[ad_1]

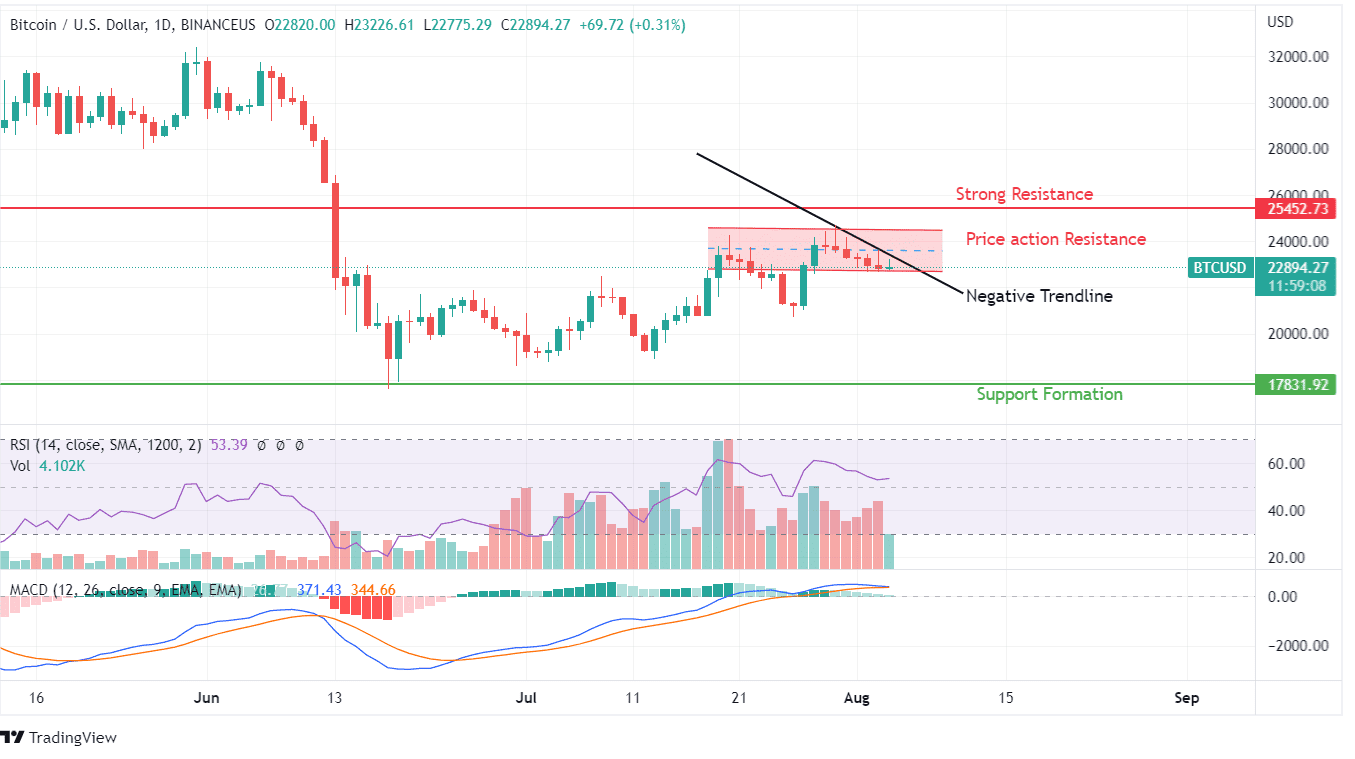

Bitcoin showcased large shopping for power and potential throughout its current push again from July 27. This motion was short-lived as every try to breach key resistance ranges based mostly on earlier pivot factors and sellers are destroying the shifting common. As its market capitalization nears USD 500 billion, promoting motion will get stronger as if whales have hedge bets on BTC remaining underneath the $24,000 mark.

Bitcoin’s first present of power can be to commerce above the Could 2022 lows of $25,455. The emergence from this degree would offer sufficient power to consumers to take the worth past the necessary shifting averages and in direction of the next goal. The one shortcoming is the shortage of shopping for rallies on the present resistance zone. Even the candle formations are strengthening the thought of one other breakdown for Bitcoin, which might primarily imply a darkish cloud for your entire cryptocurrency valuations.

Bitcoin value motion exhibits twin prospects: a optimistic breakout and one other retracement to current assist ranges of $20,000. Key ranges are lined and defined within the value evaluation under. Nevertheless, in the event you want detailed predictions for the token, you’ll be able to click on right here!

Bitcoin gained tremendously from its lows of June 2022. The income received erased due to resistance, however regardless of increased promoting motion, the volatility is kind of marginal, which signifies the customer’s assist for the value motion. RSI is holding the sentiment between 50 to 60. It’s pretty impartial as per the sentiment, however consumers anticipate a repetition of the July 27 breakout shopping for development. MACD is near making a bearish crossover, however sturdy shopping for motion can create a bullish motion.

Even on long-duration weekly charts, the BTC candle sample shouldn’t be sturdy sufficient to engulf the positive factors made on July 31, 2022. The broader trendline appears to be way more optimistic on weekly charts. The chart confirms the present week’s value motion as the primary clear and decisive optimistic candle. As such, the chance of a breakout in direction of a optimistic course centered on the intent of reaching $24500 will restart quickly.