[ad_1]

Within the declining crypto market, Bitcoin is defending the assist degree of $30,000. There is no such thing as a signal of a miracle worth surge, however analysts observe range-bound upside momentum with potentialities of a downtrend.

Bitcoin managed to indicate energy in its worth this week. If it continues, we will discover a short-term restoration in worth. The worldwide market rules and inflation are pushing the BTC worth down.

It additionally permits the bear market to bounce again and monitor the state of affairs as a result of most traders aren’t assured in regards to the upside bounce. They’re anticipating the breakdown of the earlier backside of $23,800 this 12 months, particularly after the crash of Terra.

Moreover that, one should argue in regards to the consensus of Bitcoin as a result of it runs on a Proof-of-Work algorithm, which isn’t environmentally pleasant. Many distinguished cryptocurrencies are switching to Proof-of-Stake consensus, which saves vitality and the price of mining.

Miner manufacturing value determines their ongoing exercise, and it’s at present round $26000, which might trigger a bigger shift of algorithm to keep up the profitability of this blockchain. Hashrate has been rising, and it got here to the all-time excessive of an estimated 233 EH/s on Might 23. Then again, the hashrate elevated, whereas the Bitcoin worth dropped considerably within the final 12 months.

Now many analysts query the basics of this cryptocurrency whereas the market stays chilly as a consequence of numerous different causes. Verify BTC predictions to know whether or not the value of Bitcoin will plunge or rise.

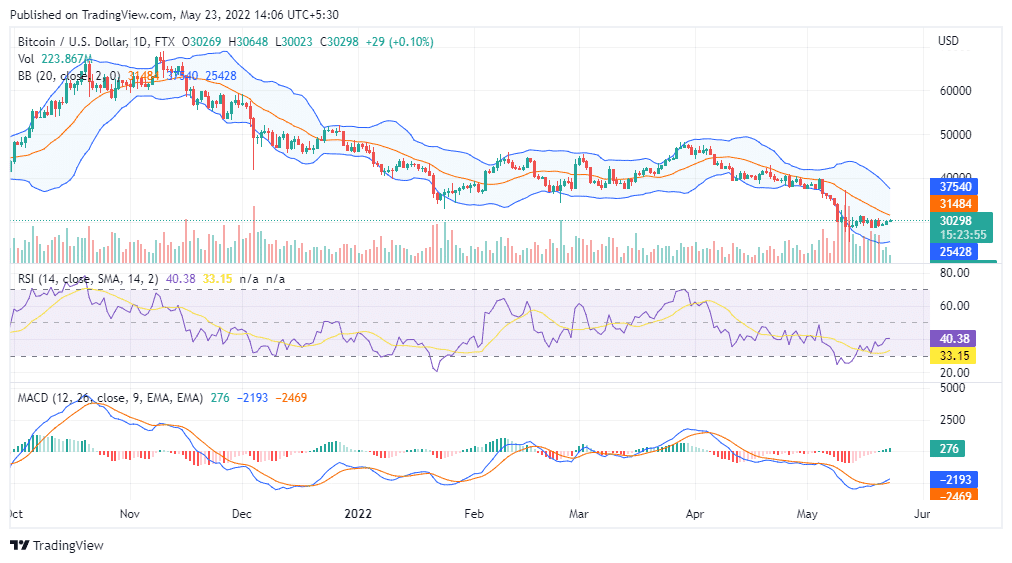

On the time of writing, BTC was buying and selling round $30K. On the every day chart, it has taken short-term assist at round $29,700. BTC is consolidating round this degree, and the earlier assist degree of $37K will work as a powerful resistance degree for this coin.

Certainly, it’s displaying an indication of restoration with increased buying and selling quantity. MACD line and RSI are bullish, together with the Bollinger Bands. There are inexperienced histograms on the MACD indicator with the BTC worth across the baseline of the Bollinger Bands.

BTC has been consolidating between $40K and $37K within the final month. Attributable to inflation and the US Fed rate of interest hike, cryptocurrencies grew to become a sufferer. Thus, the BTC worth falls drastically.

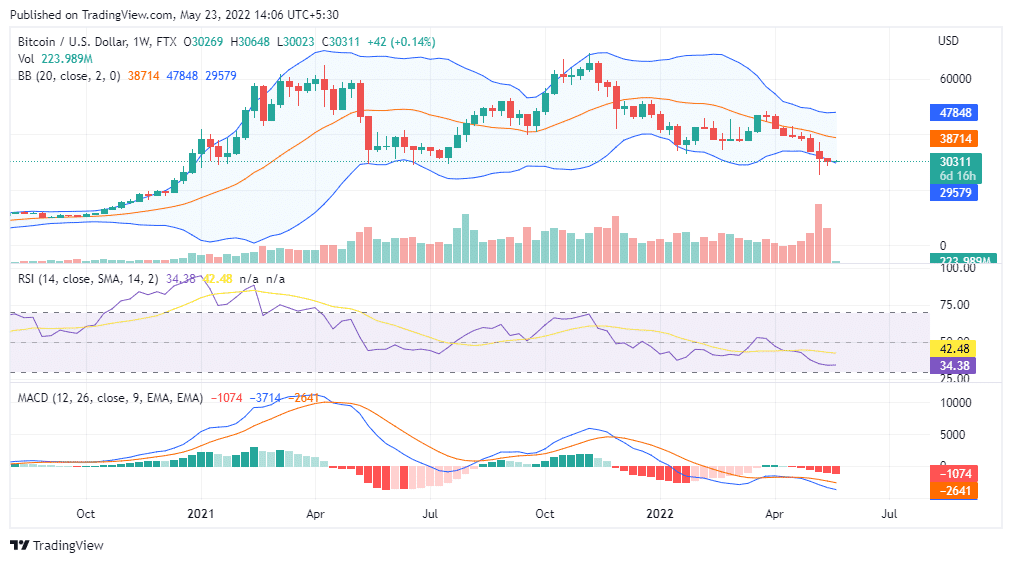

Now many analysts suppose it could come right down to $9K. Nonetheless, the long-term evaluation doesn’t mirror any such view. Although it has been forming decrease highs, it has taken assist across the historic assist degree of Might 2021.

A lot of the technical indicators are bearish within the weekly chart. MACD types purple histograms with bearish alerts; RSI is round 34 and may be thought of in a bearish grip. Bollinger Bands additionally exhibits bearishness as a result of weekly candlestick might break the decrease band.

Nonetheless, we expect it’s the excellent time to begin accumulating Bitcoin as a result of it has nice potential sooner or later, and it gives an enormous return to the investor in the long term.