[ad_1]

The Flexa funds community developed AMP as a way of collateralizing and verifiable assurances that may permit different funds networks reminiscent of Flexa to safe transactions earlier than engaged on them. This course of allows safer good contracts and permits for constant progress. AMP has misplaced a major market capitalization, now having a price above $352 million regardless of simply 42% of tokens underneath common circulations.

The problems introduced forth by SEC initiatives AMP as safety, and since they’re accused of insider buying and selling, the token has been delisted by a majority of exchanges. Outlook seems to be detrimental within the brief time period, however the long-term outlook is pretty constructive because it holds large positive aspects in comparison with 2020 lows.

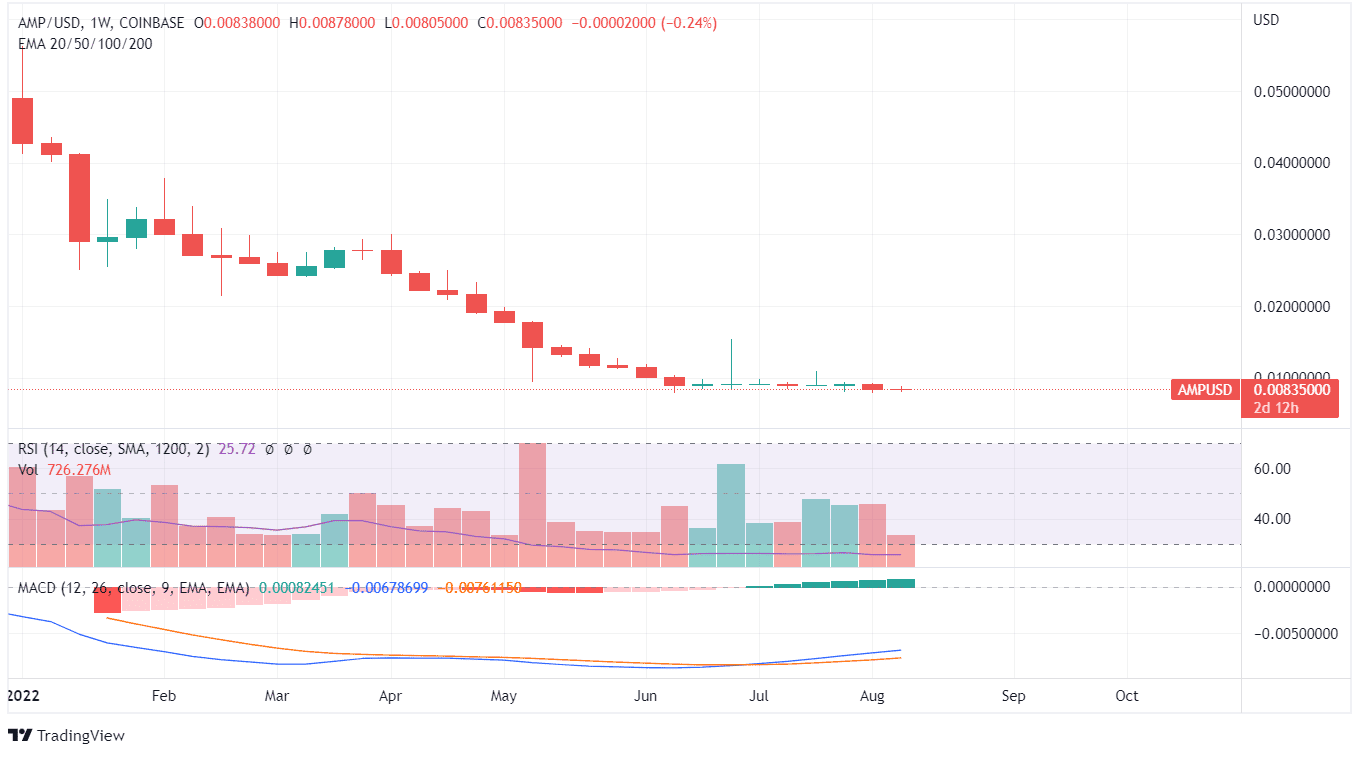

AMP token has witnessed a groundbreaking realization that’s going to negatively have an effect on AMP worth motion. The outlook since a decline in Might 2022 has remained detrimental, with costs not having the ability to get away of consolidation and a detrimental pattern line. Every breakout try is taken as a possibility to guide earnings and scale back holdings.

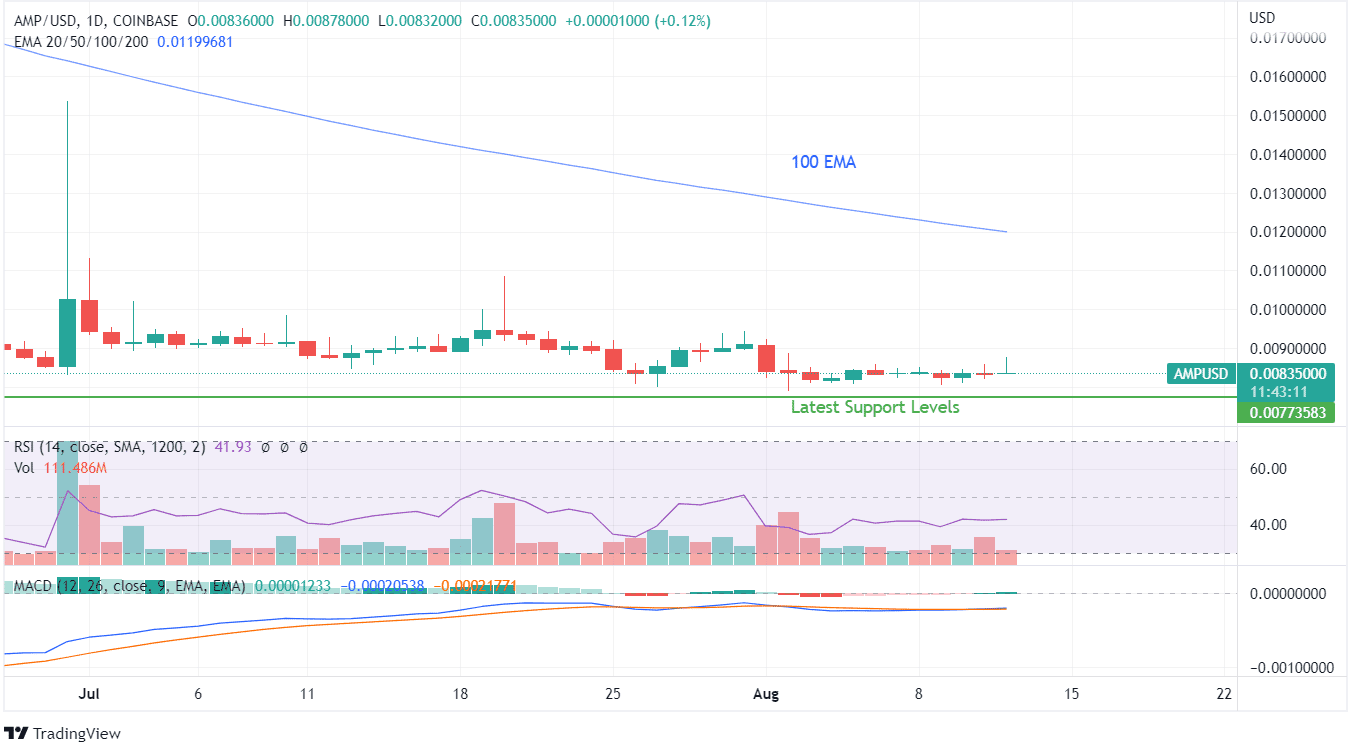

Since hitting its latest lows in June 2022, the AMP token has improved its shopping for sentiment indicator as RSI has now entered impartial territory. Equally, the MACD indicator is transferring in direction of the constructive axis with a bullish crossover brought on by a good worth acquire in three days. Moreover these newest worth actions, AMP has been a complete loss for consumers who took benefit of dips to make entry and maintain.

With worth motion transferring in a detrimental consolidation, hitting recent lows with every week, the outlook doesn’t appear constructive within the brief run. Transactional volumes have been fairly low, which is hitting the token even more durable, however information of the SEC checklist of insider buying and selling might be disastrous for the holders of AMP tokens. The outlook has turned extremely detrimental, and one ought to deal with this token as a chance with the information and prospect rotating round AMP. Do you have to promote all of your AMP holdings in such a scenario? Click on right here to search out the reply!

On weekly charts, AMP is transferring in a detrimental pattern hitting new lows that may be disastrous for its designated progress. The indicator exhibits bullish crossover, however the shopping for sentiment is detrimental, which signifies consumers are making the most of present values.