The principle drawback of decentralized blockchain know-how is it can’t work together with real-world information. Chainlink goals to unravel this drawback. It makes use of a breakthrough platform for blockchain oracles which acts as a breeze to attach off-chain and on-chain information.

Good contracts working on Ethereum would not have entry to real-world information, however the Chainlink makes it doable to retrieve information from outdoors.

Briefly, it’s a decentralized community of nodes launched on the Ethereum (ERC-20) blockchain. It helps to offer real-world information from third-party assets and provides it to the good contracts via oracles.

Certainly, good contracts play an important function on this platform as a result of it depends on automation techniques to judge and execute information based mostly on predetermined agreements. So long as the settlement is fulfilled, the good contracts will execute mechanically.

The perfect half is Chainlink runs on totally different blockchains concurrently and permits exterior assets equivalent to API integration. It additionally connects real-world funds and occasions with blockchain know-how, and it additionally provides an additional layer of safety to the blockchain system for delicate info. On this means, it will possibly join cryptocurrencies with banking techniques and allow good contracts for conventional monetary establishments.

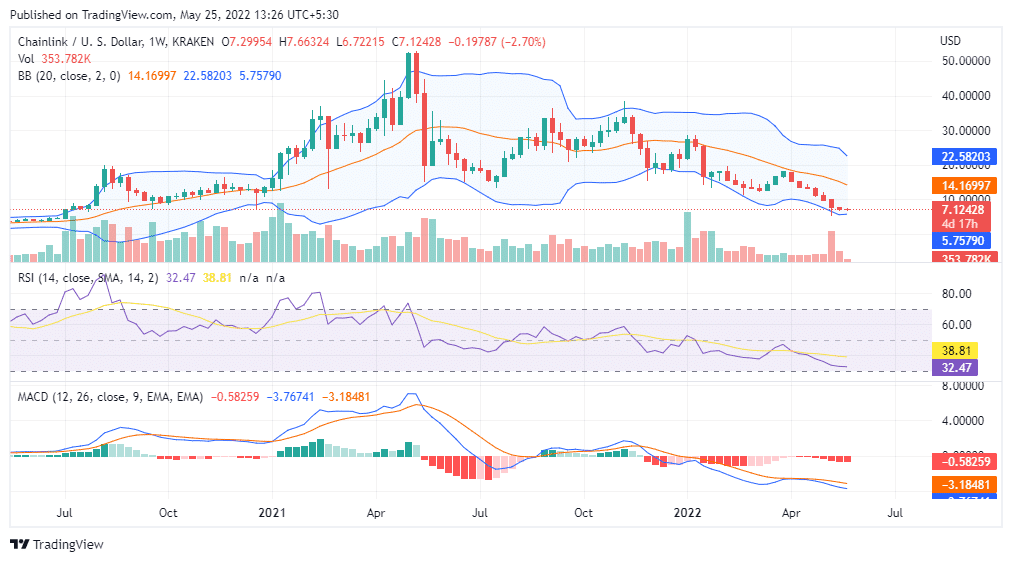

On the time of writing, LINK was forming a Assist Stage of round $7.12. Earlier than the correction within the crypto market, it was consolidating between a variety of $18.3 and $12.8.

Nevertheless, it has damaged the vary and shaped new help at round $7.1. It’s troublesome to foretell how lengthy it’ll maintain. Nevertheless, our LINK worth prediction tries to offer you near correct future projections.

On the day by day chart, the MACD indicator is bullish. Whereas RSI signifies impartial momentum, yow will discover a rise in quantity with an absence of volatility. Day by day candlesticks are forming across the center band of the Bollinger Bands, and all of those counsel short-term bullishness.

Nevertheless, on the weekly chart, it has damaged the robust help degree of $8.9. Eight consecutive crimson candles have been forming within the decrease half of the Bollinger Bands, which suggests robust bearish momentum within the worth motion. MACD and RSI additionally mirror bearish momentum.

We expect it isn’t the best time to purchase the coin for the long run. Nevertheless, you can begin a brief commerce from the help degree, however will probably be dangerous. Look forward to the suitable alternative earlier than investing within the LINK coin.