[ad_1]

Bitcoin dominates the crypto market because of its recognition as the primary and largest cryptocurrency. With a big consumer base and a excessive degree of safety, Bitcoin has established itself as a dependable funding choice within the digital foreign money world. It has a powerful community impact; the extra individuals use it, the extra priceless it turns into. Bitcoin’s decentralization and transparency improve its recognition, giving customers management over their transactions with none interference from third-party intermediaries.

Moreover, Bitcoin has a historical past of stability and development that has impressed confidence amongst traders. General, its repute, safety, and vast acceptance make it the main participant within the cryptocurrency market, giving it a major edge over different digital currencies.

Bitcoin’s worth has a direct influence on different cryptocurrencies out there. Its dominance out there makes it a benchmark for different cryptocurrencies, and its value actions can typically set off related actions in different cash. When Bitcoin’s worth will increase, it’s typically accompanied by a rise within the worth of different cryptocurrencies, often called the “Altcoin Rally.”

BTC now stays simply marginally wanting its $5000 billion market capitalization, which might enable consumers to participate within the subsequent leg of motion in the direction of $40,000. BTC’s worth is a vital issue within the cryptocurrency market. Therefore, its influence on different cryptocurrencies can’t be ignored.

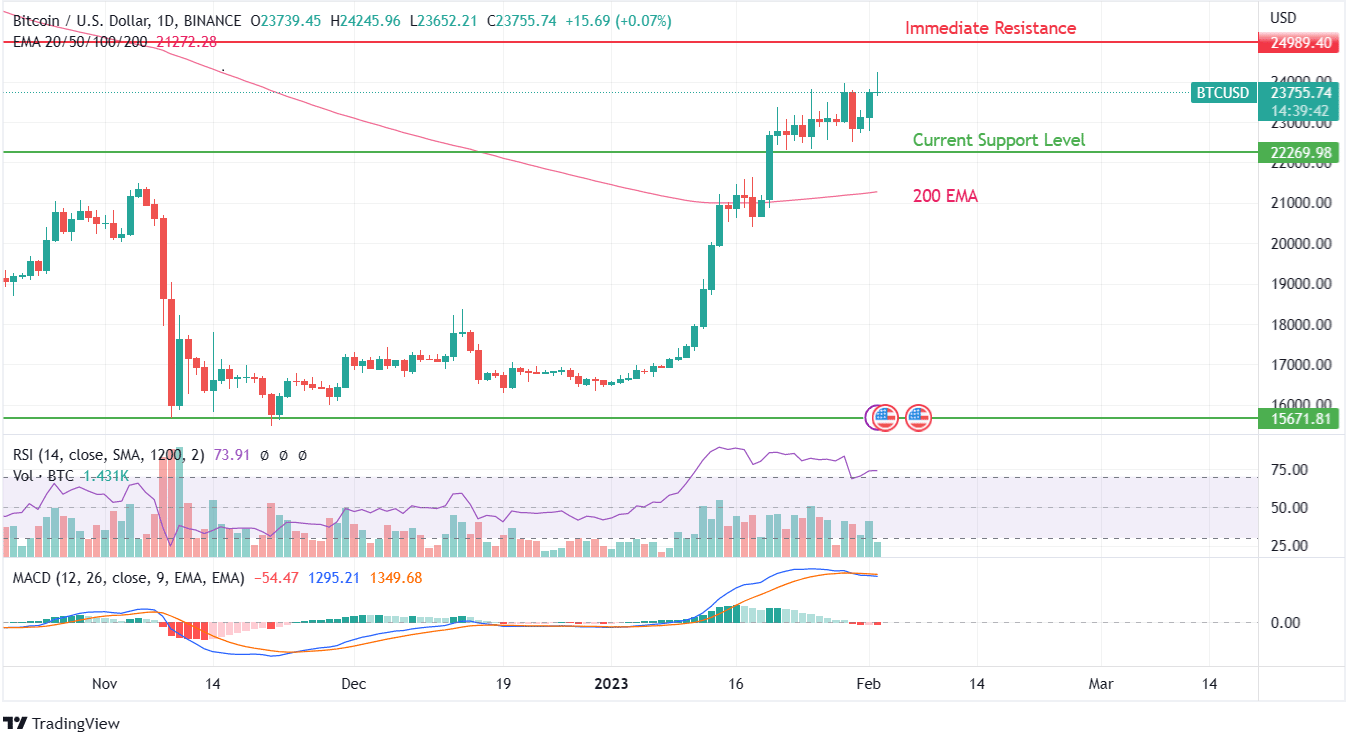

Bitcoin might rally up from $16000 to $22000 ranges simply. Nonetheless, making a powerful single-sided rally allowed the right situation for sellers to ebook earnings which created hindrance within the additional development of BTC in the direction of the $25,000 mark. The outlook for BTC has significantly improved lately, with the token headed in the direction of higher values. Learn our long-term Bitcoin value prediction to know the way excessive the token will attain within the coming years!

The breakout value rally made within the early hours of February 02 was rapidly erased by promoting exercise within the second half of the day. Regardless of reaching almost $24000, BTC faces a stiff decline in its MACD indicator, all whereas its RSI continues within the overbought ranges.

BTC transactional volumes have been within the greater ranges with out dealing with any problems or issue. Though, the MACD producing a bearish crossover sample might enable sellers the chink in BTC’s armor to downplay its current features.

Fast help is obtainable for consumers close to $22,269 ranges whereas the 200 EMA curve positioned close to $21000 is step by step beginning to transfer in a parabolic sample confirming a change in sentiment even on the long-term charts. On weekly charts, breaching $25,000 can be a important issue pushing Bitcoin in the direction of earlier important resistance and psychological ranges equivalent to $40,000 and $50,000.