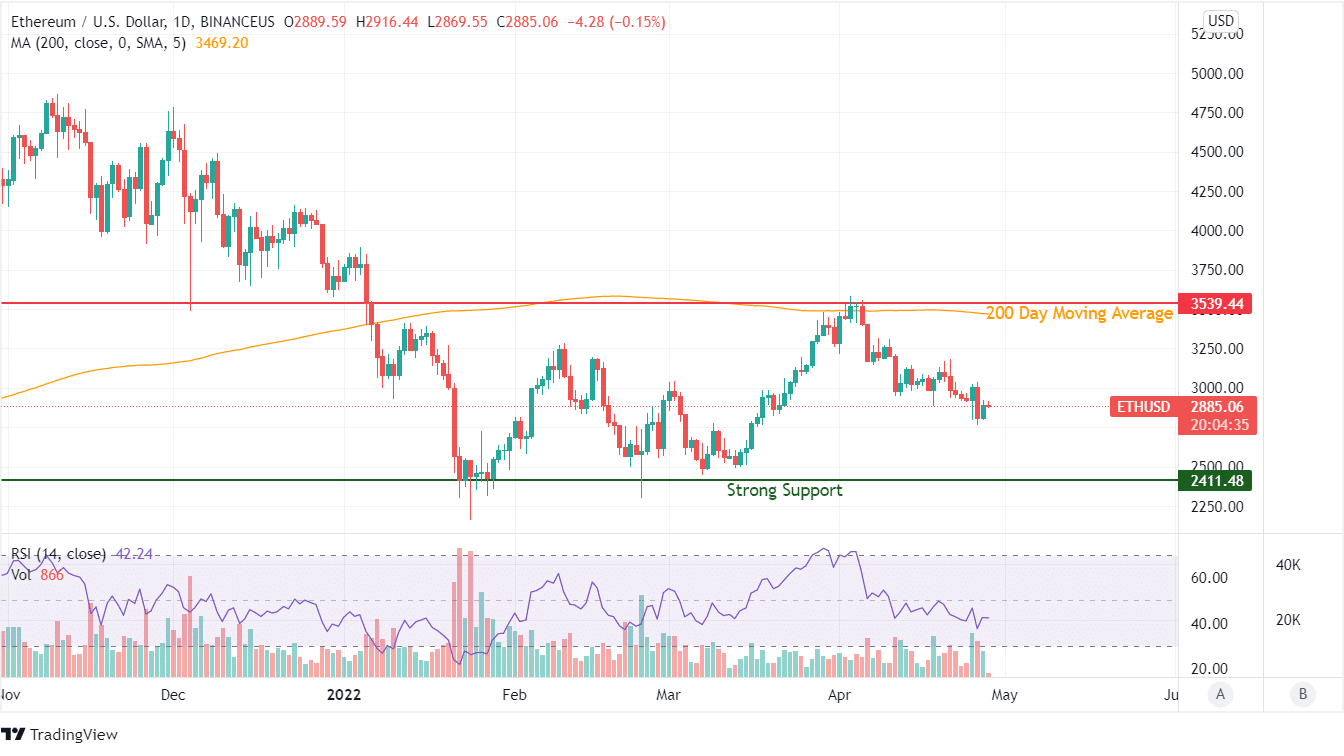

ETH worth development has repeatedly overwhelmed expectations, however since ETH is buying and selling beneath the 200 DMA curve, there’s a adverse sentiment within the quick time period.

On the similar time, patrons are always trying to breach $3600 whereas the 200 DMA curve is slowly dipping in the direction of a decrease stage. The second ETH surpasses this 200 DMA curve, there could be an explosive worth motion in the direction of contemporary excessive ranges.

Allow us to talk about the indication of technicals and worth patterns of ETH within the quick and long run to realize a greater understanding.

ETH has a powerful demand at $2400 ranges, and there could be an explosive demand from this stage within the coming days. The one resistance seen above is $3200 to $3600, which has turn out to be a resistive zone hindering the additional motion of ETH.

The candlestick patterns since April 2022, when ETH didn’t surpass the 200 DMA resistance, have been revenue reserving in free fall, consolidation, and additional revenue reserving. The current 6% collapse on April 26, 2022, appears to be a results of exterior issues concerning the affect of Elon Musk on the crypto market.

For the reason that ETH worth tanked near 22% in April, the shopping for energy indicated by the RSI indicator has declined by 66% throughout this time. Transaction volumes for the final six months have largely remained the identical, with some days of spikes however common out at comparable ranges. For the quick time period, ETH has just a few milestone costs to surpass to turn out to be positively trending once more. Nonetheless, merchants ought to discover market sentiments and learn extra concerning the ETH’s future worth momentum earlier than investing.

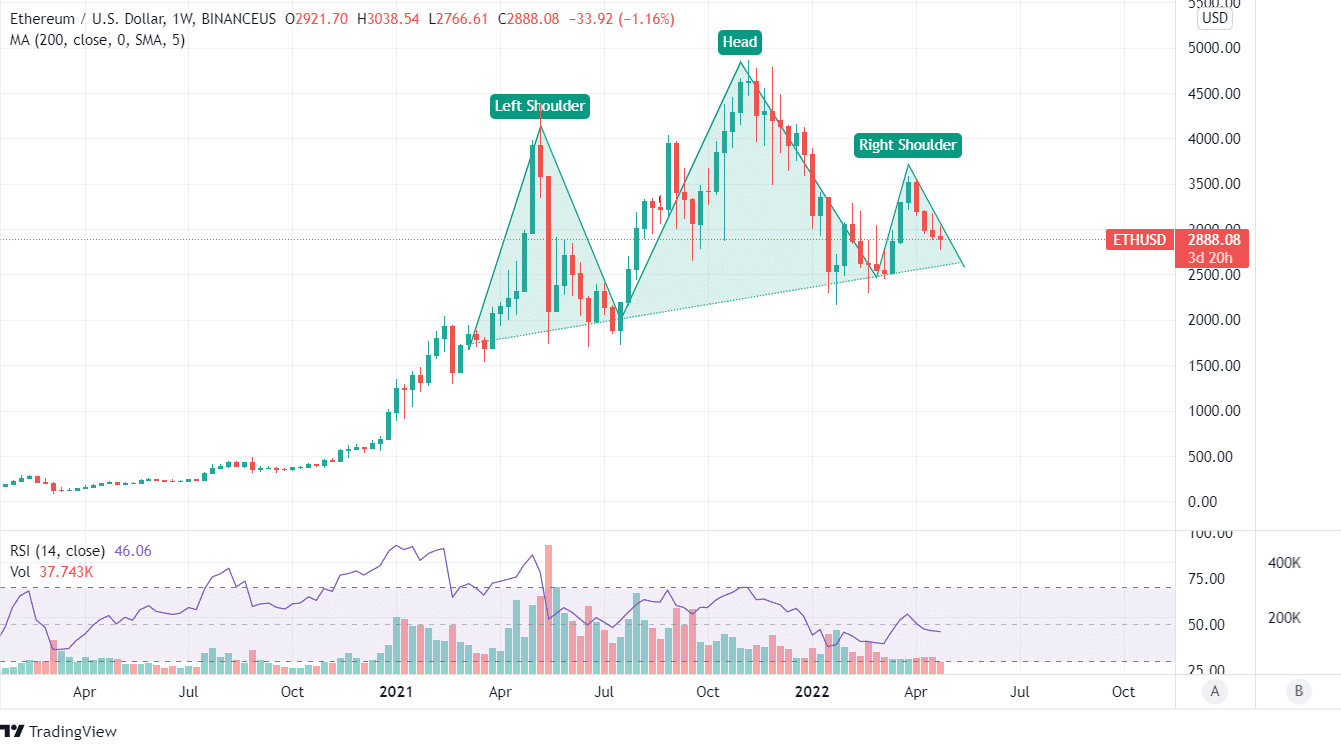

ETH worth development is powerful, however weakening demand could be seen arising for the reason that starting of 2022. The rationale for a similar can’t be recognized from its worth development, however one can assess that costs above $4000 shall be bullish for ETH whereas values beneath $2500 shall be adverse.

The battle strains between the trending stage of $2500 to $4000. One ought to guarantee they don’t purchase at a excessive worth since returns on such investments could be considerably decrease. As soon as ETH strikes on to the proof of stake algorithm and improves transaction speeds, issues can take a whole turnaround from present sentiments.