[ad_1]

Being seen as an alternative choice to the most important cryptocurrency, Bitcoin and Ethereum maintain many potentials sooner or later. Possibly because of this ETH is up by greater than 200% whereas BTC has nonetheless not been in a position to hit a century. The bigger dialogue and buzz is across the improve of Ethereum 2.0.

ETH 2.0 will use the proof of stake know-how which primarily takes energy away from miners and rewards them as validators for the transaction. On ETH 2.0, the proof of stake is rumored to have a deposit contract that may be sealed if there’s a case of malpractice. No matter the information, allow us to dissect the value motion and momentum in Ethereum as of now.

ETH Technical Evaluation

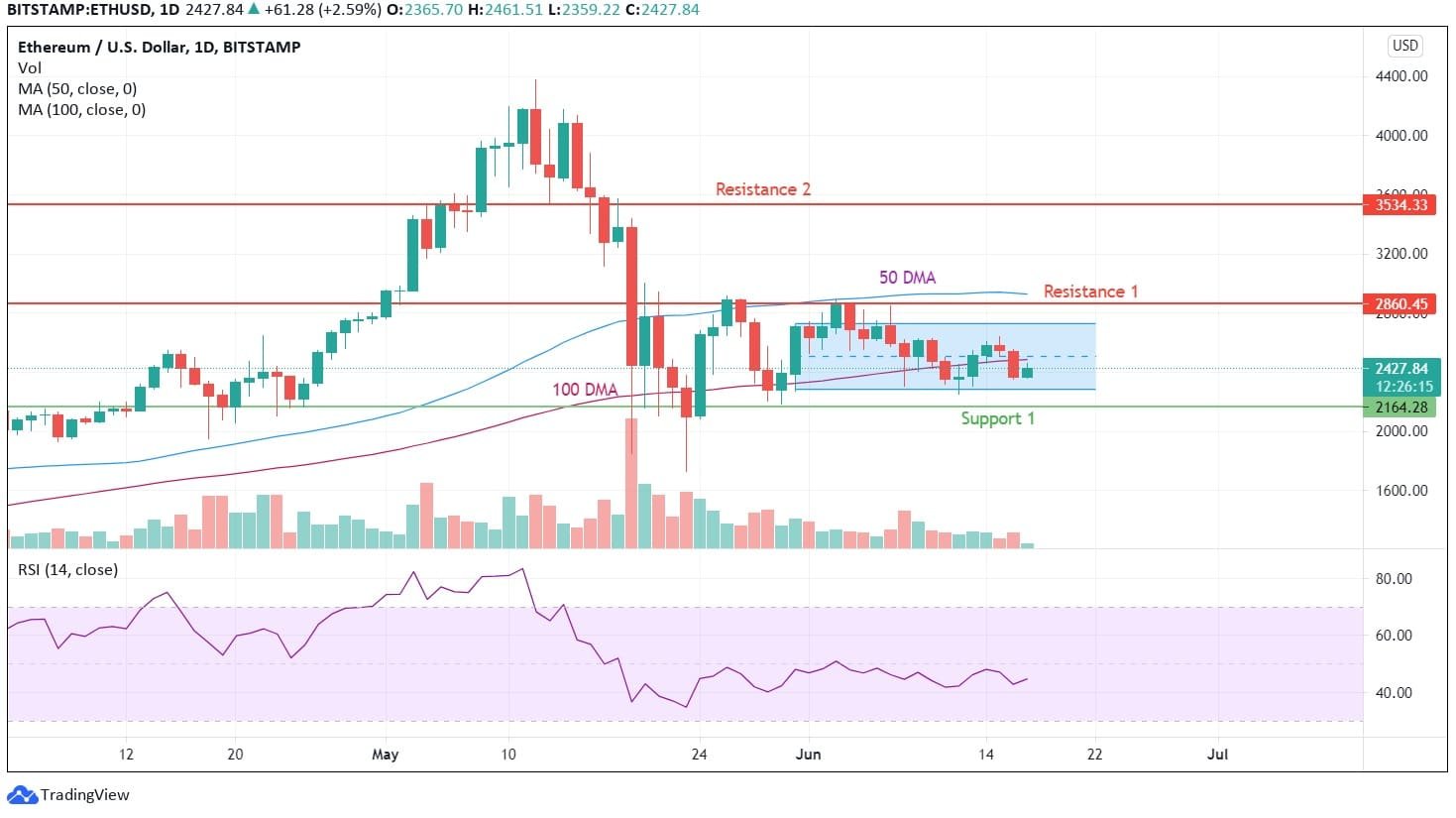

Ethereum continues to be caught within the consolidation zones. The breakout at the start of June 2021 turned out to be a false one. One other vital issue to contemplate is that ETH has damaged its 100 days easy shifting common line by a major downtrend. There appears to be stiff resistance round $2700, and it’s additionally following the broader crypto-market pattern.

As of seventeenth June, ETH is attempting to make it again above the 100 DMA, and till then, there’s solely negativity on this counter. The upper resistance has nonetheless not been examined in additional than a month, and it’s the identical situation with consolidation zones. Within the final two occurrences of breaking the 100 DMA, ETH adopted a fast and powerful shopping for to push the costs in the direction of resistance zones.

Based on this pattern, ETH ought to quickly be near $2850 throughout the subsequent month or implement promoting stress. Traders ought to think about the $2165 ranges as a transparent cease loss for holding Ethereum at $2420 ranges. RSI signifies a impartial sentiment available in the market because it holds a price between 40 and 50 for the final three weeks.

Heikin Ashi charts present a constructive try at retaking the 100-day shifting common line. There was some rally in the previous few hours, however the momentum is capped round $2410 ranges. The creation of a crimson candle on this chart with no higher wick is an indication of fear for brief timeframe merchants. ETH is destined to stay weak for the subsequent few hours if there isn’t a vital information available in the market.

Taking positions at present ranges is affordable. Its 200-day shifting common is at the moment positioned round $1800 ranges, which is about 30% under the present ranges. In an unlikely state of affairs, ETH may take help from the 200 DMA. Therefore, till it crosses above the 100 DMA, it’s not sensible to take dangers.

However, nonetheless, as an energetic dealer, if somebody desires to put money into Ethereum, it is strongly recommended that first examine ETH value prediction by consultants after which determine for any funding on this foreign money. Because it’s higher to attend for the best time to realize big returns sooner or later.