[ad_1]

Regardless of sustaining its place as the highest blockchain contender for 2022, Bitcoin has loads of upcoming challenges on its means. Elon Musk is a well-liked title that may disrupt or create a scarcity of tokens primarily based on his notion of cryptocurrencies and their applied sciences. The day information broke out of Musk’s profitable acquisition provide being accepted by the Twitter board, as a substitute of making a rally, it has created a market shorting situation.

The reply to this query might be linked with Elon’s complete wealth being linked with the market capitalization of Tesla Motors and its subsidiaries. Musk has pledged his shares to fund this acquisition, and BTC has no direct relation to this newly acquired stake of, Elon.

Nonetheless, on the similar time, the world is aware of Tesla made a $1.5 billion funding into Bitcoin again in February 2021, which may quantity to the same worth because it was repurchased then. Whereas this worth is barely 0.2% of the whole BTC market worth, in case of contemporary funds requirement, Musk can shortly liquidate this funding, inflicting widespread panic for BTC traders.

Bitcoin Value Evaluation

Essentially BTC has no worth other than its storage worth and widespread person base. Nonetheless backed by mining operations that closely depend on renewable power, BTC certainly can not stay the highest cryptocurrency when others are looking for methods to cut back power consumption by overlooking the validation course of accepted by its blockchain. Primarily based on the Bitcoin prediction, the worth development may dip additional to new ranges within the coming days if the promoting sentiment stays heavy on the traders.

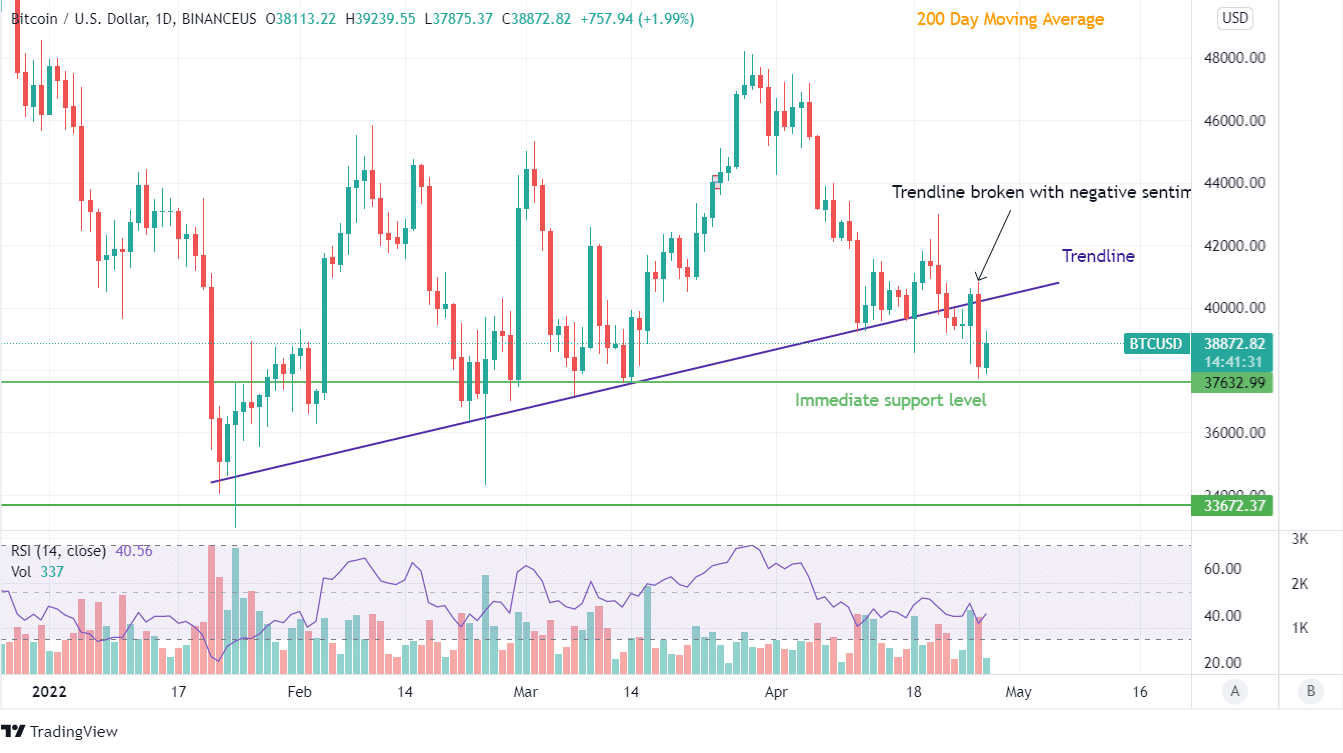

The Bitcoin worth development has as soon as once more turn into damaging because it did not respect the trendline that was being fashioned for the final three months. BTC tanking from $48,000 to $37,000 twice inside a yr signifies damaging sentiment. Traders are hoping for a optimistic breakout, however BTC is buying and selling beneath its essential shifting averages, and failure to take help from the quick stage of $37,500 would result in additional lack of worth, as the subsequent historic development help lies at $33,700.

RSI has moved down from near overbought zones at the start of April 2022 to damaging with a present RSI of 40. Transaction volumes have taken shock jumps, however such a development will proceed for a while. On the flip facet, a bounce again from $30,000 might be anticipated since traders can be seeking to purchase extra Bitcoins at a reduced worth.