[ad_1]

Ethereum is not only a blockchain or cryptocurrency however a necessary side of cryptography that showcases transformation and evolution alongside the way in which of its progress. Understanding the altering dynamics, ETH has even ready the format to transition in the direction of Proof of Stake to handle the power consumption difficulty of its present operational Proof of Work. Of the various kinds of cryptocurrencies, resembling utility, fee, stablecoins, and safety, ETH comes beneath the utility differentiation.

There are a lot of rumors concerning the coming age for Proof of Stake ideas rendering it meaningless to sort out future challenges. At current blockchain dynamics, ETH ranks second, and there isn’t any potential blockchain to dethrone Ethereum from its distinguished state. Market capitalization for Ethereum has already reached above $202,879,176,111, which is an efficient signal because the optimistic development mixed with sentiment will take this worth even additional.

The value motion of ETH acquired a brand new life in July 2022, scaling its market capitalization considerably. All technical indicators help the optimistic development, however a short-term revenue reserving proportional to consolidation is due earlier than a significant breakout. Click on right here to know extra concerning the ETH technicals!

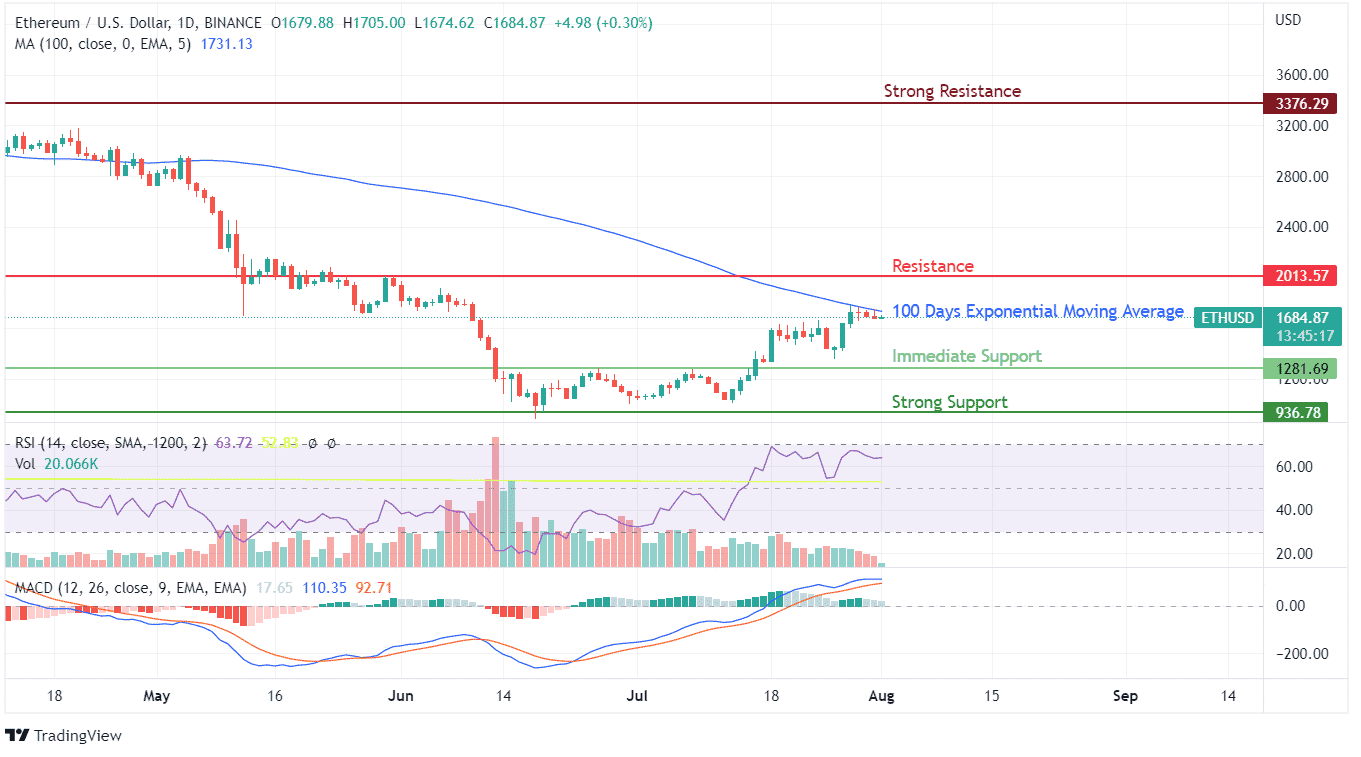

ETH presently faces resistance at 100 EMA because it spends 5 days overcoming this stringent resistance. Day by day worth momentum has additionally stopped inside marginal tolerance from optimistic to adverse aspect. The transaction quantity has additionally hit a contemporary low throughout this time regardless of RSI indicating a near-overbought development. It will basically name for a revenue reserving or discount within the shopping for sentiment, which is pushing toe-to-toe effort identical to the sellers.

The speedy help stage of $1281, adopted by sturdy help at $936, will proceed to help ETH within the brief time period. Based mostly on historic worth motion and pivot ranges, the present resistance lies at $2013 and $3376. On an outer look, ETH’s worth motion looks as if substantial shopping for occurred close to the help stage of $1280, adopted by the resistance on the 100 EMA curve coming into motion, forcing the token to maneuver down.

ETH will want a bounce again, which could possibly be doable from $1600. Ethereum has an uptrend risk for the brief run and future too. The MACD indicator has moved nearer to realizing the potential for a bearish crossover that might hit the token’s bullish momentum.

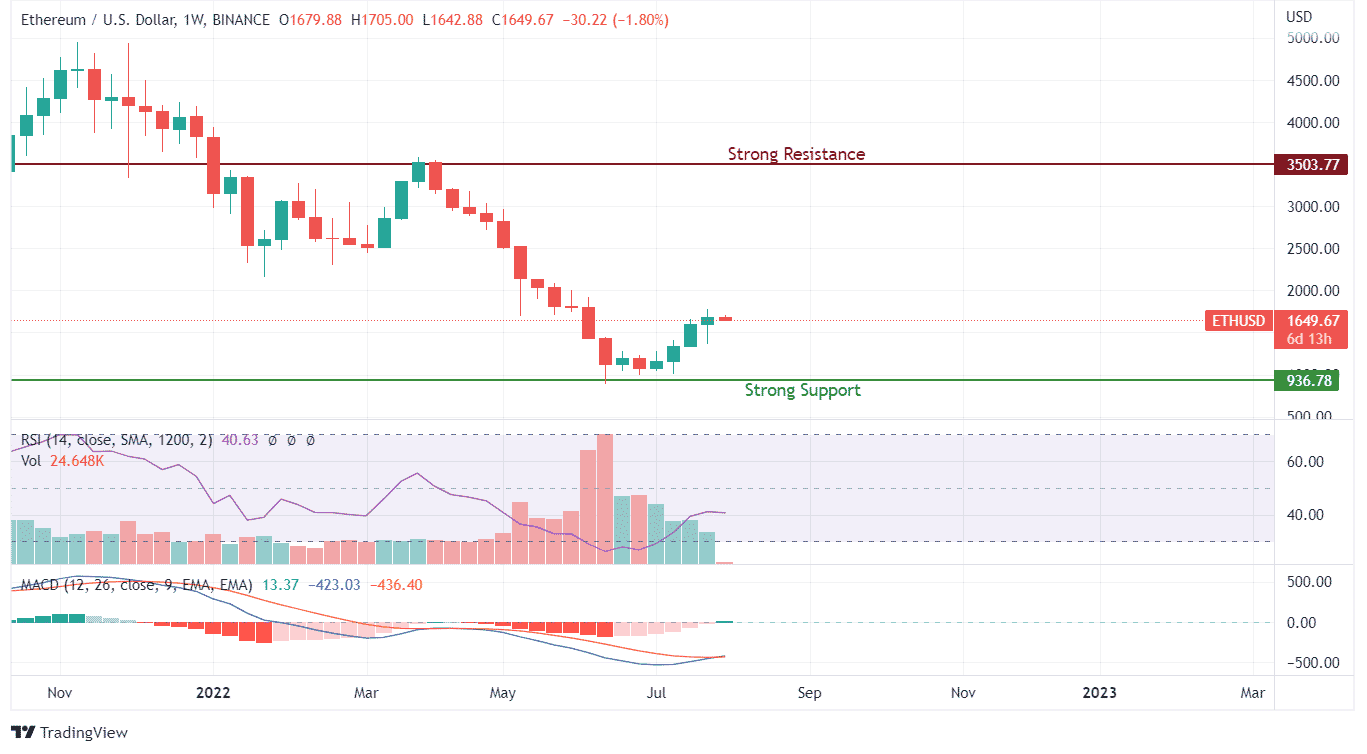

ETH on weekly worth development closed the final week in a state of no confidence. The decrease wick signifies help serving to the value climb, however the higher wick signifies resistance at $1780. With the present week beginning on a adverse tone, the lack to take care of a optimistic motion can weigh closely on the value motion.

RSI indicator has proven reaching a airplane after its preliminary upside motion, however the MACD indicator signifies an alternate motion with a bullish crossover already having undertaken. The resultant worth motion ought to transfer upwards to $2000 with some consolidation because the day by day candlestick signifies decrease day by day volatility.