[ad_1]

Ethereum’s successive plans to dominate the cryptocurrency world are on observe with its progressive thought behind the rumored merger. Whereas ETH is performing strongly on elementary grounds, the affect isn’t seen by holders of this token, who think about it a token of merely a storage worth.

As of now, there aren’t any blockchains to threaten the dominance of ETH in sensible contracts or the decentralized finance area. On prime of internet hosting a majority of blockchains, Ethereum has been a most popular alternative as a safety chain for brand new blockchains.

The market capitalization of this token is $203,858,376,166 and has made a achieve above 6% within the final 24 hours alone. This value motion, regardless of the quashing of rumors by its developer Vitalik Buterin that transferring to Proof of Stake would end in decrease transaction charges for Ethereum blockchain customers. The outlook of this blockchain is impartial of its transaction value or comparable dynamics, as individuals have thought of ETH to be the subsequent blockchain worthy of being thought of a storage worth token.

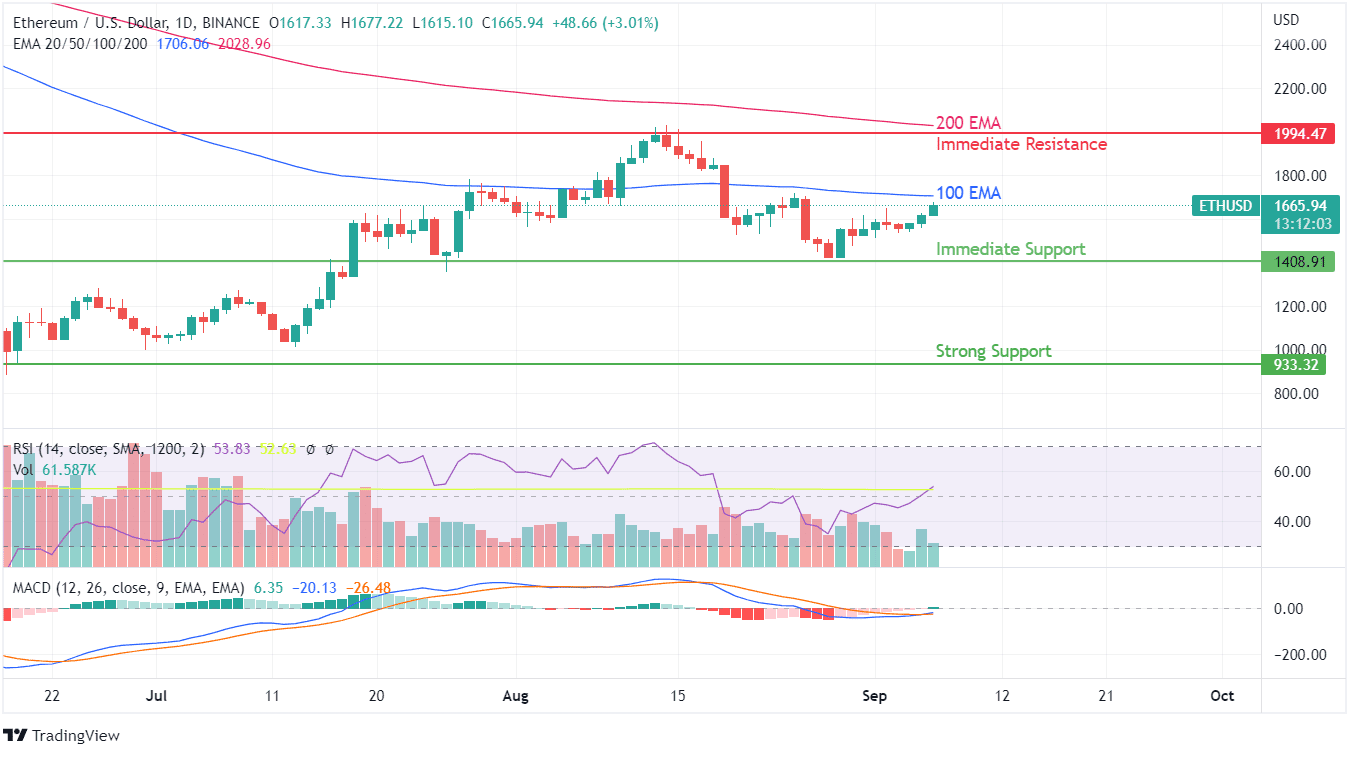

ETH token has confirmed instant help, which can show to be the pivot it wanted to proceed its constructive trajectory. The instant help stage of 100 EMA is a should for a breakout and testing the power of resistance at 200 EMA. Go to right here to know when Ethererum will cross 100 EMA!

Ethereum cryptocurrency has developed resistance at $1994, which must be breached in an effort to safe a constructive outlook. The instant help stage of $1408 and robust help stage of $933 look very agency, and patrons can take reference from these pivots to establish the uptrend and achieve chance.

On candlestick patterns, since taking help of $1408 has fashioned back-to-back constructive candles gaining vital worth within the final eight days. Because the sellers took management of the worth momentum close to the 100 EMA curve, an analogous development could be repeated this time too. The short-term resistance has developed round $1725, which is inside the grasp of the present value of ETH.

On technical indicators, RSI might be seen leaping from 40 to above 53, whereas the MACD indicator has created a bullish crossover sample that will assist in an extra uptrend of ETH within the quick run.

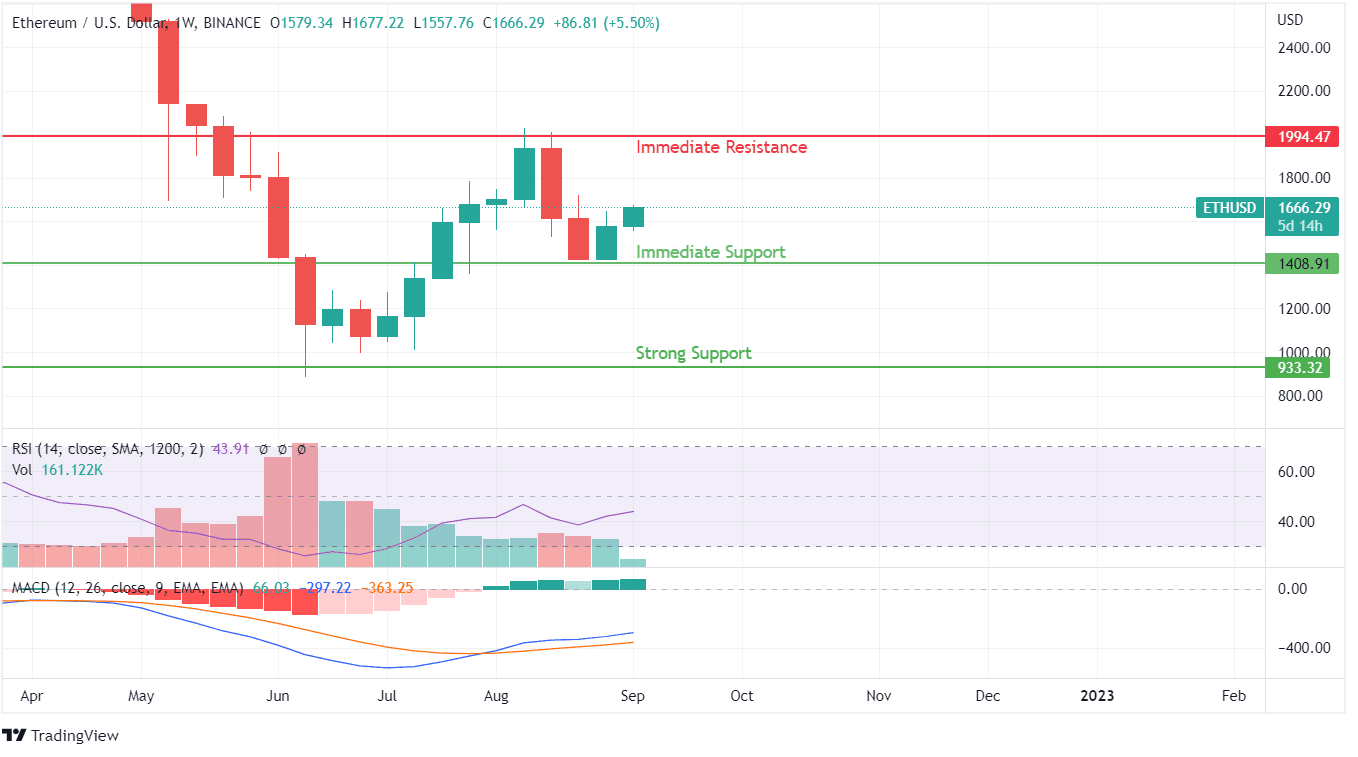

ETH had managed to beat the unfavourable development developed within the second final week of August 2022, with two constructive operating weekly candles overtaking the height worth of $1617. Continuation of this value development can work wonders for Ethereum as technical indicators on this period point out the start of a constructive shopping for sentiment.

Whereas RSI signifies a shopping for rally, MACD has maintained its constructive stance that was created throughout the first week of August 2022. When it comes to momentum, the present week goes stronger and seems to have gained larger motion in simply three days than required for a complete week throughout the earlier week.