[ad_1]

Bitcoin has been thought-about the mirror for the efficiency and progress of the cryptocurrency business as an entire which is with just a little over $1000 billion. Regardless of its dominance to the tune of 3x the market capitalization of Ethereum throughout its peak cycle, BTC now stays simply 2.4 instances.

The present market capitalization of Bitcoin stays $435,399,405,529, primarily based on the final traded worth of $22,868. The risky value motion has introduced Bitcoin as an illustrative token quite a few instances, however in actuality, BTC will not be rising on the identical tempo as different main blockchain and cryptocurrencies.

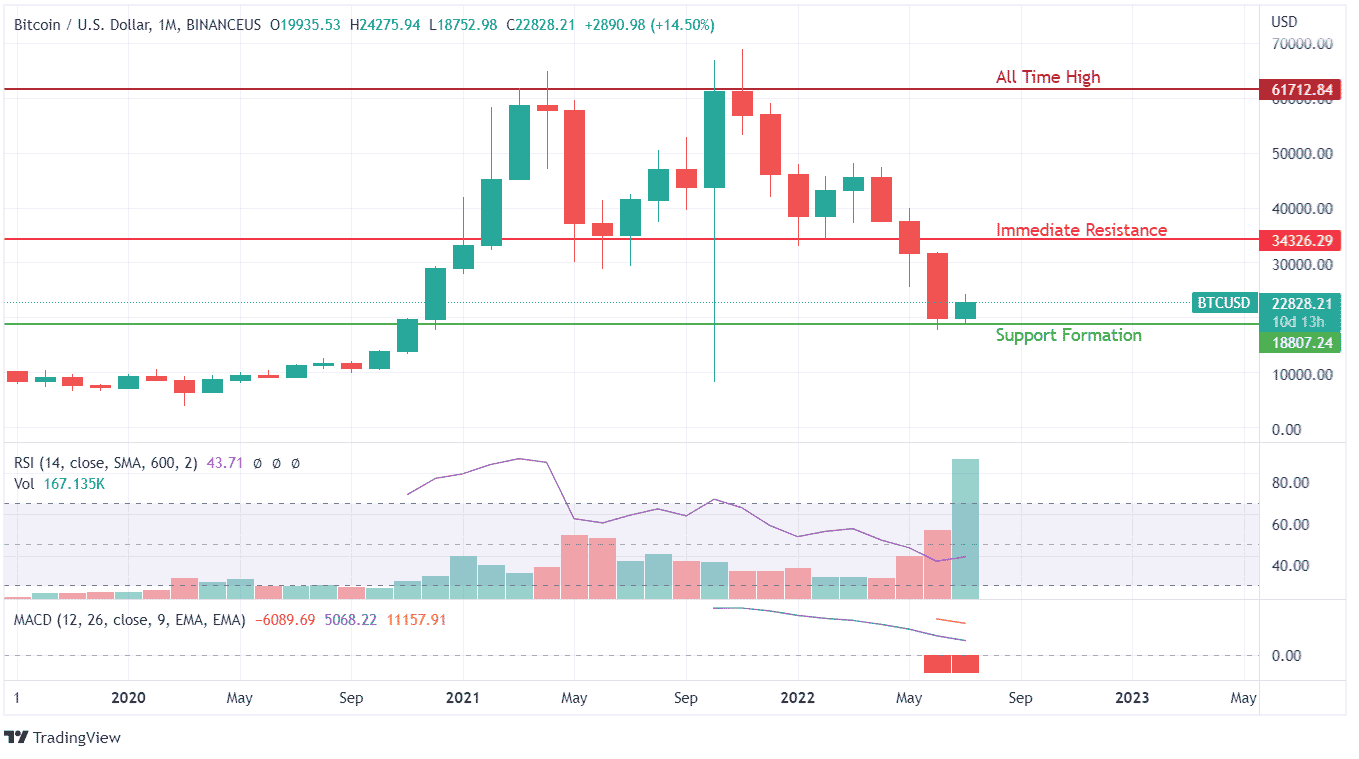

Bitcoin is as soon as once more starting from the breakout of January 2021 ranges. Technical indicators have been destructive in the long run, with a small glimpse of a development reversal. The story is extra in the direction of constructive consolidation with concern of resistance ranges within the short-term each day charts. Learn our BTC value prediction to know the way forward for the token intimately.

Everyone seems to be effectively conscious of the BTC spike of 2017 and 2020, however 2021 was a consolidative 12 months. On this gentle, BTC has had one among its worst years, whereby the costs have tumbled from $45,000 to $17,744 in June 2022. Though the candlestick has been constructive for July to this point, there’s a wick formation that should vanish by the top of July 2022 to mission Bitcoin in a constructive stance.

The speedy resistance to this value motion is elevated to $34,326, with robust help at $18,807. The all-time excessive zone is out of the query for the subsequent few months. To return to $60,000 ranges, BTC must make an enormous soar. The amount for July 2022 has already doubled in comparison with Could 2022. It may very well be a sign of the pump and dump by whales that patrons have to defend themselves.

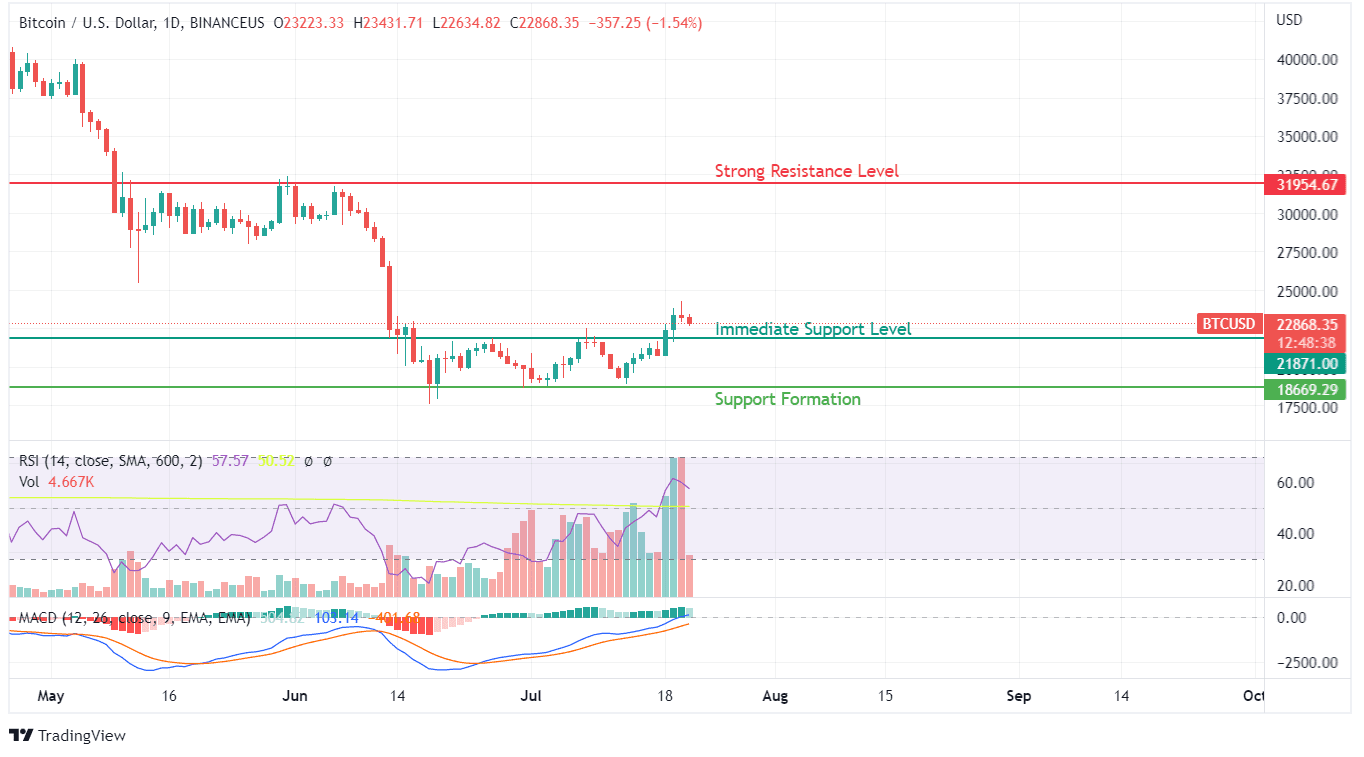

Quick-term value evaluation signifies an enormous shopping for spike for the reason that second crash in June 2022. Simply as costs went below $20000, a rising volumetric transaction could be seen with RSI leaping from oversold zones of 20 to peaks of 57. On the identical time, when costs had been shifting with a constructive stance, revenue reserving was again in motion to halt the sentiment.

The closing candle of July 20 makes it seem to be BTC confronted a significant dump which is verifiable by the 15K tokens traded on the destructive stance, which equals the amount of July 19. Even the MACD indicator is shifting with large power, signifying a steady rally to $30,000. There may very well be some revenue reserving between $25000 and $30000, but it surely must be restrained to a slender zone.