[ad_1]

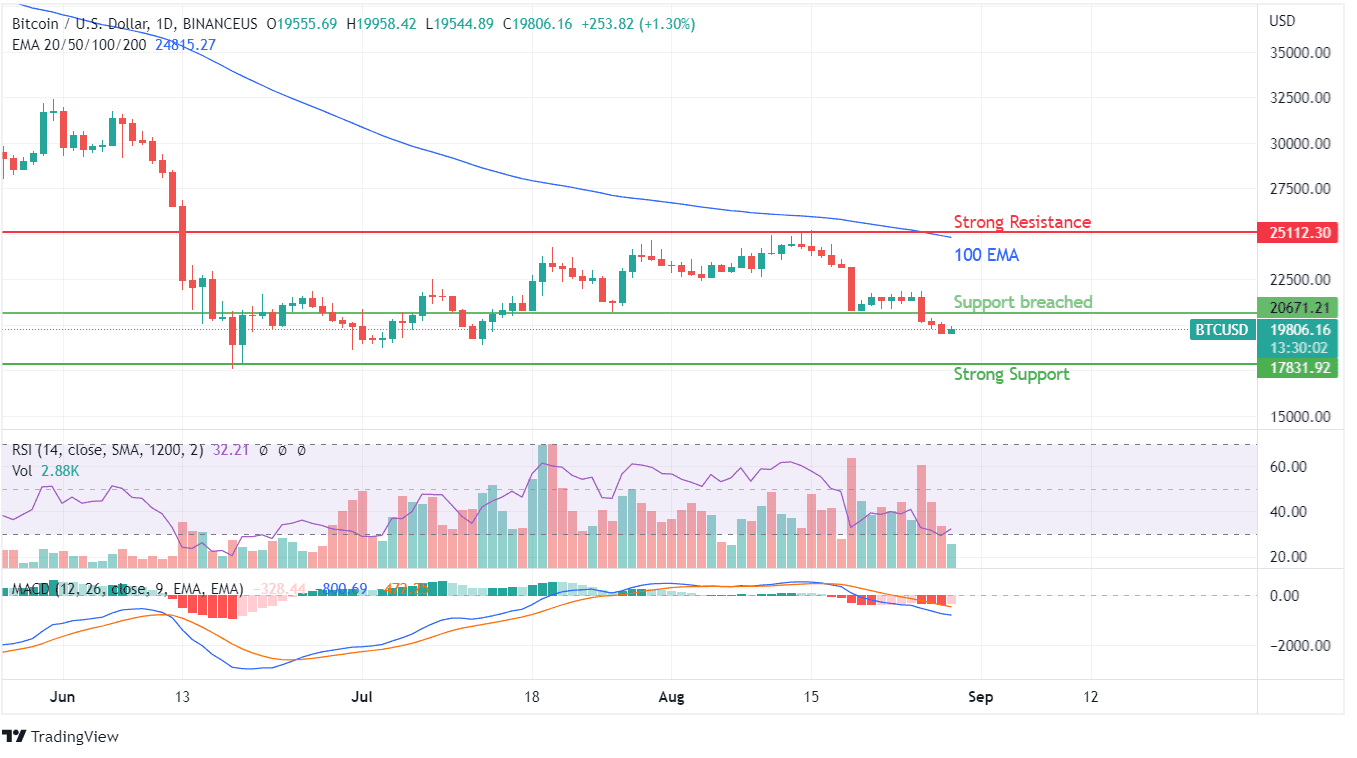

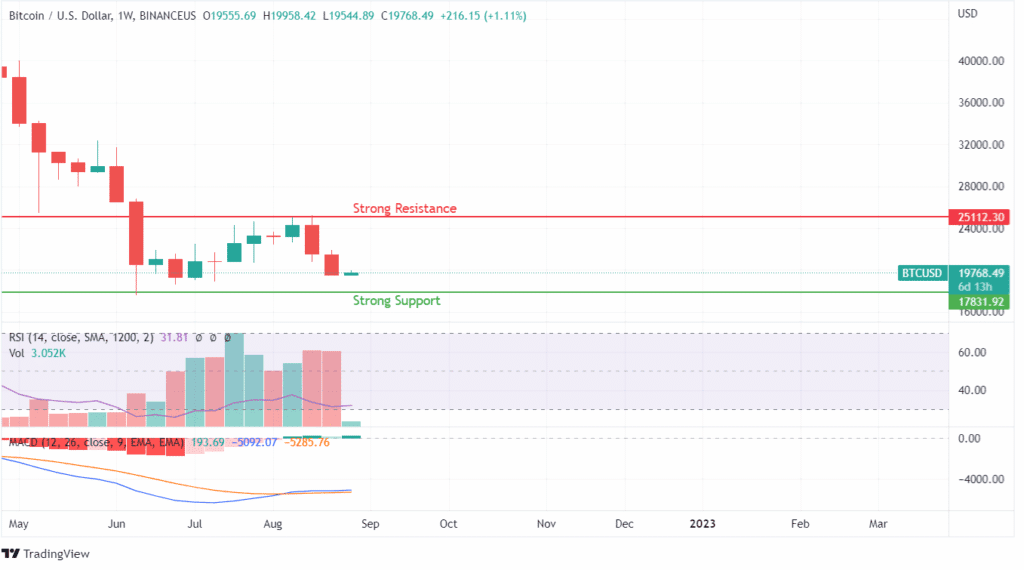

Bitcoin’s movement and motion by way of value motion have entered a unfavourable development after months of consolidation and constructive breakout makes an attempt. The worth evaluation of particular person candles on each day charts signifies the shortcoming of BTC consumers to surpass the 100 EMA curve to show instrumental in making a unfavourable sentiment. The following rejection at a better stage with no constructive final result in sight offered the much-needed energy to the sellers, who’ve pushed the worth of BTC beneath $20,000 as soon as once more.

The Bitcoin value sample resembles a breakdown and consolidation for additional breakdown preparation. The breach of the $20,671 help stage has fully shattered consumers, who would now be re-assembling at one other help stage. If unfavourable promoting continues to hamper the costs, we are able to witness a value band even decrease than $15,000 within the coming days.

Bitcoin examined the energy of its quick help seen over the last week of July however failed to supply comparable resolve to consumers, affecting the shopping for sentiment much more. A brand new trendline in unfavourable momentum has now developed, testing the helps on the decrease bands too. Learn our Bitcoin projections to know if the coin will transfer in direction of its help or resistance stage.

At first, the double-digit revenue reserving on August 19, 2022, was robust sufficient to create a panic promoting state of affairs. Patrons have didn’t make their presence seen within the value actions for the reason that candles have failed to the touch a brand new excessive for the reason that breakdown. The rise in volumetric motion with a lower in shopping for sentiment signifies just one final result: a stronger revenue reserving. Present costs being beneath even the 20 EMA, no quick turnaround could be anticipated from BTC.

Any hopes of robust shopping for could be anticipated after BTC’s stronger help stage and additional consolidation is breached. MACD already indicated a unfavourable final result again on the August 19 breakdown, and so did the opposite transferring averages. Patrons ought to maintain their positions and look forward to consolidation and breakout patterns to re-emerge to common out their unfavourable holdings.

consumers of Bitcoin ought to look forward to a consolidation sample to emerge; in any other case, they’d be holding fingers for additional draw back motion.

BTC’s unfavourable candles have gained momentum bringing the costs again to the preliminary consolidation part. The creation of a constructive candle could be seen as BTC trades in a constructive development on the time of scripting this evaluation. Whereas making a recent low, RSI has displayed indicators of revival.

MACD is transferring in an identical development, with a bullish crossover created final week. The unfavourable final result from this Bitcoin value motion could be anticipated to final for the approaching weeks. Therefore, enthusiastic consumers ought to look forward to value consolidation.