[ad_1]

Ethereum brings the concept of change and the change-making potential of its progressive blockchain. The motion for its blockchain cryptocurrency ETH might need taken a again seat in 2022, however the outlook in comparison with its opponents, resembling SOL, ADA, and others, is pure gold.

Transition validation and the choice to shift to Proof of Stake would save important assets and permit a lesser transaction quantity within the coming years. The optimistic affect of this variation wouldn’t be seen instantaneously.

ETH stays the quantity 2 place holder, however market capitalization has slipped additional beneath $148 billion. The marginal positive factors witnessed yesterday had been a shopping for try to make the most of this dipping worth. It shouldn’t be thought-about an precise shopping for spree.

Of its options, ETH is able to dealing with DeFi, dApps, and Sensible contract-based purposes together with different trendy transaction wants. The merge of its mainnet, beacon, and POS chain has lastly been executed.

However this act provides one other new dynamic of a a lot slower ETH issuance course of; stakers are incomes a marginal return on the staked Ethereum holdings. This quantity might be lesser than the gradual inflation, however with a complete of 490,000 validators, the rewards are anticipated to be skinny.

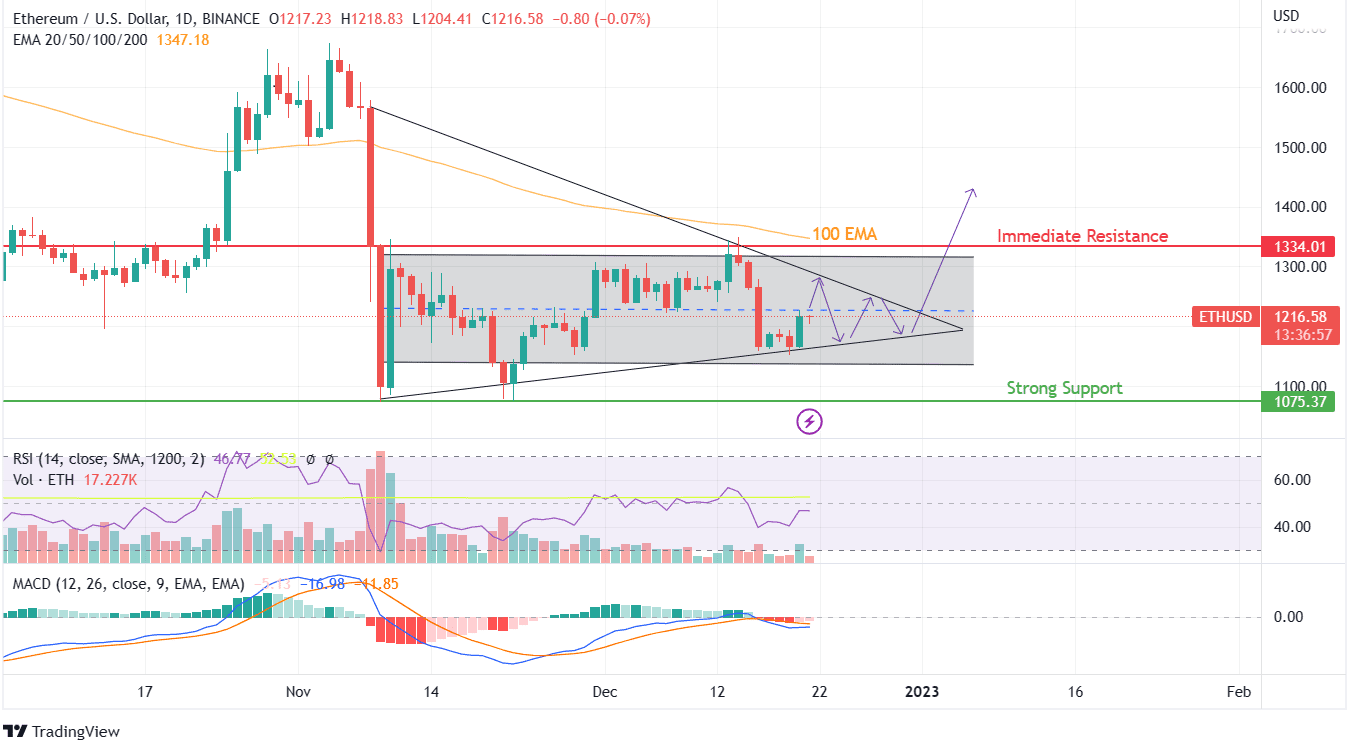

Trendline drawing resistance from the shifting common has created new hurdles for purchasing sprees. The promoting exercise ramps up upon reaching these ranges. The rapid resistance may be witnessed at $1334, synonymous with the 100 EMA ranges. Discover extra particulars about whether or not or not the Ethereum token can attain the resistance!

Crypto leaders have been shifting in a consolidative sample as information has stopped impacting these tokens. On the similar time, Christmas for ETH consumers will most likely be unsurprising as buying and selling volumes have a significant hit through the weekend and festivities.

Moreover, the resistive worth motion retains consumers from shopping for as they’ve a powerful likelihood of testing new lows earlier than the yr ends. Whereas 2021 was filled with volatility and motion, 2022 has been shifting in a adverse path.

Ethereum has managed to wipe out the positive factors made within the final two years, as comparable values had been witnessed in January 2021. The one distinction was the shopping for sentiment, as RSI indicated an overbought zone again then in comparison with the oversold ranges at present worth.

ETH may proceed to battle until $1650 earlier than making a powerful breakout. Therefore the following motion could be filled with volatility and shocks. On long-term charts, Ethereum showcases a rejection at $1350 ranges to have pushed off consumers in the direction of retesting the $1150 worth.