[ad_1]

As a blockchain-based protocol, Helium is common as a result of it is among the few initiatives that focus primarily on the Web of Issues trade. It has a Helium hotspot that works as an web router. These nodes present the customers with cheaper and broader web entry.

It runs on a worldwide wi-fi community and supplies long-range connectivity with helium hotspots. Most crypto initiatives are based mostly on decentralized finance purposes and non-fungible token segments, however just a few of them are engaged on IoT.

These hotspots are the pillar of this community that gives connectivity to all IoT units. They supply wider protection and rewards to the proprietor of such hotspots. These nodes enable IoT units to ship and obtain data with Helium decentralized blockchain know-how. When customers plug hotspots and run the system, they get HNT as a reward.

LoRaWan is a distributed structure on the bodily layer LoRa that gives wi-fi communication between IoT units. LongFi is a crucial function of this Helium community that mixes blockchain and LoRaWan structure. It runs on Proof of Protection consensus that communicates with totally different hotspots (or nodes) by way of radio frequency utilizing a mechanism known as PoC Problem.

General, Helium has an enormous potential to thrive within the blockchain market of the IoT phase. If you’re fascinated by investing in HNT long-term, learn our Helium worth prediction for a greater funding resolution.

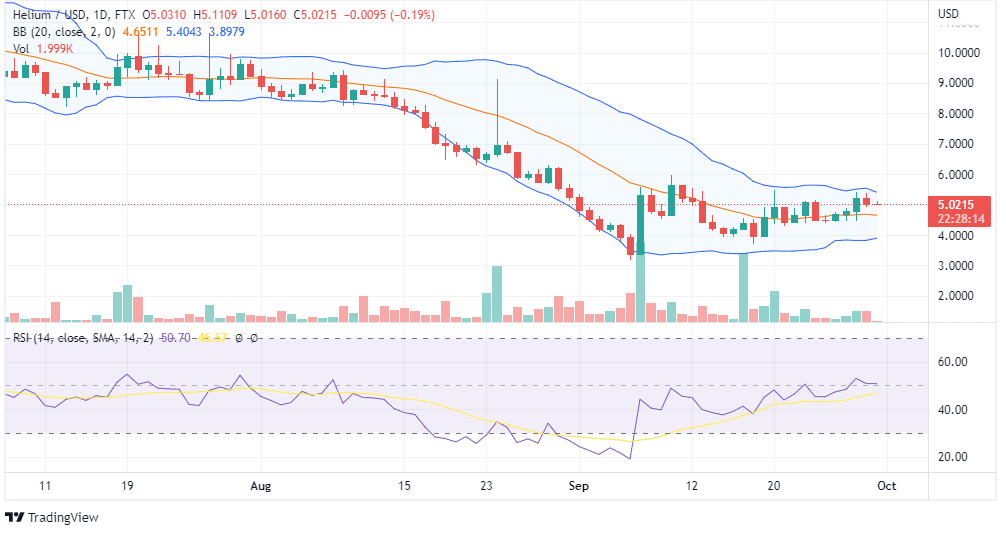

On the time of writing, HNT was buying and selling round $5.02, forming decrease lows. The earlier low was round $6.9, however the latest low is round $3.5. The Helium candlesticks are buying and selling round $5.5 and $3.5. So, you’ll be able to anticipate the value will consolidate inside this vary, at the very least for the quick time period.

On the time of writing, HNT was buying and selling round $5.02, forming decrease lows. The earlier low was round $6.9, however the latest low is round $3.5. The Helium candlesticks are buying and selling round $5.5 and $3.5. So, you’ll be able to anticipate the value will consolidate inside this vary, at the very least for the quick time period.

The candlesticks are forming within the higher Bollinger Bands, which suggests a slight constructive perspective for the quick time period. You may make investments for the quick time period, however HNT is dangerous for the long run.

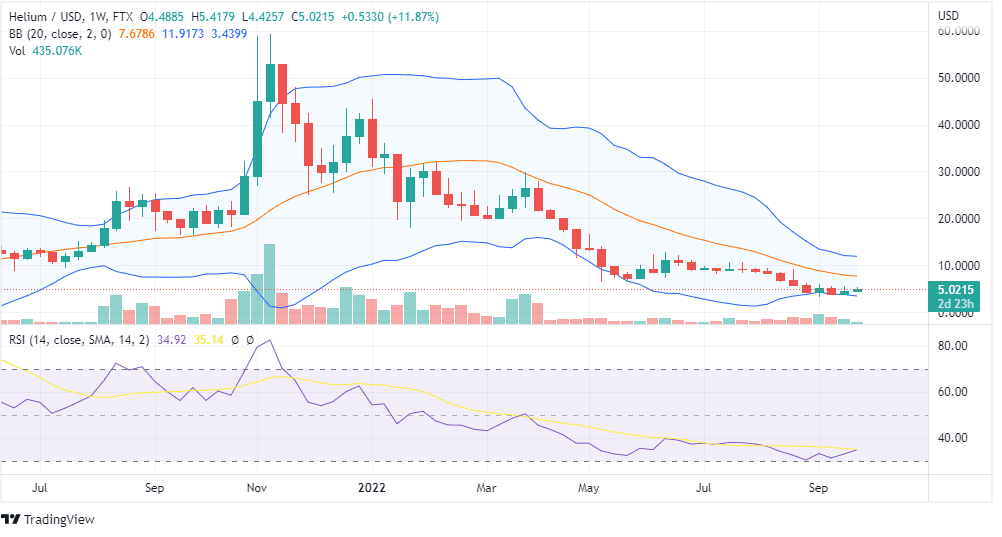

After hitting an all-time excessive of $55.22, Helium is now buying and selling across the degree of $5. On the weekly chart, $10 was sturdy help, however now it really works as a resistance, so that you make investments when it crosses $10 decisively.

After hitting an all-time excessive of $55.22, Helium is now buying and selling across the degree of $5. On the weekly chart, $10 was sturdy help, however now it really works as a resistance, so that you make investments when it crosses $10 decisively.

HNT candlesticks are forming within the decrease BB, and RSI is under 40, which don’t recommend bullishness for the long run. The one constructive signal is that the value of HNT has been consolidating within the final 5 months, so it may be a sign of a change in momentum. Nonetheless, you shouldn’t make investments presently, speculating an excellent revenue within the subsequent few years.