[ad_1]

Bitcoin (BTC) is a decentralized digital foreign money that makes use of cryptography for safety and isn’t backed by a government. Constructed on a decentralized ledger expertise known as the blockchain, which data and verifies all transactions on the community. All of the transactions are recorded in blocks, linked collectively in a sequence, that creates a safe and clear report of all exercise.

Bitcoin can be utilized as a method of change, just like conventional currencies, and may be purchased and offered on cryptocurrency exchanges. Bitcoin has gained important reputation and recognition as a type of digital foreign money, with a rising variety of companies and retailers accepting it as a type of cost.

Nevertheless, it has additionally confronted controversy and regulatory challenges in some jurisdictions. The latest market capitalization for BTC has reached a backside aspect of $322,326,348,778, with restricted value jumps as consumers are making methods to extra trending tokens. Worth motion may see restricted motion within the coming days.

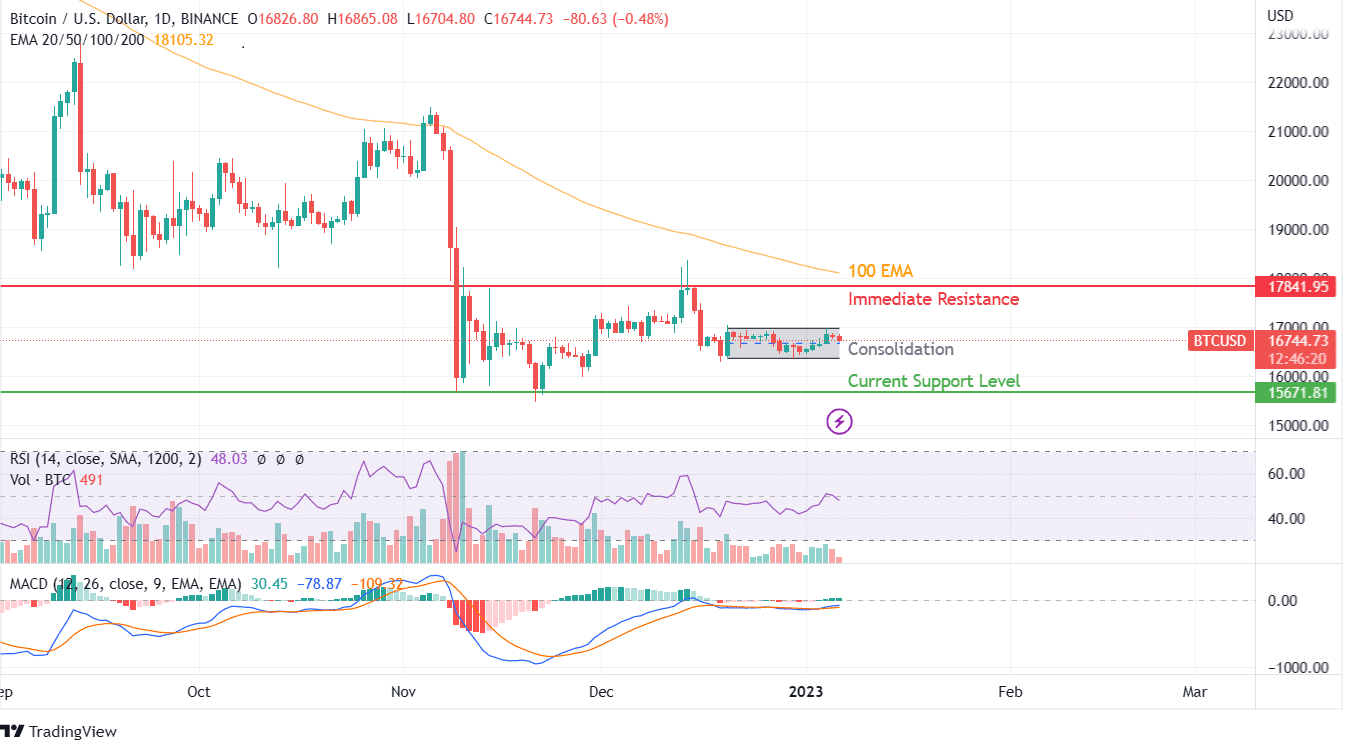

Bitcoin value motion highlights a consolidation in progress with an higher band of $16980 and a decrease band of $16380. With historic traits, the probabilities of additional decline in BTC are restricted, whereas the upside has multi-folded return potential. Which aspect will Bitcoin select? Learn our BTC prediction to know!

Bitcoin began gaining consideration in 2013, when its value started to rise quickly, reaching a peak of just about $1,200 in December of that 12 months. Nevertheless, this value surge was adopted by a pointy decline, and the value of Bitcoin fell to round $200 by the top of 2014. Since then, Bitcoin has had a number of different important value actions.

In 2017, it reached a excessive of almost $20,000, pushed by elevated adoption and mainstream recognition. Nevertheless, this was adopted by a major crash, and the value of Bitcoin fell to round $3,000 in 2018. In recent times, the value of Bitcoin has been extra steady, fluctuating between $10,000 and $40,000.

The decline beneath $20000 has been seen as a crypto winter indicator, and a serious rally may be anticipated in BTC tokens by the top of 2023. Technical indicators RSI or MACD are extremely consolidative, with value motion witnessing very minor volatility. The closest value action-based resistance is sitting round $17841, adopted by $21500.

Quite the opposite, help is accessible from $15671. Because the BTC token has been consolidating for the previous few days, a serious breakout is usually a ensuing motion. Buying and selling above the important thing transferring averages of 100 and 200 days may additionally deliver a powerful shopping for spree at BTC.