[ad_1]

Ever puzzled why main cryptocurrencies are sometimes tied with the efficiency of Bitcoin basically. Whereas not all of them are pegged with BTC, it showcases consumers the comparative efficiency of a market chief with different crypto performers.

BTC value motion as we speak is severely impacted by whales and Stablecoin Provide Ratio. SSR is nothing however the ratio between the overall market capitalization of Bitcoin and the overall market capitalization of stablecoins. As this ratio dips, stablecoins get extra shopping for energy to carry Bitcoin and spike the sentiment of the crypto market.

Nonetheless, because the reverse positions begin to construct up, stablecoins start their promoting rampage, thus damaging the demography of BTC’s dominance within the crypto market.

Bitcoin at present holds a market capitalization just like ETH’s throughout its peak valuations. With the dominance of stablecoins slowly rising, BTC will get a constructive push in the long run because the purchaser energy will likely be rising. In easy phrases, the rising market capitalization of stablecoin would profit Bitcoin in the long term.

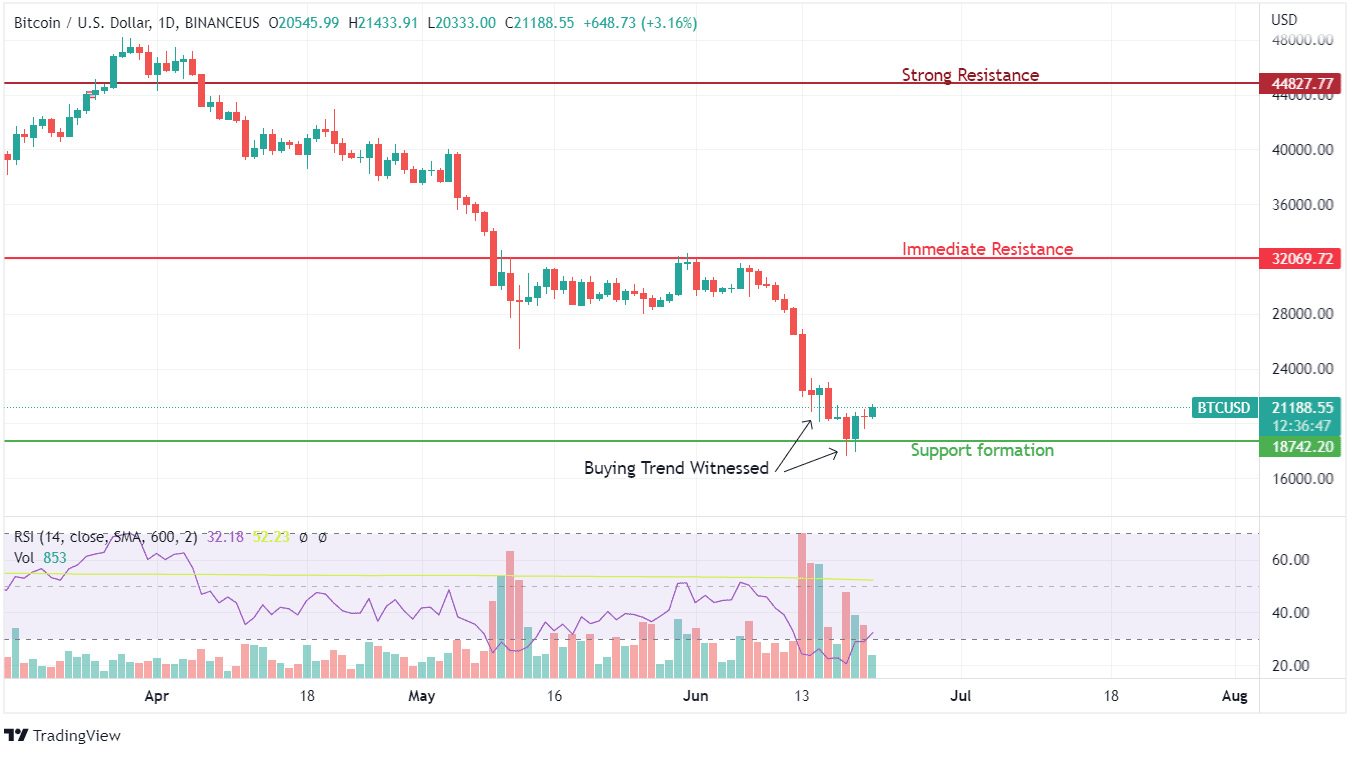

Bitcoin has gained large shopping for momentum from current lows of under $20,000. The consecutive days of consumers dominating the sellers have resulted in constructive motion starting to develop within the quick time period. Do you have to purchase BTC? Click on right here to search out out!

Bitcoin costs have plummeted to new lows because the Terra (LUNA) disaster that left your complete crypto world. BTC’s dip is healthier for stablecoins to solidify their momentum, and within the final two days, we’ve witnessed enormous shopping for spikes from lower cost ranges.

This motion is seen close to an upcoming breakout pattern and is a logo of bullishness gaining momentum. Transactional volumes have breached the earlier ceiling set in the course of the Could 2022 decline under $30,000. The current drop in valuation has shocked new buyers, however BTC believers will likely be profiting from these discounted valuations.

RSI in these actions has jumped from 22 to 33 in simply 4 days. There appear to be some uncertainties because the candlestick for June twentieth closed in a no-profit no-loss situation. Bitcoin has witnessed a powerful help formation close to $18,700 ranges which is confirmed by the formation of wicks in the course of the weekends.

We will anticipate BTC to succeed in $30,000 once more by the tip of 2022 and a recent emergency of a bullish pattern for the crypto market basically.