[ad_1]

Blockchain was developed for added utility and comfort over problems. AMP-enabled fee corporations like Flexa and others make the most of the brand new age applied sciences to unravel many issues. AMP is only a digital community that connects to all {hardware} and software program factors of sale on-line utilizing Flexa.

It’s only a net that permits funds to go to retailers. Wallets can hook up with Flexa and pay with the belongings listed on its fee mode. AMP brings its collateral mechanism to permit all of the wallets to take part within the community itself.

Bank card processing as we speak witnesses big fraudulent actions however utilizing AMP funds wallets can confirm digital belongings and their genuineness cost-effectively. Decentralizing verification throughout these various kinds of applied sciences will flip fee methods to be far more efficient.

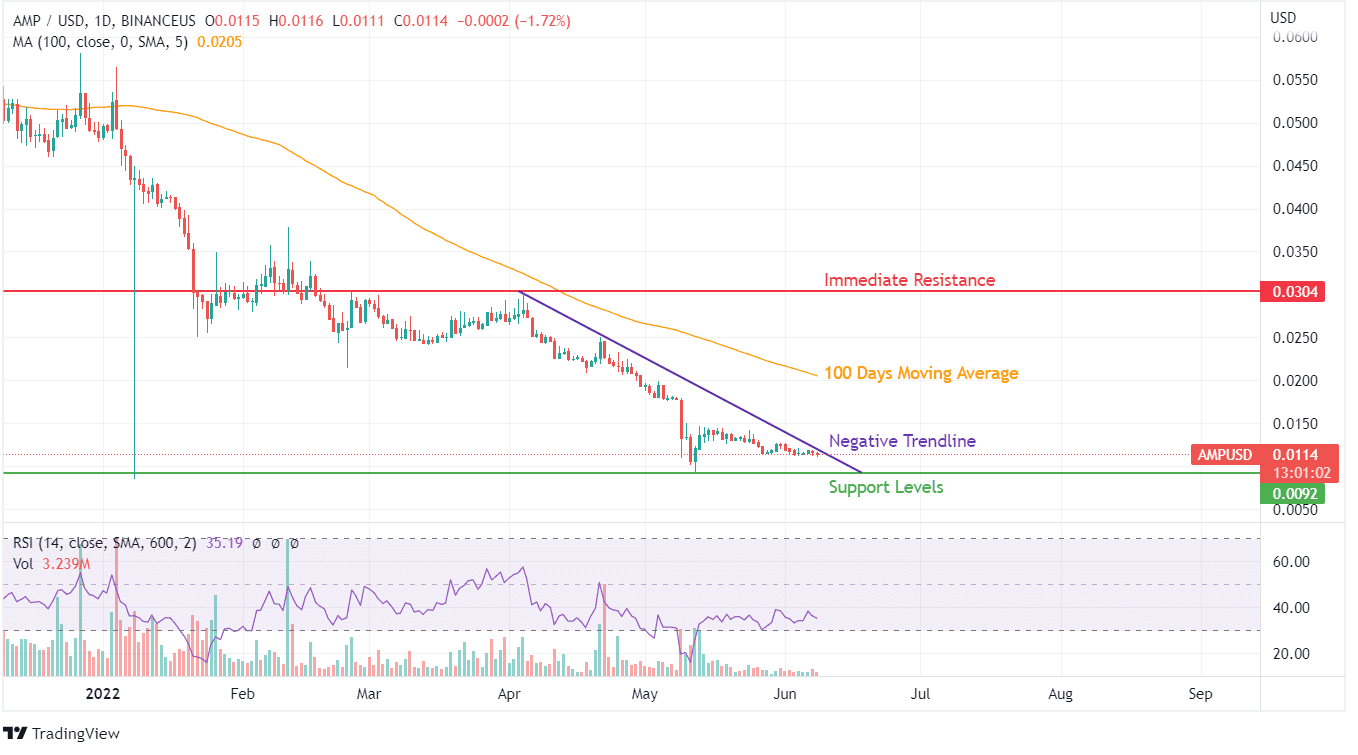

In such a situation, AMP showcases a robust presence and progress potential. Regardless of its big market loss, it carries a market capitalization of $479,239,312, with 46% of AMP tokens in circulation at present valued at $0.0114.

AMP has plunged a decimal place marking a major decline in its valuation, elevating extreme eyebrows about its sustainability and continued progress to market real-time income. There was some assist close to its contemporary low ranges. Nonetheless, AMP worth is only a means to challenge the worth of digital collateralization, which requires a spike in digital transactions utilizing unliquidated belongings.

The numerous decline in April and Could has been a testomony to reducing transactions on digital belongings utilizing collateralized strategies. Merchants mustn’t transfer forward with quite a lot of warning throughout such a unstable interval, and should learn detailed AMP worth predictions and establish futuristic potential.

AMP token has no real-time utilization apart from collateralization. Therefore, two components, immediately and not directly, have an effect on its worth development. The primary can be the time required for a transaction to finish, whereas the second can be the variety of digital collateralization ongoing.

The rise in transactions and a decline in collateralization completion time might be the one approach to make progress in AMP’s worth. AMP has been sustaining the onslaught for a month, halting the decline. Nonetheless, it might be troublesome to carry this stage for a very long time. Both the value would elevate to $0.03 or tumble down under the latest lows of $0.0092.

RSI signifies barely any motion in shopping for sentiment, which is confirmed by its comparatively decrease transaction volumes and worth development. Therefore, patrons ought to watch for optimistic indications to rise earlier than buying this coin as a result of it’s buying and selling at a reduced worth to its contemporary highs.