[ad_1]

Ethereum holds its $200 billion market capitalization with the shopping for assist it gained from $1500 ranges. On the basic degree, the information of its merger is creating huge waves in value motion as an unpredictable final result is more than likely to happen. Many crypto specialists emphasize that altering Proof of Work for Proof of Stake wouldn’t create any drop within the transaction charges at the moment relevant on the Ethereum community.

Dropping the mining potentialities will create a ripple impact throughout industries as a drop in GPU items could be anticipated. Whereas current miners can be transitioning in the direction of different main Proof of Work blockchains implementing a aggressive marketplace for ETH. The next variety of validations for any blockchain is a optimistic signal for its additional development and acquire.

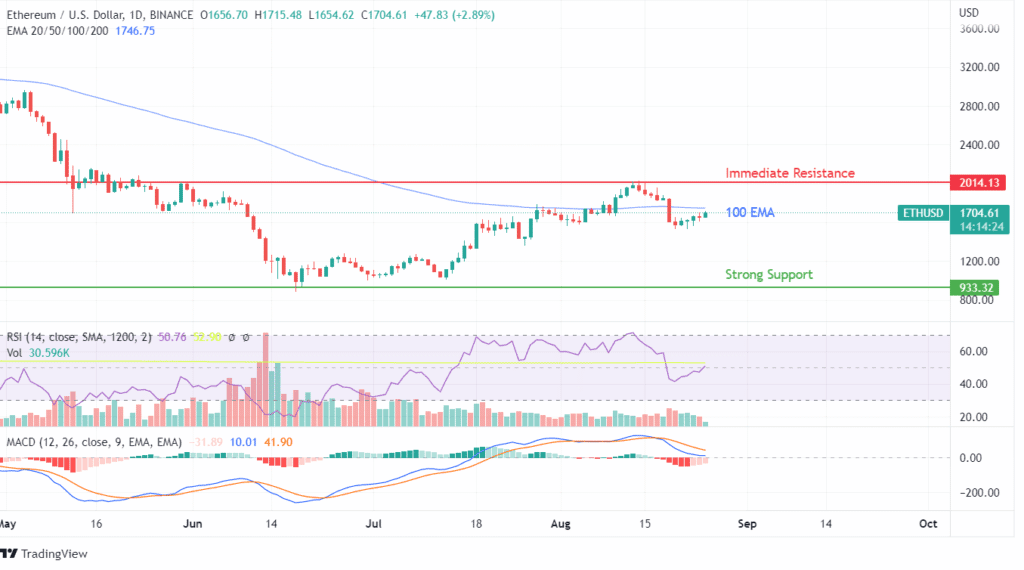

Ethereum blockchain displayed super shopping for energy within the first half of August 2022. The worth of this cryptocurrency has as soon as once more began shifting upwards to the 100 EMA curve. The earlier sell-off from this shifting common introduced ETH consumers to their knees as costs crashed considerably in simply 6 days. Will Ethereum be capable to maintain the 100 EMA mark this time? Learn our ETH prediction to know!

Ethereum value motion exhibits the token to have taken assist from the psychologically essential degree of $1500. From August 20 so far, the candlesticks showcase a giant wick on the backside, which confirms consumers are battling the promoting stress of revenue bookers, thus making a short-term assist degree for ETH.

Breaching the 100 EMA curve received’t be a giant buzz this time, because the anticipated final result is a breakout. Nonetheless, Ethereum crypto received’t be capable to attain the $2000 mark. RSI confirms consumers’ short-term optimistic stance because the indicator has moved from 40 to 50, whereas MACD is on its path to making a bullish crossover that might roll up the extra optimistic potential for ETH within the brief time period.

Earlier, a revenue reserving was additionally predicted for the reason that value acquire momentum was somewhat too fast in comparison with the gradual value motion within the final 4 months. $2000 stays the robust resistance ETH has tried to check in the previous few weeks; thus, a bottleneck can type round $2000 as consumers would expect one other revenue reserving inflicting a gradual shopping for stress. In case, Consumers can take ETH above $2000; an enormous up transfer could be anticipated as value motion showcases $3000 as the following robust resistance. On the flip aspect, revenue reserving ought to principally be constrained above $1500.

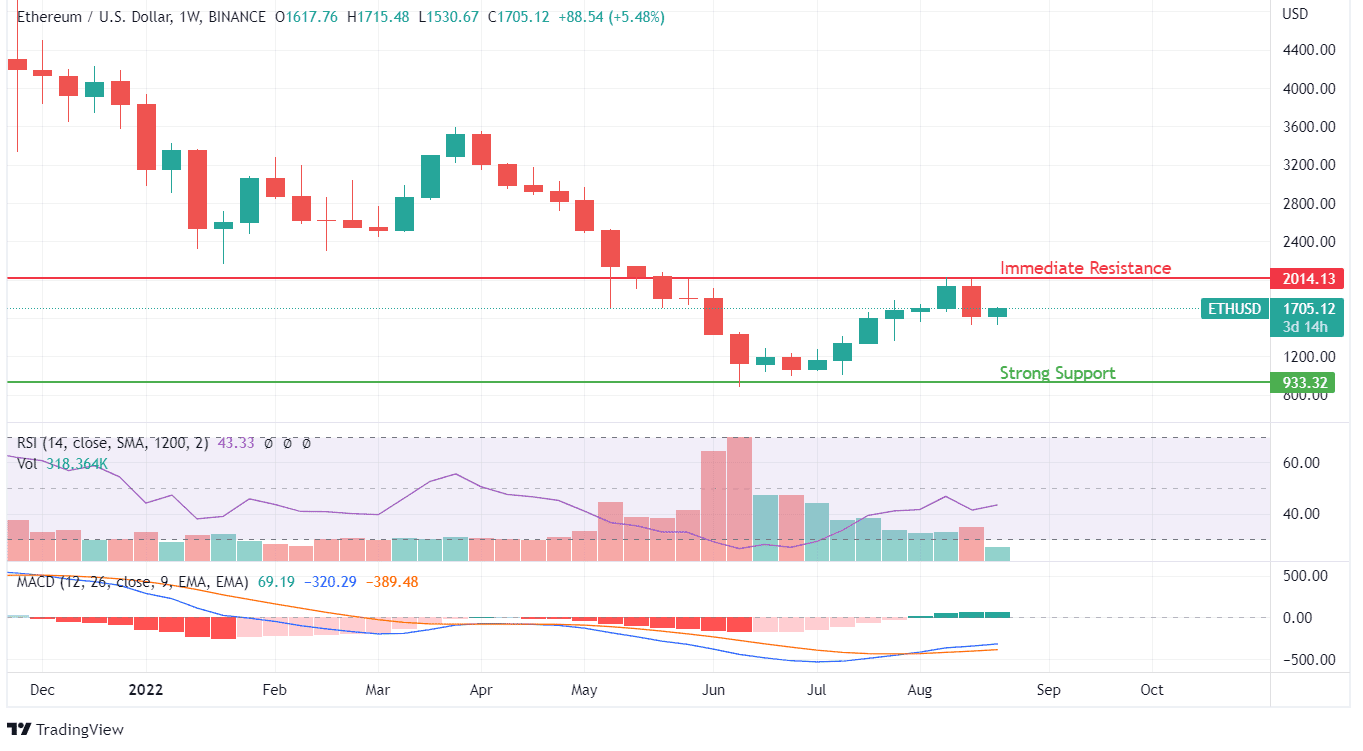

Weekly charts of Ethereum affirm the unfavorable development within the final week as a bearish engulfing candle was developed that threatened to destroy all of the positive factors made within the final two months of gradual value motion. The present week’s candle formation replicated the primary week of candle formation that led to a breakout.

However this time, the presence of a bearish engulfing candle might be creating new points for the ETH up transfer. RSI and MACD indicators each venture a optimistic final result.