[ad_1]

Bitcoin is performing in tandem with totally different digital and monetary property. As world tensions have reached new highs, the concern of traders in several types of funding is turning into brighter. With totally different components of Europe dealing with an vitality disaster, Proof of Work may turn into out of date within the coming years. At present, BTC is the one cryptocurrency with the best confidence.

Regardless of dropping near $100 billion within the final week, the long-term outlook isn’t a lot affected by the various levels of worth volatility at the moment witnessed in cryptocurrencies. BTC now has the best liquidation to the tune of 91% of its whole provide. The Bitcoin worth achieve is predicted to create new highs because the momentum leaps.

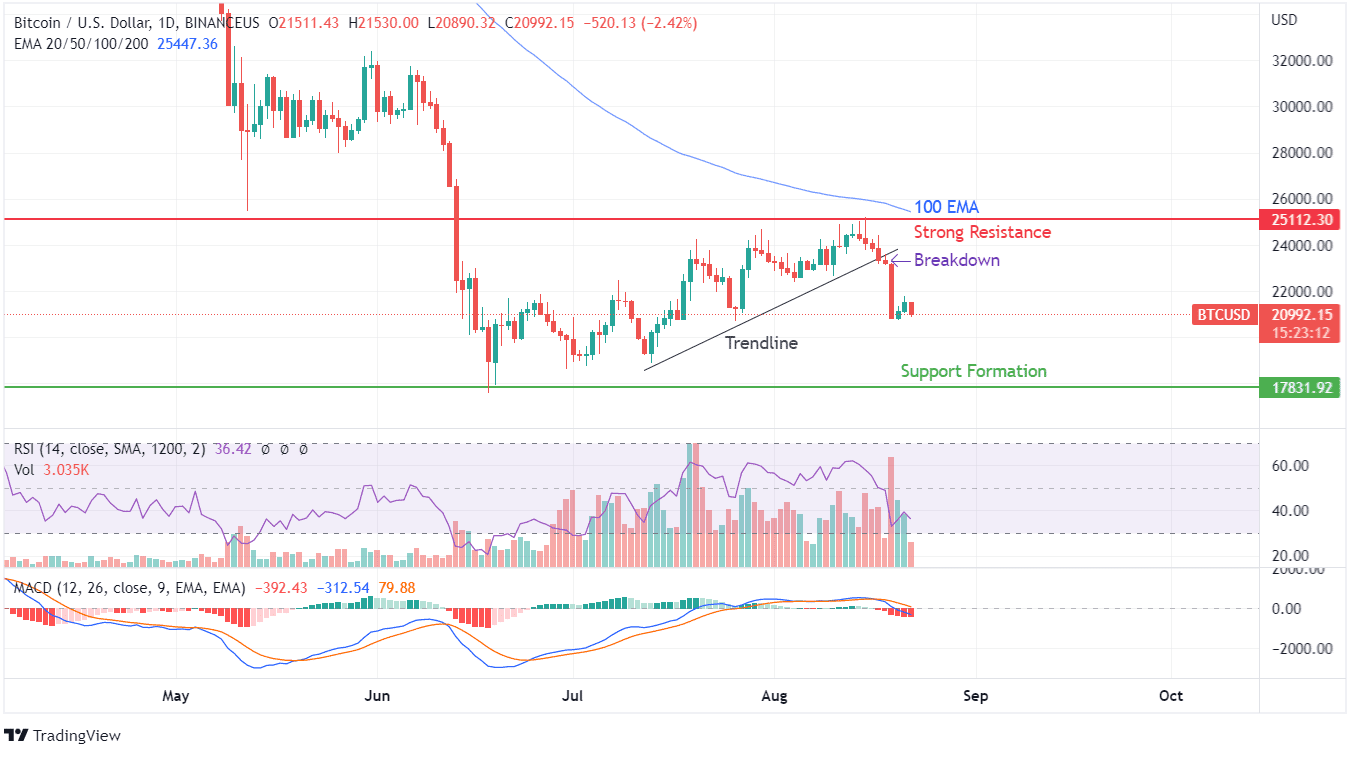

Bitcoin witnesses a large revenue reserving from 100 EMA that breaches the vital optimistic bearing trendline that began mid-July. Breach of this trendline ignited the revenue reserving fires creating a large sell-off. Do you have to additionally promote your Bitcoin holdings? Discover out right here in our BTC forecast!

Breaching the rapid assist of $22500 has created a BTC dumping situation, inflicting a sudden worth decline in only a week. This worth motion is at the moment testing the assist close to $20700 that helped BTC achieve upside momentum within the final week of July 2022. After the large double-digit sell-off on August 19, 2022, patrons could be seen rallying to use the dropped worth worth of BTC so as to add extra tokens to their portfolio.

Whereas the most recent pink candle formation is type of engulfing the good points made on August 21, 2022, patrons are actually trying to defend the $21000 stage on a closing foundation. Bitcoin ending its day above $21000 can as soon as once more provoke recent shopping for, which might present a scope of consolidation.

BTC’s worth drop has affected different main cryptocurrencies, and this situation is just not a single token issue however reasonably an industry-wide motion. Speaking about shopping for sentiment showcased by the RSI candle, we’re witnessing an enormous decline in Bitcoin sentiment. MACD fell true to its phrases, which indicated a possible for revenue reserving within the present swing because the shopping for rally was too steep. At present, MACD has opened a brand new portal that may extend the unfavorable tendency of this cryptocurrency.

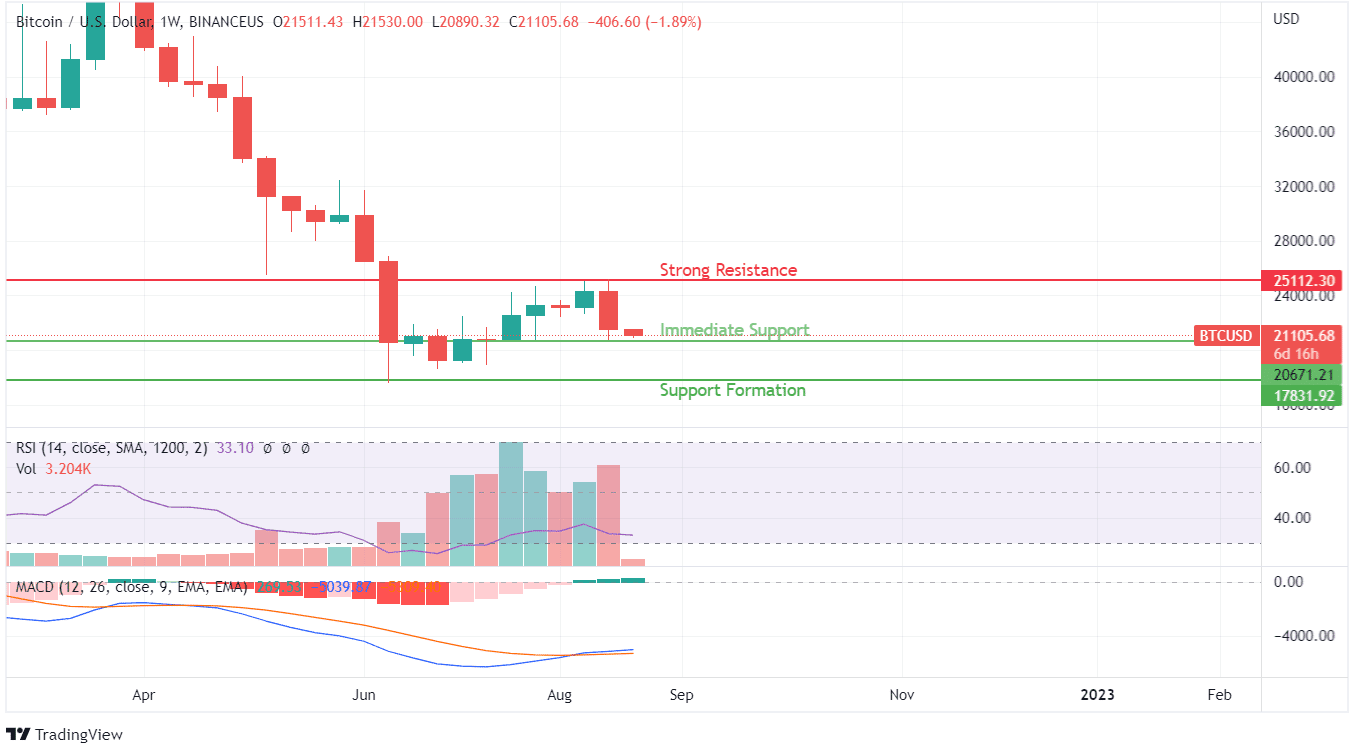

Bitcoin worth motion on weekly charts signifies the earlier shopping for zones of $21000 to help in controlling the large promoting stress that emanated from touching the $25000 mark. RSI has remained in comparable zones as witnessed through the June 2022 lows, whereas the MACD indicator halts the creation of a bearish crossover on this time-frame. Such a sign could be disastrous for the worth motion of BTC. MACD histograms are already showcasing a optimistic turnaround, and the short-lived optimistic indication may have an effect on the length of unfavorable sentiment throughout BTC.