[ad_1]

Ethereum is the second largest cryptocurrency on the planet, which is well accessible and could be transferred worldwide. It has a variety of use circumstances, so many traders favor ETH as a long-term asset, however after the merge improve, it was in a downtrend. Nonetheless, many traders are accumulating the ETH cash for the long run as a result of it has change into extra sustainable and eco-friendly than different cryptocurrencies and rivals.

The world of crypto has been going by an unsure part. Most cryptocurrencies are down, whereas a few of them have been secure this 12 months. Do you wish to purchase ETH in your portfolio? There are a couple of causes in your favor.

The very best half is that Ethereum is a well known cryptocurrency aside from Bitcoin, which can also be helpful for buying and selling, decentralized utility, NFTs, and different conventional real-life use circumstances. With this blockchain know-how, builders construct industry-leading dApps, particularly for banks and different monetary establishments.

Merchants, retail traders, massive traders, and tech fanatics are closely investing in Ethereum for its exponential development sooner or later as a result of decentralized finance functions are excelling out there, and Ethereum will proceed to soar as a result of builders get wonderful options in Ethereum that no different platforms supply.

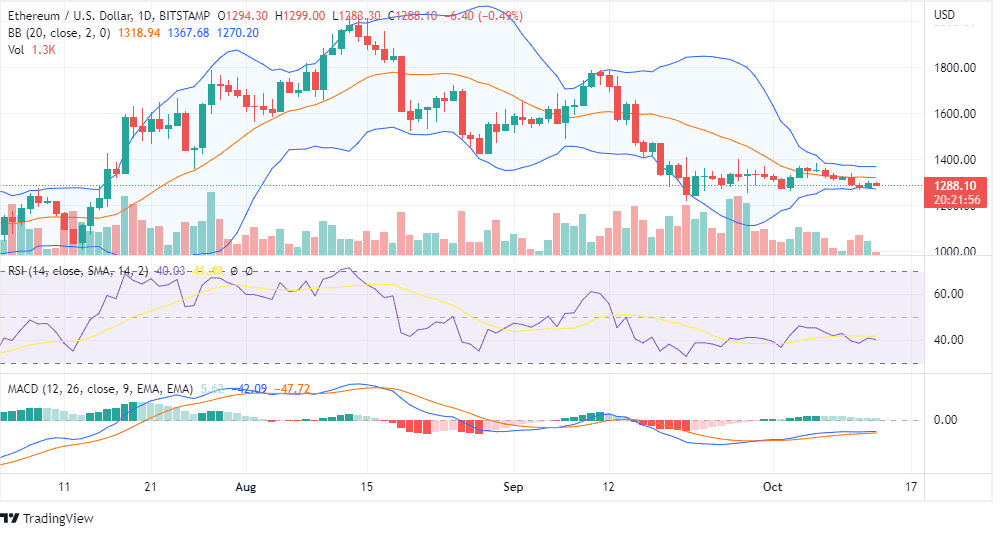

On the time of penning this publish, ETH was buying and selling round $1288, which is across the assist degree that means sideways motion, however Ethereum could break this assist quickly and are available to the extent of $1000, which will probably be a terrific alternative to purchase for the long run. However when will that occur? Learn our Future ETH forecast to know!

RSI is at 40, so technical indicators counsel bearish sentiment for the brief time period. The candlesticks are forming round $1300 within the final month, and Bollinger Bands lacks volatility which may change the momentum on this unsure market.

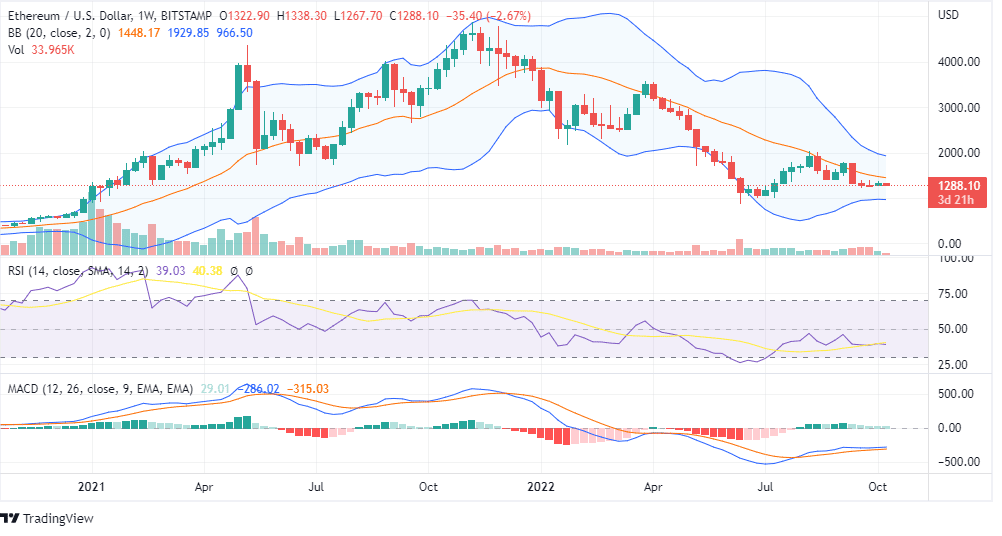

On the weekly chart, candlesticks are forming decrease lows across the baseline of the Bollinger Band, holding the assist of $1200. Ethereum began a bull rally final 12 months, however after forming an all-time excessive of $4891.7, it has been in a downtrend.

The long-term chart suggests $2000 is a powerful resistance as a result of ETH has fashioned a triangle sample from the all-time excessive. It might be higher to start out accumulating ETH close to assist ranges and make investments for the long run when it decisively crosses the essential resistance degree.