[ad_1]

Ethereum was formally launched on July 30, 2015, with the discharge of its first stay mainnet, Frontier. Since then, it has grown to turn into one of many largest and most generally used blockchain platforms, with a worldwide community of customers and builders. Ethereum permits builders to construct and deploy a variety of purposes on its platform utilizing a programming language known as Solidity.

ETH now holds a market capitalization of $161,483,079,935 however has didn’t make a considerable uptrend. Even with a 165% bounce within the volumetric transaction during the last 24 hours, ETH has didn’t make any progressive impression on the worth motion. Learn how Ethereum will carry out within the coming years by clicking right here!

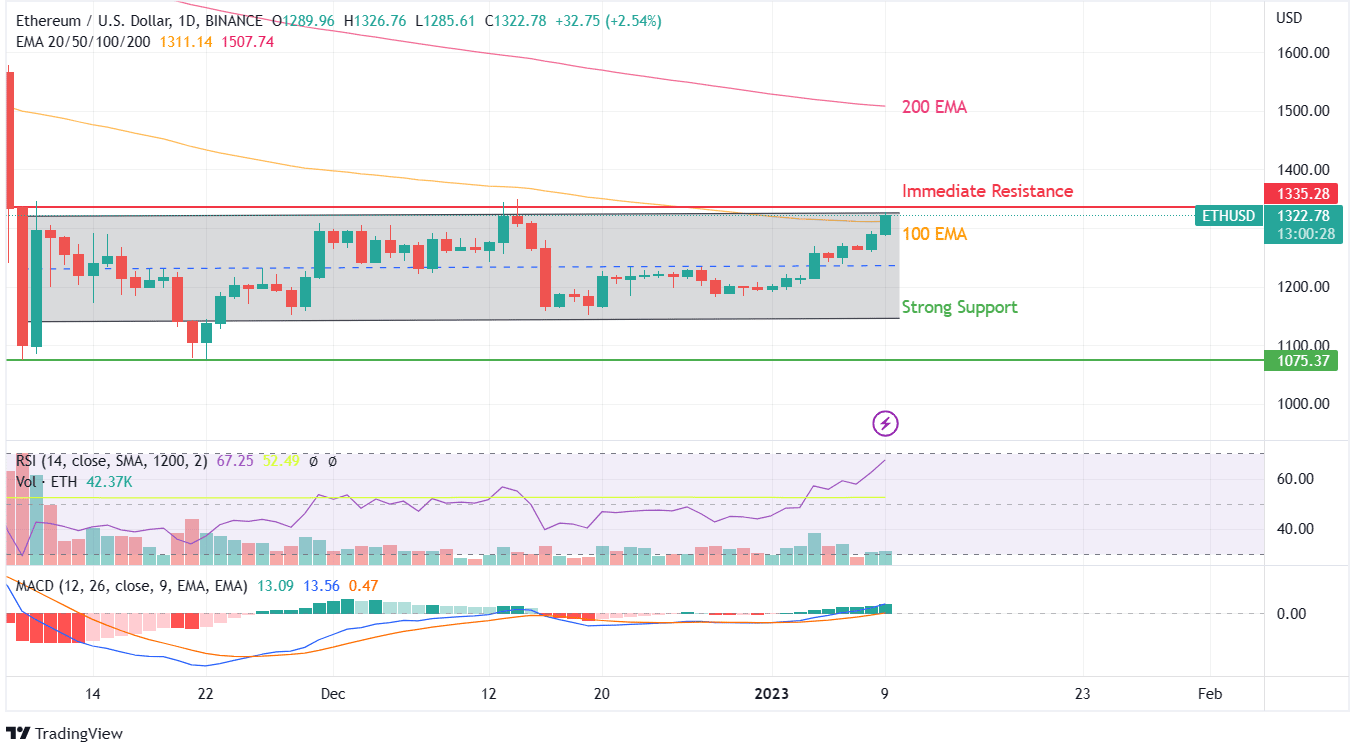

At a single look, ETH appears to be trapped in a consolidation zone since its decline in November 2022 with none constructive outlook. With costs having tumbled from the present values a month in the past, the hope of a constructive breakout will not be justified. The one distinction this time is the buying and selling worth of ETH being above the 100 EMA curve, whereas the 200 EMA curve is buying and selling close to the $1500 worth.

In case consumers don’t hoard in direction of Ethereum within the coming days on account of it breaching the 100 EMA, one might need to attend until the 200 EMA curve for a turnaround in consumers’ sentiment. Retailers have confronted large bearish developments within the final 12 months, and regardless of having overcome the challenges of a merger, ETH has didn’t garner the eye anticipated for this feat.

Since all earlier worth rejection of ETH has occurred because the token moved in direction of the 200 EMA curve, consumers may be anxious about its development reversal earlier than it managed to commerce above $1500. A large bounce in token demand may lead it to surpass even $2000 if the order of occasions maintains decrease volatility and constructive information comes from the federal government actions of crypto adoption.