[ad_1]

Ethereum has efficiently defended its second spot and just lately touched the $225 billion market capitalization. The anticipated merge of its blockchain in the direction of the Proof of Stake validation course of will guarantee a much less rewarding profit for validators, however it’s anticipated to cut back the transaction validation value by 90%, guaranteeing greater advantages for precise customers of the Ethereum blockchain.

The one detrimental citation of ETH holders can be the comparative fuel charges of ETH transactions on the Proof of Stake algorithm, which is commonly seen as a much less correct validation technique in comparison with Proof of Work. However, such a progressive step can result in greater assist of this blockchain by totally different gamers.

Ethereum has outgrown different opponents by means of its correct and progressive sensible contract ecosystem. The present value motion on ETH appears extremely speculative as the result of the merger is tough to foretell with out being applied and finding out the influence of this exercise.

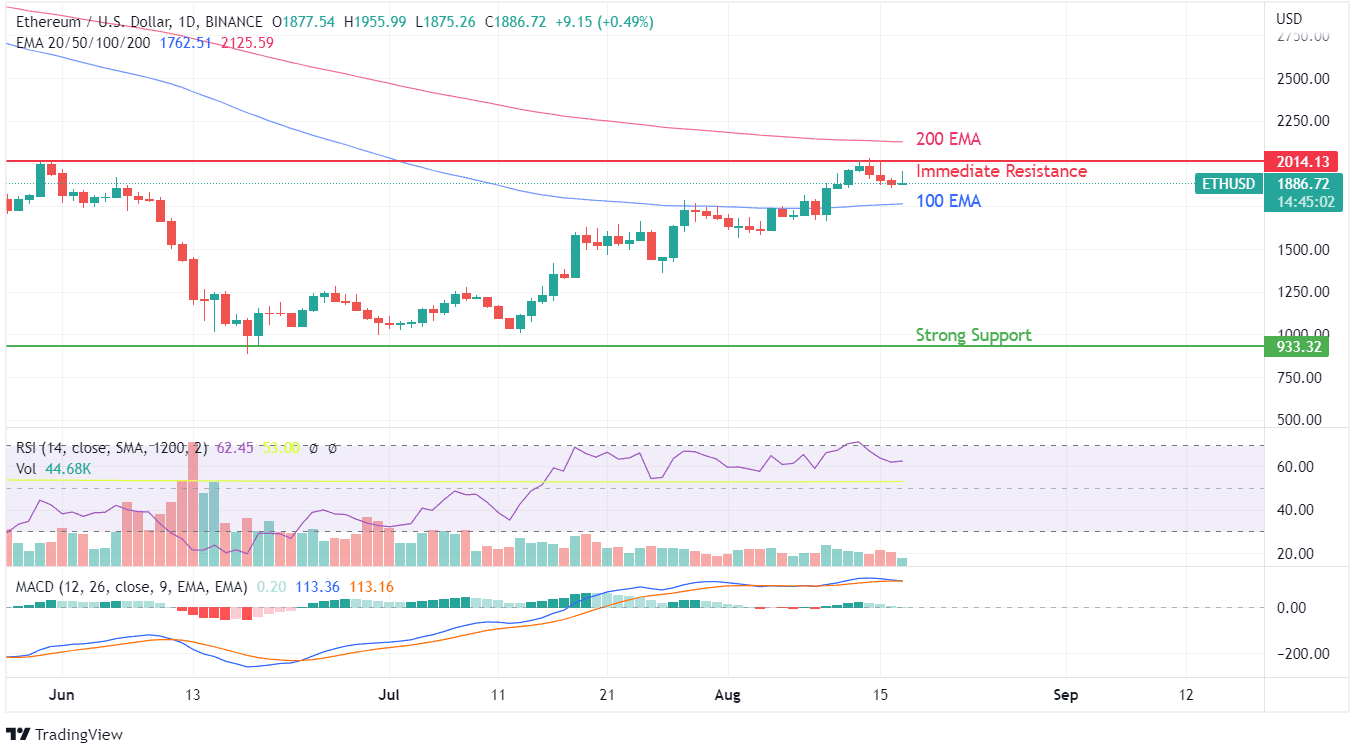

Ethereum has displayed a formidable resolve to surpass the instant resistances based mostly on transferring averages, however value action-based resistance nonetheless negatively impacts the value motion. ETH should surpass $2014.13 to enter a powerful floor for additional constructive value motion with out worry of revenue reserving. Go to right here to know if the ETH token will cross the instant resistance or not!

Ethereum reveals a bearish crossover with RSI succumbing from overbought zones to a stage of 60. It’s taking place in tandem as ETH confronted a troublesome resistance above the 100 EMA curve. August 14 and August 15, 2022, are the one two days since Could 31, 2022, to the touch the $2000 psychological stage.

Because the detrimental candles have been fashioned constantly for the previous couple of days, every day is ending with a wick on the prime, indicating consumers are reserving revenue or dropping to promoting strain. The outlook of ETH is barely constructive because it surpassed the 100 EMA curve with a powerful breakout of marginal features.

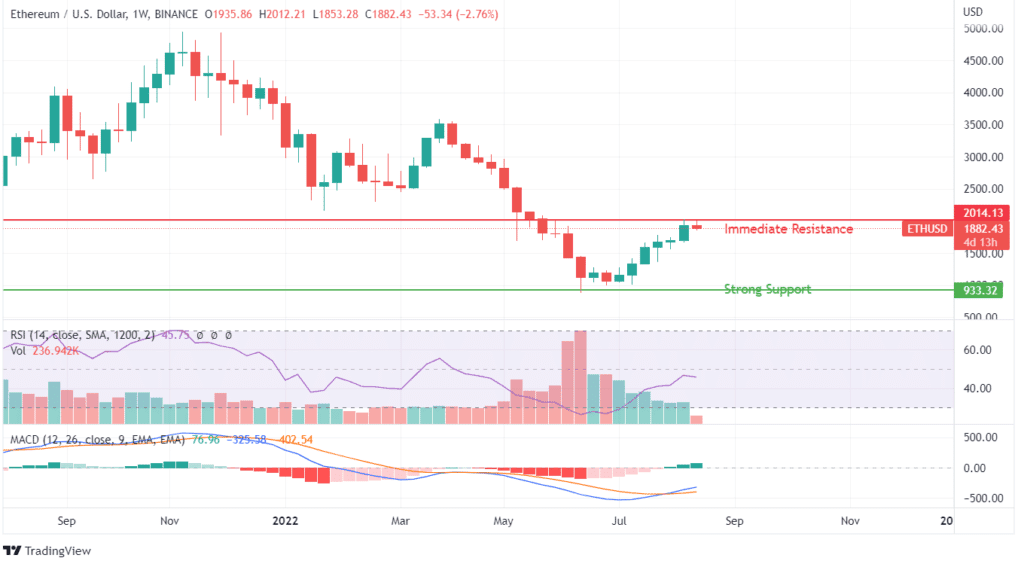

Related value motion is required to breach the $2000 stage resistance submit, which the 200 EMA curve will come even nearer for Ethereum supporters. If these resistances are breached earlier than the introduced merger date of September 15, a powerful breakout could be anticipated. In any other case, revenue reserving will pressure consumers to promote their holding out of unpredictable value motion close to the 200 EMA vary.

If ETH continues to commerce between 100 EMA and 200 EMA, there is usually a crossover of those two vital transferring averages creating the best time for consumers to attend for a breakout value motion with a constructive expectancy. Ethereum ought to get assist from $1600 ranges in case of revenue reserving or pullback.

On weekly charts, a transparent resistance could be witnessed close to the $2000 mark, which might be psychological in nature. Since RSI has improved so much in comparison with two months in the past, the Ethereum outlook depends upon its skill to scale this resistance within the shortest potential time. MACD holds its constructive breakout indication, which might help in ETH reaching $2500 by the merger date of September 2022.