[ad_1]

Ethereum has now develop into revenue and positive aspects. Regardless of the ups and downs, the ETH worth has returned to its earlier peaks. This time it has gained large worth motion from its June 2022 dip worth of $883. The market capitalization of ETH has reached $204,925,177,350 and showcases a robust potential to proceed shifting upwards.

The final thirty days alone have supported an enormous achieve. This digital financial system was value above $600 billion throughout its peak in December 2021. The core concept behind ETH is now even stronger; as new developments are launched every month, the worth of this token is ready to maneuver upwards.

ETH token has emerged victorious to some extent as the costs have moved upwards with a excessive depth regardless of the volumes remaining below wraps. Technicals showcase shopping for sentiment nearing the overbought zones, which may end in some revenue reserving or consolidation. Take a look at wherein course the ETH worth will transfer by clicking right here.

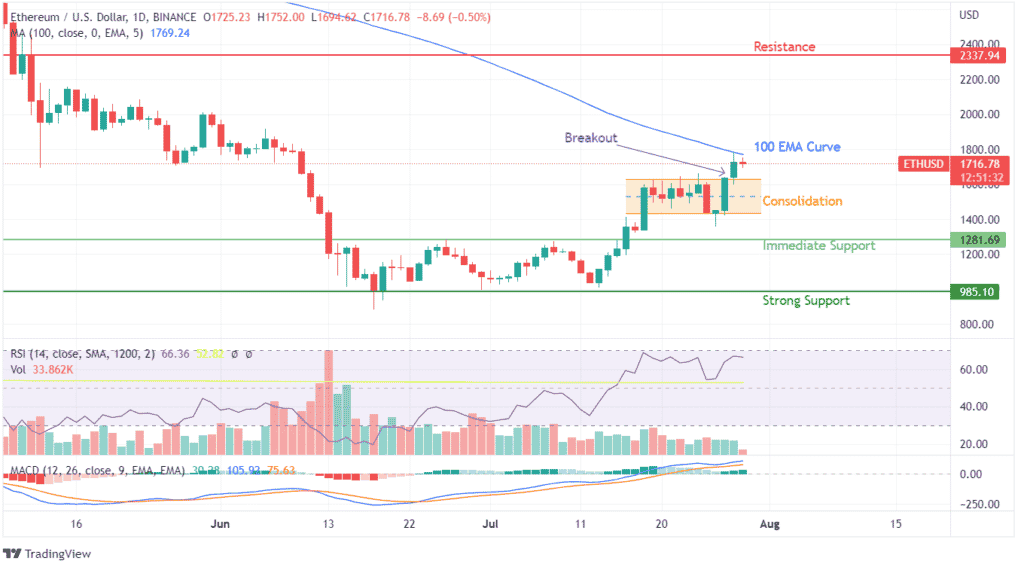

The worth motion occurred as ETH closed in the direction of its 50 EMA. The instant response to the pattern was rejection, however quickly an enormous bounce took ETH above its 50 EMA curve. An analogous pattern is being repeated as ETH is now closing on to the 100 EMA curve, which may very well be a sport changer for its worth potential within the quick time period.

Speaking concerning the technicals of Ethereum, RSI is showcasing hibernation by the sellers whereas patrons dominate the market sentiments. As soon as once more, ETH has marked robust positive aspects with an depth that makes patrons consider in its functionality to breach the 100 EMA curve. MACD indicator for Ethereum has now entered the optimistic axis with no instant projections of a bearish crossover.

The instant help stage has moved as much as $1281, whereas a robust help stage is energetic at $985. A consolidation breakout has already occurred on July 28, 2022, marking for-profit reserving. Because the technical indicators current proof of ETH getting into an overbought zone, patrons ought to brace for an actual consolidation as patrons and sellers would battle it out for the 100 EMA.

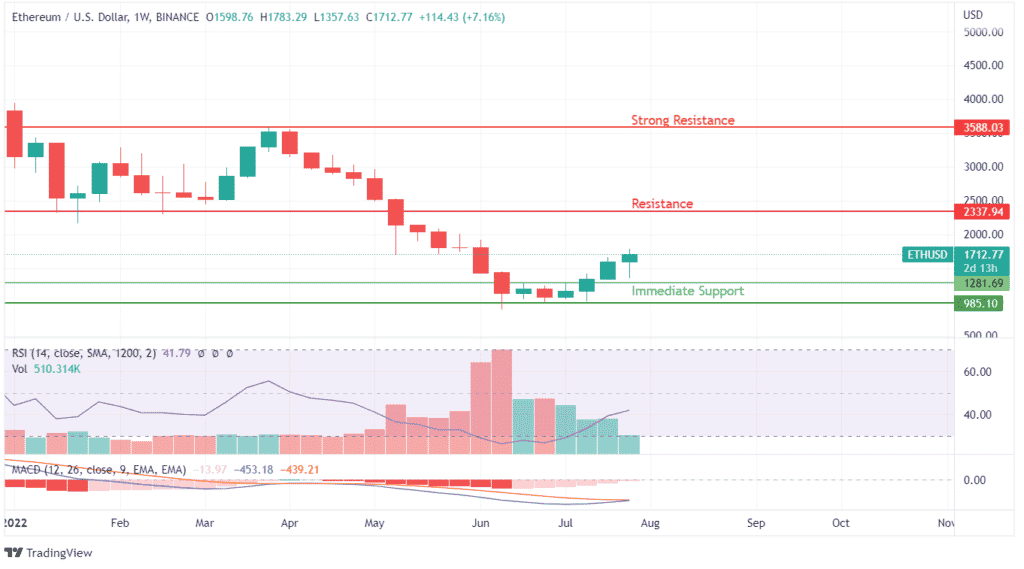

The readability provided by weekly charts exhibits a robust pullback from the instant resistance stage regardless of going through seller-based resistances for the final three weeks. ETH is in need of 36% from its instant resistance and 108% from its robust resistance of $3588. MACD on this timeline signifies a bullish crossover is quickly to occur.

Whereas the RSI and the volumetric indicators mark the expansion of shopping for sentiment even on a bigger time-frame, breaching the Could 2022 peak must be its goal within the instant reversal swing. Ethereum creates the right setup for making large positive aspects within the quick time period.