[ad_1]

Terra was initially among the many market leaders in creating stablecoins utilizing algorithmic processes, however the sudden collapse of its collateral and sync pairs has created a large uproar aiding within the general unfavorable growth in the whole crypto house.

Regardless of the 99% losses, LUNA has as soon as once more tried to rebuild its empire, and this time, it’s getting assist from Binance. Binance will very quickly offer a burn mechanism for Terra (LUNA) to strengthen its stability by decreasing its obtainable provide quantity. The principles for this mechanism have already been established and talked about on a Binance web site.

Primarily based on its liquid provide, Terra’s market capitalization has reached $322,785,177, whereas the circulation provide is 127,475,474.31 LUNA. The outlook for this token within the quick time period could be stuffed with revenue reserving and new hurdles, however in the long term, the outlook may return to constructive as soon as the builders have proved the soundness of LUNA.

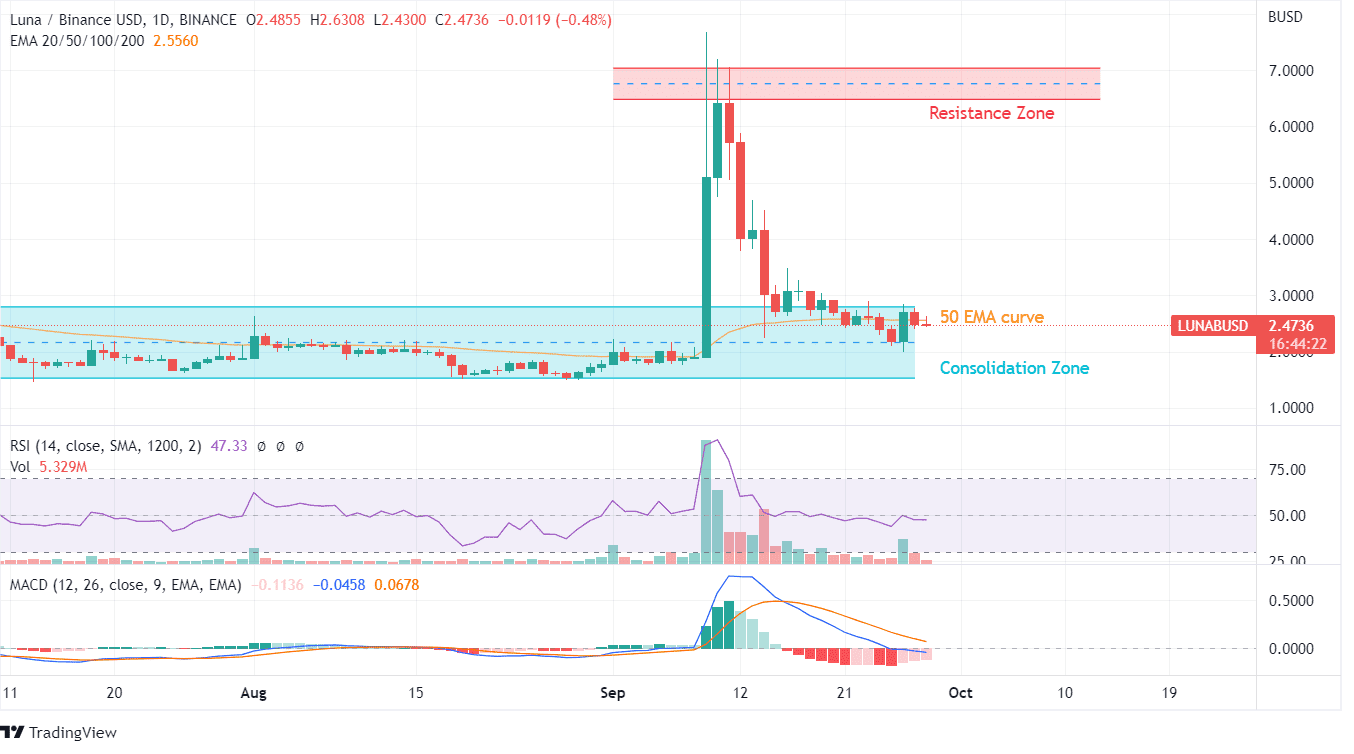

Terra (LUNA) witnessed a sudden spike in the course of the second week of September creating an immense constructive sentiment. However this sentiment was reduce quick by sellers who booked their income to cowl the losses incurred from earlier classes. The present worth motion outlook showcases a troublesome situation as 50 EMA has turn into a powerful retracement stage serving to sellers make big income. Do you have to do the identical or maintain your Teraa tokens? Learn our LUNA prediction to search out out.

The uptrend curve for LUNA ended promptly with a transparent indication of a unfavorable development of consolidation to proceed until a bit of elementary information is launched to incite consumers. The current bounce helped LUNA breach the 50 EMA curve for a short second earlier than making a profit-booking stance that destroyed half of the gained wealth.

The uptrend curve for LUNA ended promptly with a transparent indication of a unfavorable development of consolidation to proceed until a bit of elementary information is launched to incite consumers. The current bounce helped LUNA breach the 50 EMA curve for a short second earlier than making a profit-booking stance that destroyed half of the gained wealth.

On the MACD indicator, we’re witnessing a recent revival of shopping for spree because the unfavorable volumes have began to wither off. On the RSI indicator, the outlook stays consolidative and much like that earlier than the spike of September 2022.

Even on weekly charts, the beneficial properties achieved due to sheer information and shopping for spree had been shortly engulfed by sellers indicating the general revenue reserving sentiment that has developed for LUNA.

In the long run, this outlook can change if consumers take into account worth motion as a metric to gauge the longer term potential for cryptocurrencies. On weekly charts, the shopping for development RSI is buying and selling above 54, which is a slight enchancment over the day by day chart knowledge of 47.