[ad_1]

eCash is the next improvement of the Bitcoin Money ABC that was forked away from the unique Bitcoin & BCH. Bitcoin Money got here into existence after a cut up among the many supporters of Bitcoin in August 2017. The cut up resulted in a 1:1 change worth for every BTC.

Thus, BCH supported the additional enhancement of this blockchain as a fee methodology sustaining the technical components of the unique Bitcoin blockchain. This ideological division led to 2 extra splits creating BCH and eCash in 2018 and 2020, thus creating the situation behind the transformation of eCash into XEC tokens.

It was November 15, 2020, when Bitcoin Money forked. Within the later years, the eCash token was rebranded to XEC. XEC, a newly developed blockchain, added an progressive new consensus named Avalanche whereas introducing ideas similar to staking and Free community upgrades.

About 91% of XEC tokens have already been issued, with the event workforce holding a minute provide. Market capitalization primarily based on its present buying and selling worth of $0.00003844 has been restricted to $733,986,682. The full provide of XEC tokens jumped to 21,000 billion after the redenomination of 1,000,000 tokens for every BCHA consumer held earlier.

eCash has been transferring in a detrimental pattern, and having reached its pre-breakout degree; there could be a longer consolidation earlier than this token takes off the bottom. To know the way forward for eCash, discover our eCash worth prediction.

XEC token went on a bull run showcasing a big bounce since August 14, 2021, marking a formidable bull run. As August ended, XEC began to witness important revenue reserving, inflicting an enormous decline in valuation within the following months, and this downfall continued until February 2022.

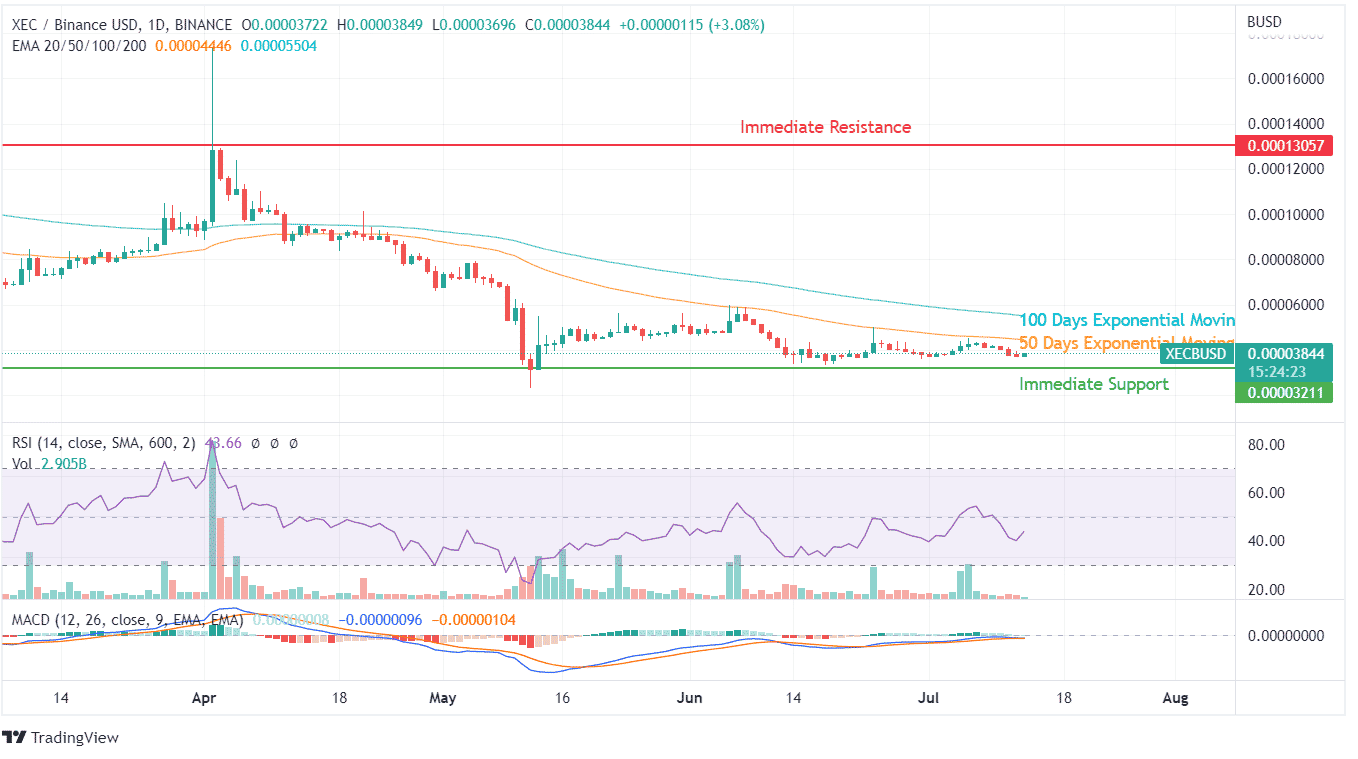

Within the subsequent two months, eCash once more tried a bull run and spiked to $0.000128, and a big momentum was observed. This robust shopping for rally wasn’t sufficient to incite a sustainable purchaser sentiment. Thus XEC was in a position to mark a bounce in its valuation in simply two cases in August 2021 and April 2022. The remaining time has declared a transparent detrimental pattern. The 50 EMA curve has developed into a robust resistance, which XEC wants to interrupt out to current itself as a token with a possible enhance in valuations.

Throughout this worth momentum within the final six months, there have been days of constructive shopping for pattern with transaction volumes hitting double the standard. After hitting its 12 months peak in April, eCash went right into a downtrend, hitting a recent low in Might 2022.

To this point, after touching this low, XEC has maintained its power, not permitting costs to dip additional, sustaining a protected distance from the Might 2022 lows. RSI indicator has as soon as once more tanked within the final week, dipping from 55 to 43, with the MACD indicator displaying a bearish crossover. XEC token wants to carry its worth within the downtrend rally to create a stronger market place.