[ad_1]

Bitcoin may be thought-about a digital gold or a broader illustration of the functioning and development of the cryptocurrency business. In actuality, the concept one thing digital can maintain weight relies on provide and demand dynamics. If sufficient individuals say it’s value $100,000, it will certainly be value it.

Earlier than buyers established it as an inflation-beating device, BTC was steadily rallying. Nonetheless, solely 17% of Bitcoin is at present being held by retail buyers.

Therefore, the dominance of whales and crypto market makers remains to be far stronger to ever let it develop into a decentralized forex. The processing of transactions is undoubtedly decentralized, however the identical can’t be showcased out loud.

Market capitalization for Bitcoin has reached $324 billion, with roughly 1.5 million tokens remaining within the circulation market. Regardless of working low on valuations, the token exhibits energy to retake its prior ranges with constant consolidation and breakout makes an attempt. Whereas lovers deal with present ranges as a once-in-a-lifetime shopping for alternative, the one query is whether or not the earlier peaks will be breached. Click on right here to know the long run projections of BTC!

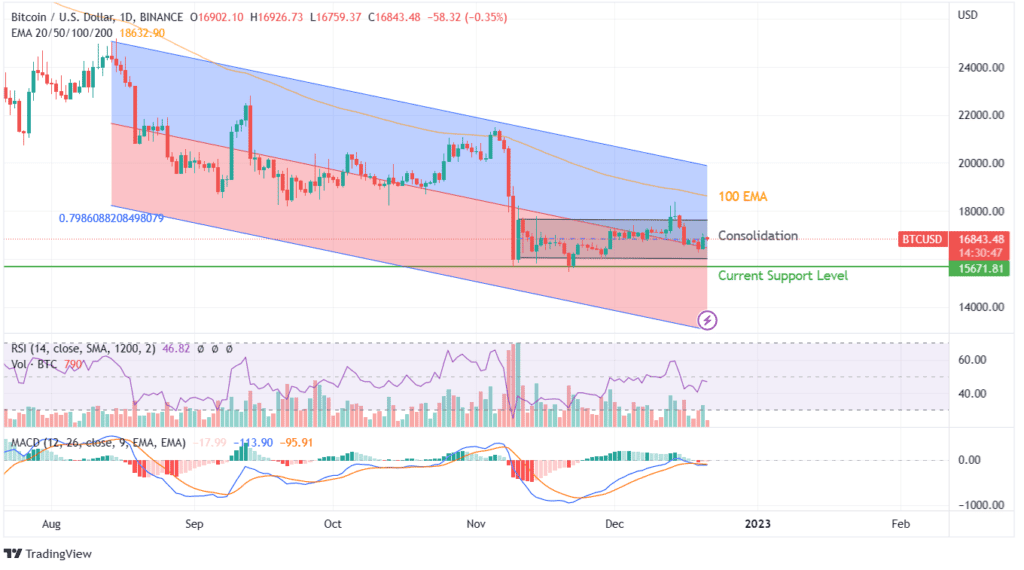

Bitcoin value motion has not but showcased the projection on both the constructive or adverse aspect. The consolidation zone between $15500 and $18000 has been ongoing for the reason that decline in November 2022. The outlook for BTC within the quick time period is determined by its capability to interrupt out and retest the 100 EMA and 200 transferring common curves.

Candlestick patterns for the reason that decline in November’s first-week showcase a assist stage concept. With consolidation, shopping for spree was anticipated, however regardless of rising RSI ranges, the precise value barely moved an inch.

On a lighter observe, the consolidation stage has been exhibiting energy. Shopping for at present values can convey a good quick acquire likelihood, whereas the draw back can’t be comprehended. Therefore, making entries ought to be strategized.

The 100 EMA curve at current has reached slightly above the $18,000 mark creating immense stress on shopping for rallies. Whereas the revenue reserving stance hasn’t but subsided, the outlook for BTC would rely on its capability to beat the short-term transferring common curves.

Help for Bitcoin has been robust and energetic for the reason that $15,650 stage, which hasn’t been touched but. Consumers to amass can be heading in the right direction to proceed shopping for partial BTCs, however these to make fast cash may discover themselves caught in difficult conditions.

On weekly charts, BTC has undergone an enormous decline within the final week, steadily including to the promoting stress as RSI on weekly charts has barely flinched from 35.