[ad_1]

Avalanche is a blockchain-based decentralized platform for launching decentralized apps, however it has been dealing with powerful competitors. It has proven huge development within the final 12 months with a major enhance in common each day transactions. It additionally provides NFTs and blockchain gaming platforms.

Builders added totally different options to make AVAX quick and scalable. It has three blockchains with totally different functions, making it environment friendly to course of round 5000 transactions per second.

- X-Chain: It’s used to create and commerce digital property. AVAX is used for transaction charges.

- P-Chain: It coordinates with the Avalanche of validators. It permits subnets on this community that are used to create new tokens.

- C-Chain: It’s used to create good contracts.

AVAX is a tricky competitor of Ethereum as a result of it permits customers to create blockchain on this community. The builders of those new blockchains can create their very own tokens and charge construction on their platforms.

Apart from that, it permits the token to be transferred on the Ethereum community utilizing an Avalanche bridge. You’ll be able to switch Ethereum-based tokens on this platform utilizing Ethereum good contracts.

It runs by itself Avalanche consensus, which is safer, sooner, and energy-efficient than the Proof of Stake. The preliminary coin providing was organized in July 2020, and after that, it’s thought to be one of many high crypto startups.

Although the community appears related, yow will discover a giant distinction between the value chart of ETH and AVAX. Thus, one ought to learn AVAX worth prediction earlier than investing in Avalanche for the long run.

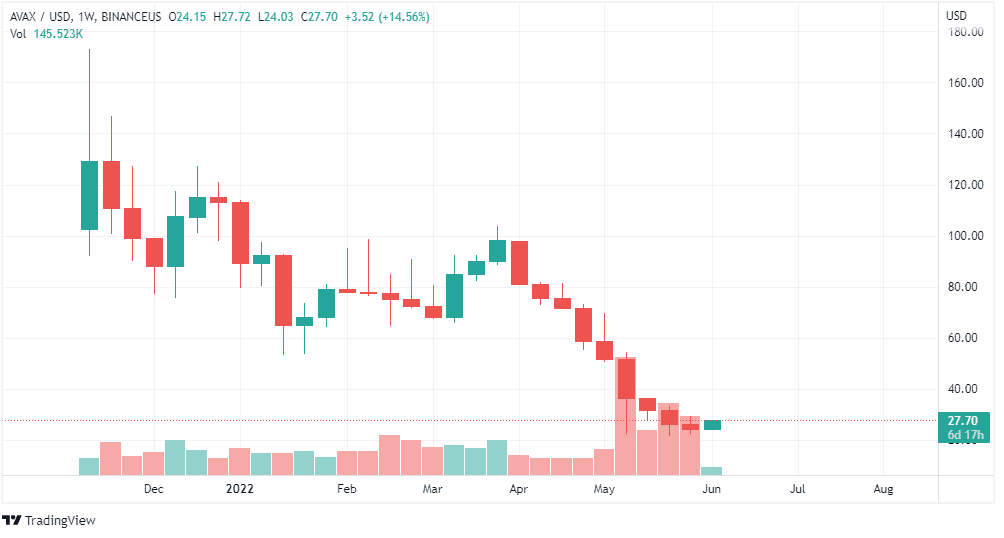

On the time of writing, the value of AVAX was buying and selling round $27. It is extremely bearish in the long run as a result of it has been forming decrease lows. This week, it fashioned a inexperienced candle after 9 consecutive purple candles with good buying and selling volumes.

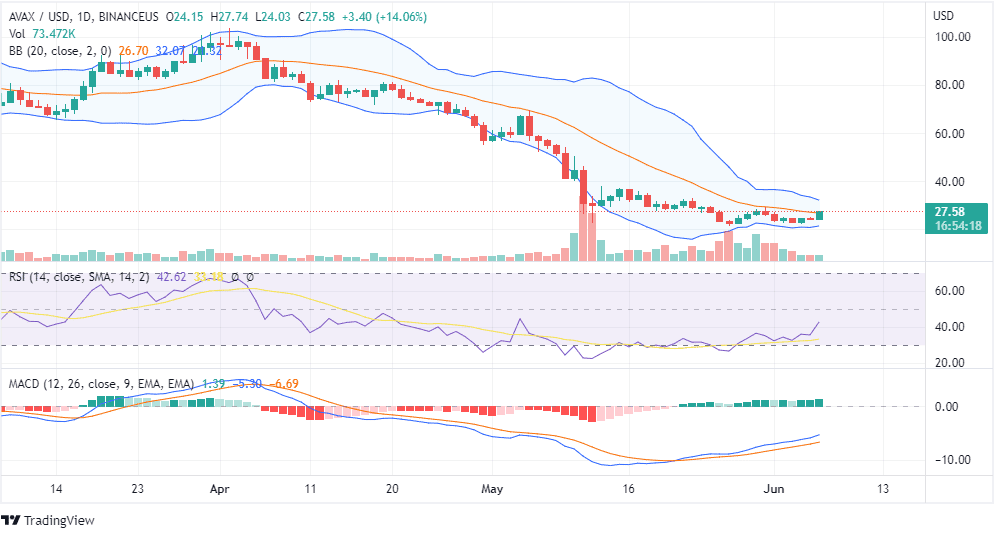

On the each day chart, AVAX has been following help round $23, however it can consolidate between the vary of $37 and $25, which isn’t a very good signal for the quick time period.

Within the quick time period, the value pattern of Avalanche appears to be bullish, with the MACD indicator forming inexperienced histograms; RSI is steady round 40, whereas candlesticks are forming across the baseline of the Bollinger Bands.

As per the above technical evaluation, Merchants can make investments for the quick time period, however it might be a dangerous commerce. On the similar time, we don’t recommend AVAX for the long-term as it’s not exhibiting indicators of excessive returns at present.