[ad_1]

Bitcoin, the market chief, directs the whole crypto market sentiment merely out of its sheer dominance. BTC is transferring with an amazing buying-focused state of affairs able to placing it past the grasp of speedy resistances.

There was an enormous spike within the final 5 days, which may flip the state of affairs in the direction of uptrend momentum solely after BTC surpasses $24,000 with out retracements. Breaching this degree would put BTC above the breakdown degree of Could 2022, indicating a better upside potential bringing extra consumers to the fold.

At present, the market capitalization for Bitcoin has surpassed $422,274,164,564. Bitcoin cryptocurrency is buying and selling at a dip of round 50% in comparison with January 2022 peaks. The same comparability for its all-time excessive would put BTC underneath 68%. Earlier worth actions point out a rejection chance at $22,000 which might delay the uptrend.

Bitcoin has seen some turbulent instances struggling to surpass $22000 for the final two months. Technicals are actually bullish, with robust inexperienced candles transferring in the direction of double-digit features as of July 18, 2022. Examine our Bitcoin prediction to know if this bullish momentum will proceed or not!

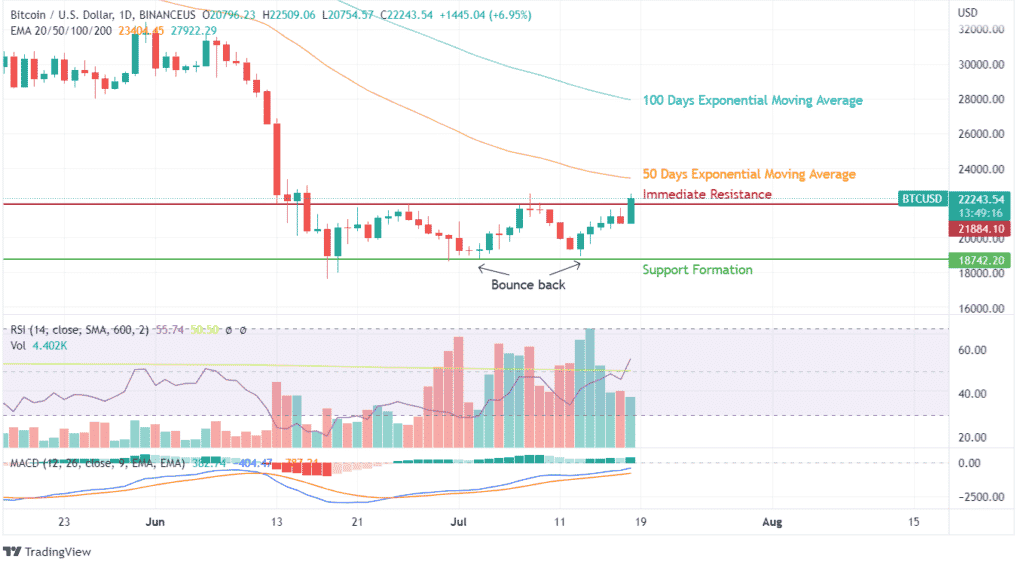

Evaluating the short-term worth motion after the dip of Could 2022, we are able to witness help developed round $18,700. Regardless of the rise of its transactional volumes, the client’s try and breach the $22000 degree has created an enormous trap-like scenario for Bitcoin.

Rejection of the final swing excessive in the course of the first week of July created a revenue reserving state of affairs dumping the value beneath $19000 for a day. With a stronger revival of shopping for sentiment and transactional volumes beating the volumes of April and Could, BTC has efficiently suppressed the speedy resistance.

RSI indicator showcases an ongoing rally, and MACD has additionally created a bullish state of affairs. The short-term outlook is optimistic for a Bitcoin, with a possible for some retracement earlier than continuous.

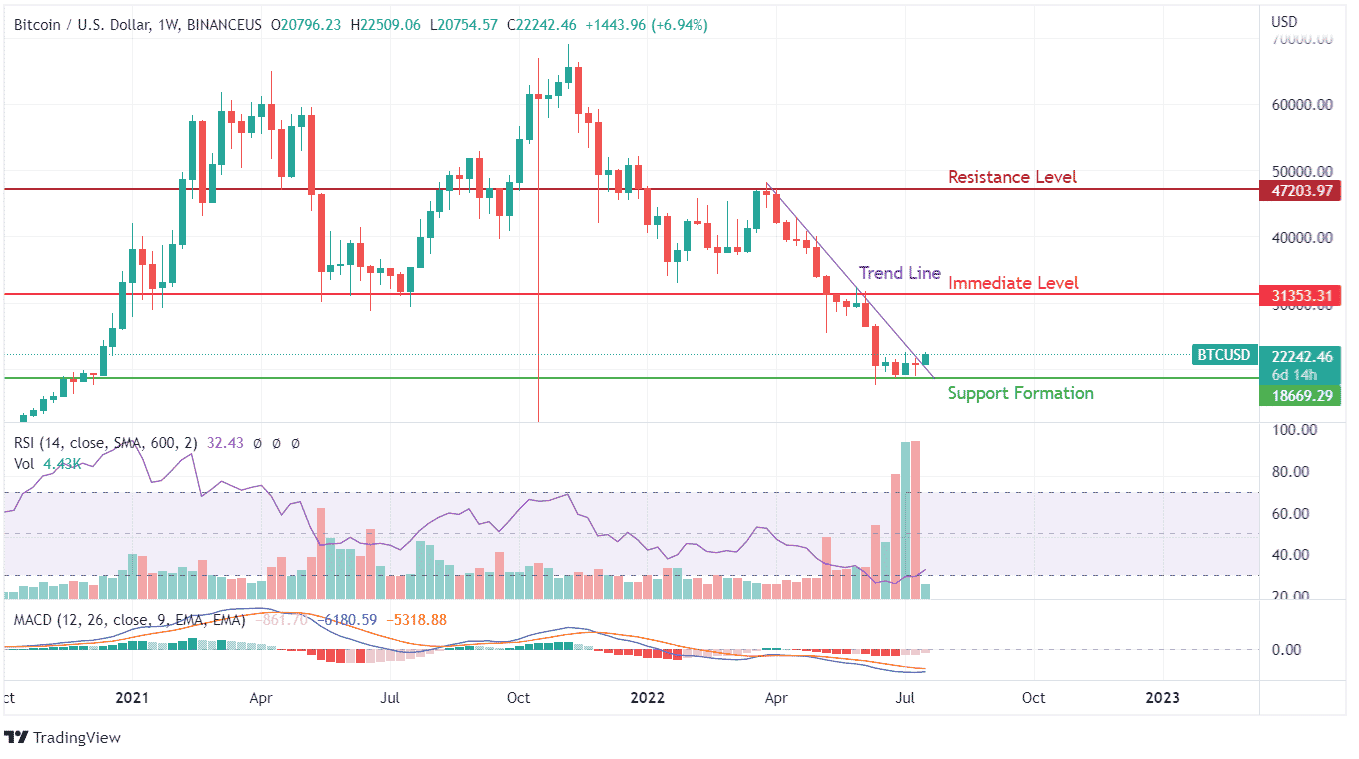

Bitcoin within the final 12 months has created peaks above $60,000 with large retracements. Failure to surpass $47,000 in March 2022, mixed with world monetary woes, pushed BTC into turmoil forcing it to lose greater than half of its worth within the previous months. Value motion exhibits a escape of its detrimental pattern line, indicating a long-lasting uptrend.

Wanting on the weekly charts, the rise in transaction volumes is phenomenal, indicating the rising buying and selling sentiment. Nevertheless, MACD hasn’t created a bullish crossover sample affirming the doable volatility. RSI has dipped from 2021, and the depth of revenue reserving has peaked for the reason that starting of 2021.