[ad_1]

Ethereum is without doubt one of the largest cryptocurrencies on this planet by market cap, which has seen an outflow in the previous few months, however now ETH has been within the information due to many causes.

Within the Ethereum 2.0 improve, it’ll swap from proof-of-work consensus to proof-of-stake consensus, which helps to save lots of power and improve the safety of this blockchain protocol. It has diversified use circumstances, which is why many retail buyers wish to know the long-term view of this cryptocurrency. With Ethereum’s Ropsten Merge underway, the chart appears to be like bearish for the long run, whereas the trade reserve charge exhibits we’re nonetheless in a bullish zone.

On the time of scripting this put up, the ETH worth trades round $1800. Certainly $1600 is a robust assist stage for this coin, and it’ll not break that stage this yr as per our Ethereum worth prediction.

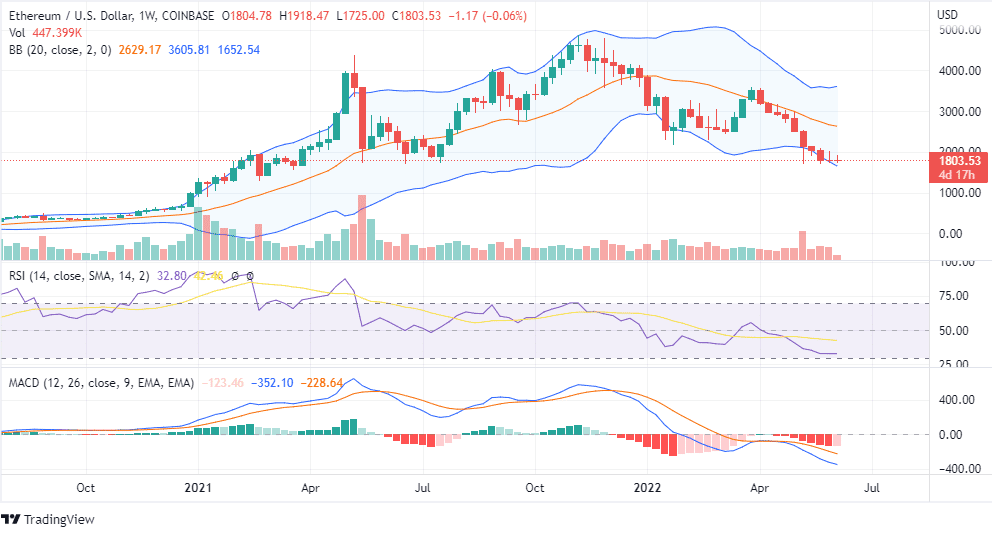

On the weekly chart, MACD is forming pink histograms with a bearish signal, and RSI is within the oversold zone. You could find 9 pink candlesticks within the decrease half of the Bollinger Band, and amongst them, the final two candlesticks are indecisive. The sentiment is totally different when you examine the trade service charge index and Ethereum market temper index.

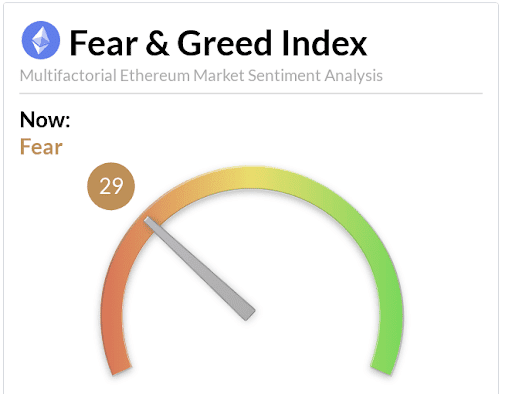

The retail buyers are fearful of the present scenario, and they don’t wish to make investments extra in Ethereum, so the rating is 29. Nonetheless, it doesn’t imply the market is bearish. When retail buyers are fearful, the massive buyers are taking part in their half to alter the sentiment out there.

They really feel it’s the proper time to take a position extra in ETH primarily based on the long run prospects of this cryptocurrency. Throughout this time, the stake might swap from the retail buyers to the massive buyers. That’s the reason huge buyers make huge cash, and retail buyers often get caught at the next stage. This logic can be supported by the trade reserve metric.

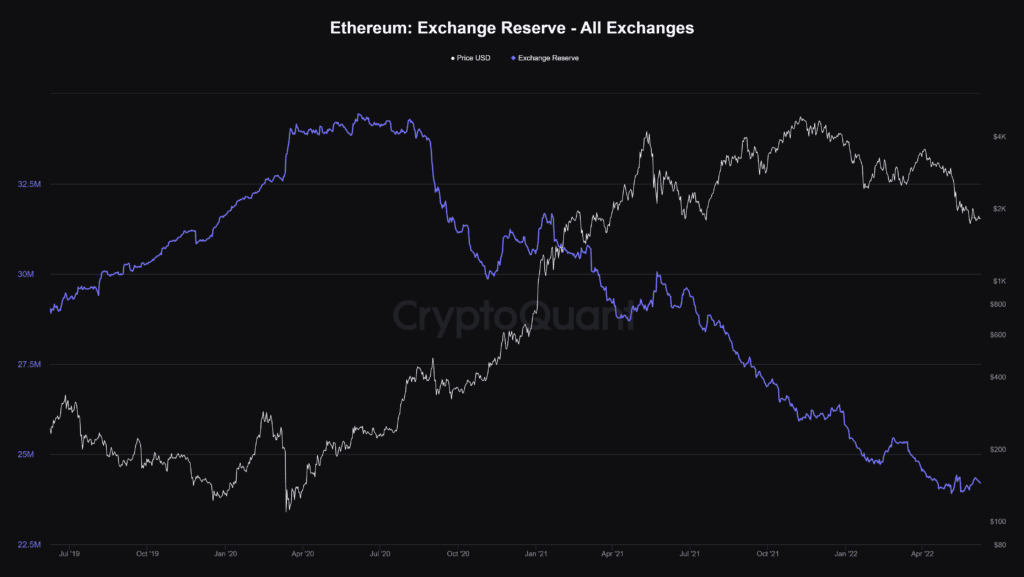

On this chart, you’ll find the black line worth USD is growing, and the blue line trade reserve is reducing. It suggests the cash are in shortage out there, and the trade doesn’t have sufficient provide to distribute cash to the sellers. It’s an early signal that the value will improve within the close to future.

The lower within the worth of the trade reserve suggests the low promoting stress out there, and it means the value of Ethereum is not going to fall additional. Apart from that, $1600 will work as a robust assist stage on the long-term chart.

All these superior technical indicators recommend the value continues to be in a bullish zone although the long-term chart appears to be in a consolidation part. The sentiment is fearful, and cash are getting scarcer. Meaning it’s the time of a reversal out there for the long run.

Many buyers deal with Ethereum as an asset. Technically it’ll face resistance across the $3000 and $3500 stage, but when it crosses these ranges, will probably be bullish for the long run and make a brand new all-time excessive. It’s a good alternative for retail buyers to extend their portfolios when the market is fearful.

Meaning the chart will be in a consolidation part for the quick time period inside a variety between $1600 and $3000, however it’s nonetheless bullish for the long run. If you wish to make investments for the following ten years, then it’s the greatest time to build up extra ETH cash in your portfolio. If ETHUSD modifications the momentum, then you might not get this worth stage within the subsequent few years.

Please learn the basics of Ethereum earlier than investing. $1700 generally is a good worth to purchase for the long run, and you must purchase it in each dip.