[ad_1]

Ethereum worth traits over completely different time frames provide completely different views. Primarily based on the charts, it’s the greatest time to carry ETH. Nonetheless, the market share of ETH’s rivals is seen to be rising, or is Ethereum simply taking a much-needed break earlier than the following large bull run?

Properly, if we take our eyes off the value and look underneath the hood, then issues are wanting nice for Ethereum, and the following large bull run shall be epic. We’ll take a look at the important thing fundamentals that should do with provide and demand metrics after which the three latest developments for Ethereum, that are extremely bullish.

ETH has sturdy potential, however the clear sentiment throughout its potential to maneuver on in direction of Proof of Stake would emerge after it efficiently implements this transition. Since there may be excellent news coming on the finish of present developments, there’s a appreciable chance of upper worth traits and bullish sentiments throughout the timeframe.

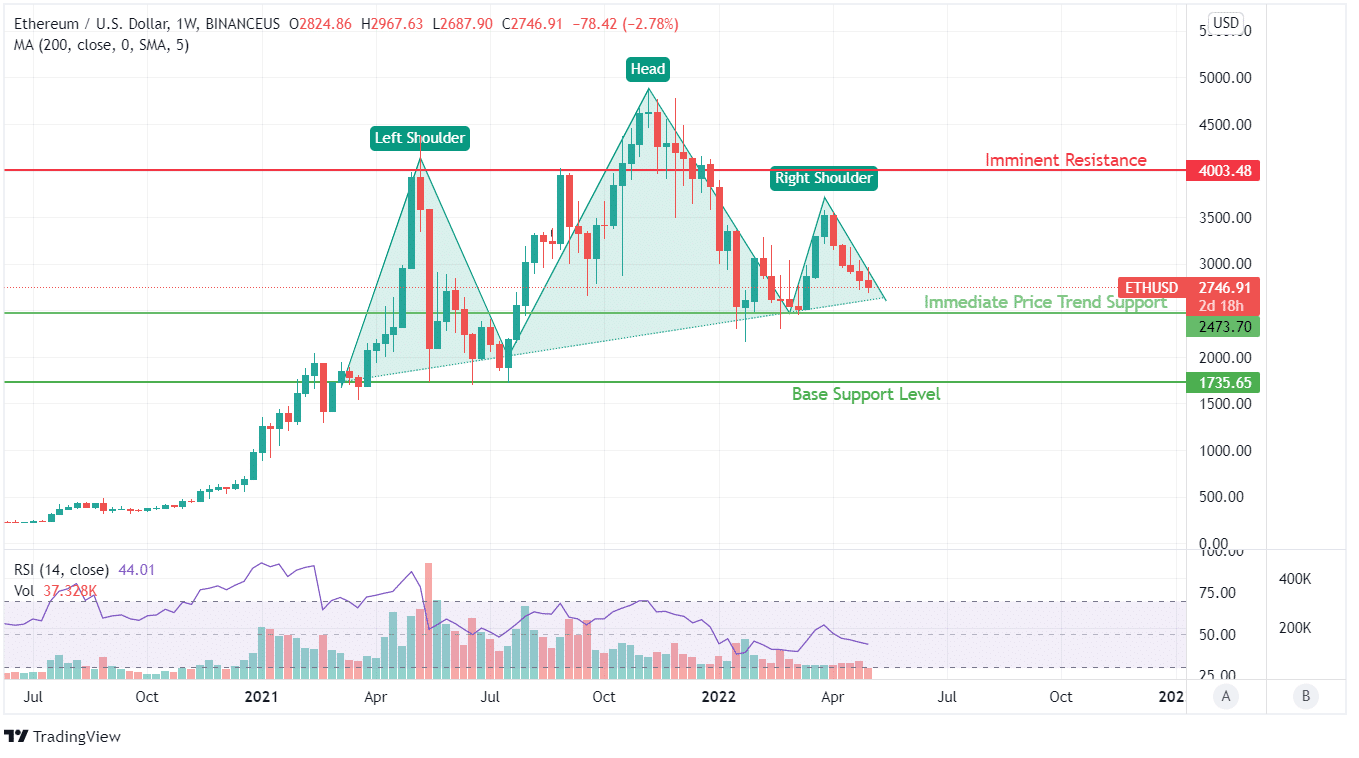

Ethereum is seemingly weakening when it comes to worth over the previous couple of months after its bullish development. Since 2021, ETH has been shifting forward with nice energy, present process revenue reserving, and retracing to breach the earlier excessive. Within the third try, this worth motion has misplaced its allure as we see the Head and Shoulder sample forming on the weekly candlestick patterns.

Ethereum worth has moved up and down all through 2021 however got here out as a winner with every swing. Presently, ETH has a resistance of $4000 on long-term charts and assist at $2400 ranges. The trade-off between these worth traits signifies a battle between consumers and sellers who’re ready for the affect of ETH’s basic developments to undertake.

Aside from the upper worth traits, ETH has additionally established a development line, which may give a robust push again from $2600 ranges to defend additional breach of values. Learn extra concerning the anticipated worth development and future ETH forecast!

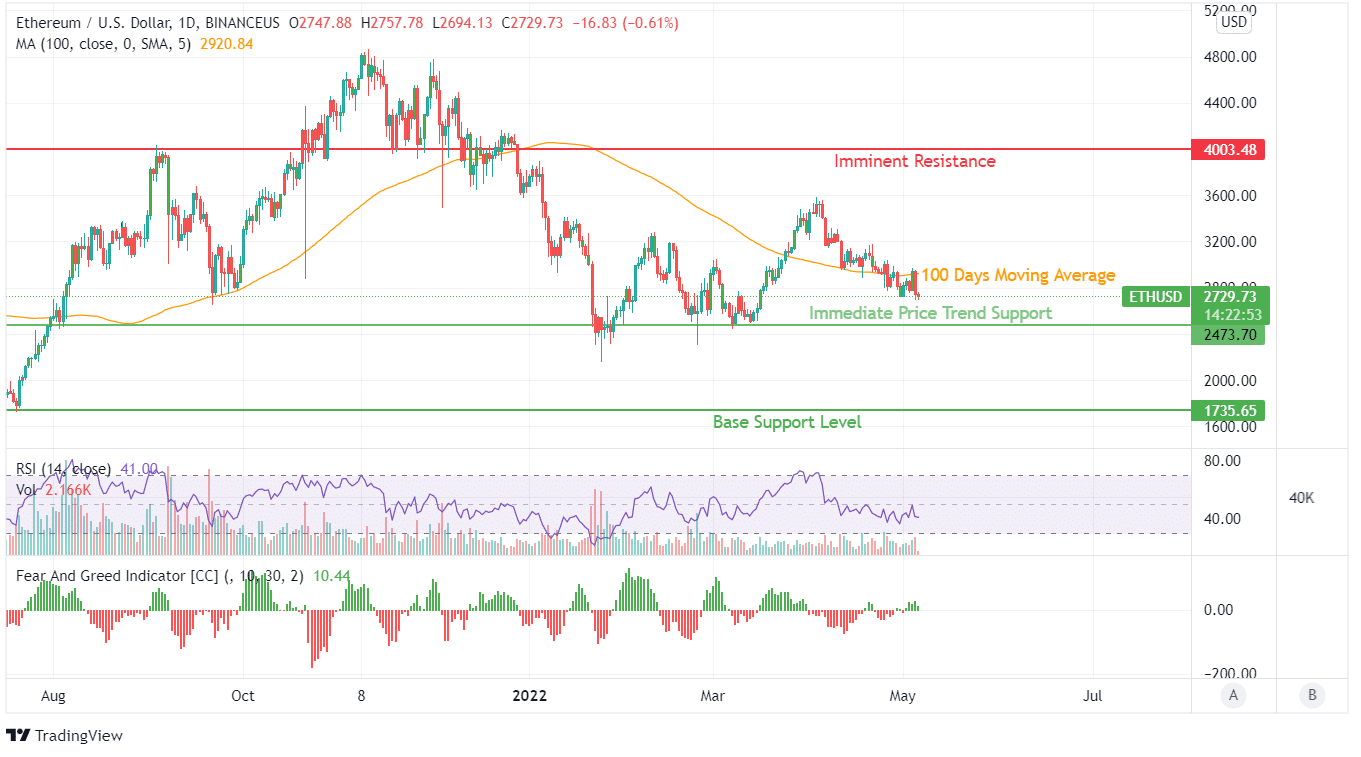

For the reason that coin is struggling to carry the $3000 mark, there’s a clear outlook that ETH is stumbling, which can be indicated by the worry and greed indicator. The value traits point out a breakdown after it has taken place, however the chance now signifies a breakout. If ETH manages to subdue the 100 DMA curve, the value will transfer past $3000 on the quick scale.

RSI has moved down and faces a stiff consolidation regardless of the falling worth. RSI indicator has maintained a stance between 35 to 50 on time. Breaching the 100 DMA curve may flip the tables for consumers, push ETH valuations above $4000 and contribute to long-term worth indications.