[ad_1]

On the tenth of March, the Biden Administration launched the a lot anticipated government order on cryptocurrencies throughout the nation. The order reportedly coated many facets of cryptocurrencies, together with their rules, sustainability, and safety. Nonetheless, what caught the eye of the crypto house is the federal government’s resolution to discover a Central Financial institution Digital Foreign money.

Ever because the introduction of Bitcoin, the world governments have had one outstanding criticism to make. Cryptocurrencies have been used as a car for illicit actions like cash laundering. Nonetheless, the bigger a part of the criticism was primarily based totally on assumptions, and stats present that fiat cash constitutes the vast majority of such actions. Now, world governments are more and more altering such views and are contemplating the chances of a digital forex that operates underneath the supervision of the Central Financial institution. The USA of America joins this checklist by the latest government order.

In accordance with Stated Edul Patel from Mudrex, the federal government reached this resolution after assessing the professionals and cons of digital currencies. Nonetheless, many international locations have already made this resolution months, and even years, earlier than the USA, he added. It appears that evidently the insurance policies of even bigger economies couldn’t outmatch cryptocurrencies, and the latest orders by the USA and India have made it clear. Surprisingly, smaller economies like Nigeria, Bahamas, and Ecuador have already introduced their plans for a centralized digital forex.

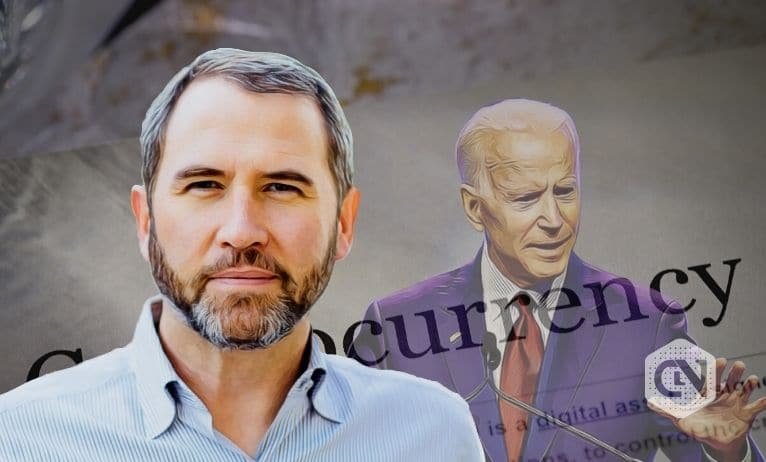

Nonetheless, the crypto house believes that the federal government’s efforts to evaluate the US CBDC would naturally consolidate the fragmented rules discovered throughout the states of the USA. Not like international locations like Japan, Singapore, or the UK, the rules on Crypto in America are fragmented. That is seen by many as the explanation why the trade was not capable of thrive regardless of having such excessive demand. Ripple’s CEO, Brad Garlinghouse, appears to be welcoming this resolution of the federal government to check the choices of regulating digital currencies. He holds this view concerning the new order after the year-long authorized battle of Ripple with the SEC. Reportedly, the lawsuit discovered some inconsistencies within the claims of the SEC in opposition to the cryptocurrency agency.

The chief order additionally addressed points like “nationwide safety, client safety, monetary inclusion, and accountable innovation”. Most significantly, a good portion of the curiosity was within the impression of cryptocurrencies on the surroundings. The federal government will appoint a committee to analysis the vitality consumption of cryptocurrencies to search out out extra concerning the scenario and implement measures to mitigate them.

Some outstanding figures like Billy Markus imagine that conventional monetary infrastructures account for extra carbon emissions. Additionally, many crypto initiatives like VeChain and Hedera have already taken initiatives in opposition to this trigger.